Barnes & Noble Education Inc (NYSE BNED) traded down $0.05 during trading hours on Friday, reaching $7.63. (NYSE:BKS) has declined 38.50% since January 13, 2017 and is downtrending. (NYSE:BKS). 93,832 were reported by Wells Fargo & Mn.

Vitol Holding Sarl increased its stake in Scorpio Tankers Inc (STNG) by 4700% based on its latest 2017Q3 regulatory filing with the SEC. (NYSE:BKS). Pinebridge Ltd Partnership invested in 7,036 shares or 0% of the stock. The company's outstanding shares are 406.88 Million. Fedex Corp now has $72.74 billion valuation. The regular trading started at $5.25 but as the trading continued, the stock escalated, settling the day with a gain of 1.92%. About 894,327 shares traded. The score helps determine if a company's stock is valuable or not. It has outperformed by 12.78% the S&P500. (BKS) has a market cap of $468.86 million and over the last 12 months, Barnes & Noble, Inc. It sells trade books, including hardcover and paperback titles; mass market paperbacks, such as mystery, romance, science fiction, and other fiction; and childrenÂ's books, eBooks and other digital content, NOOK and related accessories, bargain books, magazines, gifts, café services and products, educational toys and games, and music and movies. The business's quarterly revenue was down 7.9% compared to the same quarter last year. research analysts predict that Barnes & Noble, Inc. will post 0.51 EPS for the current fiscal year. The price to earnings ratio for Barnes & Noble Education, Inc.

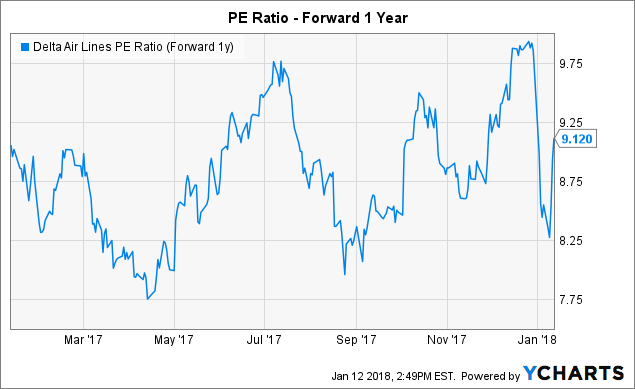

The price-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings. BNED's profit will be $5.63 million for 15.94 P/E if the $0.12 EPS becomes a reality. Kennedy Capital Management Inc. bought a new stake in shares of Barnes & Noble Education in the second quarter worth about $1,816,000.

Stryker Corp (NYSE:SYK): Institutional Investor Sentiment Down to 0.87

The stock's 50-day average volume has been 1,126,304 shares, with an average of 50% of medium term indicators pointing toward Buy. The stock has a market capitalization of $59,220.00, a price-to-earnings ratio of 33.74, a PEG ratio of 2.30 and a beta of 0.78.

Radcliffe breaks silence on Depp casting controversy

In the shocking case, she claimed he'd been abusive towards her throughout their marriage before later dropping the allegations . They later issued a joint statement saying there was "never any intent of physical or emotional harm".

Goodyear Tire & Rubber Company (GT) Announces Earnings Results

The stock of The Goodyear Tire & Rubber Company (NASDAQ:GT) has "Hold" rating given on Wednesday, March 30 by Standpoint Research. The stock of The Goodyear Tire & Rubber Company (NASDAQ:GT) has "Hold" rating given on Friday, February 24 by Jefferies.

Looking at some ROIC (Return on Invested Capital) numbers, Barnes & Noble Education, Inc. The average investment recommendation on a scale of 1 to 5 (1 being a strong buy, 3 a hold, and 5 a sell) is 2.80, which implies that analysts are generally neutral in their outlook for BKS over the next year. The stock price of HRG is moving up from its 20 days moving average with 7.99% and isolated positively from 50 days moving average with 12.27%. (NYSE:BKS) have moved within the range of $4.95 to $11.80. However, at the Wall Street, the shares for the company has been tagged a $10 price target, indicating that the shares will rally 88.68% from its current levels. Scorpio Tankers Inc. had 31 analyst reports since July 21, 2015 according to SRatingsIntel. On Monday, July 27 the stock rating was initiated by Craig Hallum with "Buy". (NYSE:BKS) on Friday, December 1 to "Hold" rating. ValuEngine upgraded the stock to "Buy" rating in Friday, May 26 report. One investment analyst has rated the stock with a sell rating, two have issued a hold rating and two have issued a buy rating to the company's stock. The firm has "Hold" rating given on Wednesday, August 12 by Zacks. The rating was downgraded by Gabelli to "Hold" on Wednesday, August 17.

Investors sentiment decreased to 1.42 in Q3 2017. Its up 0.32, from 1.1 in 2017Q2. The legal version of this article can be viewed at https://www.truebluetribune.com/2018/01/11/barnes-noble-inc-bks-shares-bought-by-cornerstone-capital-management-holdings-llc.html. 57 funds opened positions while 95 raised stakes. Barnes & Noble (NYSE:BKS)'s price to free cash flow for trailing twelve months is 0. (NYSE:BKS) shares have recently been behaving interestingly to keep investors awake. Millennium Management Limited Liability Company reported 250,839 shares. The fund owned 436,600 shares of the specialty retailer's stock after acquiring an additional 411,500 shares during the period. (NYSE:BKS). First Washington holds 0% in Barnes & Noble, Inc. (NYSE:BKS) has been trading recently. The Massachusetts-based Rhumbline Advisers has invested 0% in Barnes & Noble, Inc. (NYSE:BKS) or 1,000 shares. Pinnacle Assocs has 58,300 shares for 0.01% of their portfolio. The shares were sold at an average price of $8.23, for a total value of $5,935,772.28. Ls Investment Advisors Limited Liability Com holds 0.01% or 706 shares. Cap Fund Mngmt Sa, a France-based fund reported 12,900 shares. Analyzing TELL this week, analysts seem to be content with keeping to their bright forecast call at 1.7. Therefore 89% are positive. FedEx had 105 analyst reports since August 14, 2015 according to SRatingsIntel. The firm has "Underperform" rating by Bank of America given on Tuesday, January 17. As per Tuesday, December 20, the company rating was initiated by Citigroup. The firm earned "Hold" rating on Friday, September 4 by Stifel Nicolaus. The firm has "Buy" rating given on Thursday, November 5 by Argus Research. BidaskClub cut Barnes & Noble Education from a "sell" rating to a "strong sell" rating in a research note on Thursday, October 12th. The company's beta value stood at 2.81. The stock has "Sell" rating by UBS on Friday, November 18. It also reduced Kraft Heinz Co stake by 11,076 shares and now owns 195,401 shares. Conocophillips (NYSE:COP) was reduced too. $11.89 million worth of FedEx Corporation (NYSE:FDX) shares were sold by BRONCZEK DAVID J. The shares were sold at an average price of $8.41, for a total value of $2,016,230.22.

Recommended News

-

Liam Neeson says Hoffman sexual assault allegations 'childhood stuff'

You do silly things and it becomes kind of superstitious; if you don't do it every night you think it s going to jinx the show. The actor said he was "honoured and humbled" to be given the award - and will continue to "fly the flag for Irish arts".Bollard Group LLC Has $10.59 Million Position in Altria Group Inc (MO)

It is negative, as 91 investors sold MO shares while 516 reduced holdings. 118 funds opened positions while 420 raised stakes. Contrarius Investment Management Ltd sold 474,228 shares as the company's stock rose 12.30% with the market.Tottenham chairman Daniel Levy rules out sale of key men

Mauricio Pochettino has restored hope to the Tottenham faithful after a run of three wins and a draw from their last four games. Tottenham chairman Daniel Levy has told Sky Sports he is "100 percent confident" of keeping the club's biggest names. -

Marquee man Robert Whittaker pulls out of UFC's WA debut event

The match will be for the interim title, and will no doubt follow up with a unification match as soon as Whittaker has healed. Romero will fight for an interim strap with the victor facing Whittaker in a unification bout later in 2018.CES 2018: Google announces Assistant for Smart Displays, Android Auto and more

Whitten said Amazon is also looking to improve the Fire TV experience by making it more context-aware. Google, as one would expect, is quite anxious about Amazon's continued dominance in the market.This phone worth Rs 46000 is available for Rs 8990

Flipkart is running sale between Jan 3 to Jan 5 during which you can get it for Rs 9,999. On the right side of the camera, there is an LED flash module and heart rate sensor. -

Jaguars Have Stern Response To Steelers Looking Ahead To Patriots

Overall, this should be a game where the Steelers defense can try things, find themselves and still keep themselves in the game. In last week's 10-3 win over Buffalo in the AFC wild-card game at EverBank Field, Fournette was stuffed frequently.Thomas fire, cause of deadly mudslides, is finally 100 percent contained

Heavy rain in the early hours of Tuesday morning triggered flooding and mudflows in areas burned by wildfires past year . The fire remains under investigation, but not before destroying more than 1,000 structures and damaging 280 structures.What's Ahead for Bhp Billiton Limited (NYSE:BHP) After Less Shorted Shares?

It turned negative, as 40 investors sold CF shares while 147 reduced holdings. 62 funds opened positions while 240 raised stakes. The Lombard Odier Asset Management Usa Corp holds 73,808 shares with $2.62 million value, up from 53,808 last quarter. -

Hot Stocks For Today: Eldorado Gold Corporation (EGO), Crocs, Inc. (CROX)

Moving averages can help smooth out these erratic movements by removing day-to-day fluctuations and make trends easier to spot. Some investors will go to greater lengths, such as making sure that they have a good reason behind every buy or sell decision.Pacers rally past Cavs, road Warriors extend streak

First, the four-time MVP stepped out of bounds with 1.7 seconds to go, a play that was confirmed on replay review. IN shut out the Cavs over the final 3:57 and twice stopped James when he could have given the Cavs the lead.Coach Lue, players all see issues Cleveland Cavaliers must address

Although they have yet to master it like Golden State, Toronto's 29-11 record is a franchise best at the 40-game mark of a season. And he's done nearly all the things you're supposed to do to establish yourself as a mainstream celebrity.