Benin Management Corp sold 1,900 shares as Fedex Corp (FDX)'s stock declined 2.24%. The institutional investor held 7,304 shares of the air freight and delivery services company at the end of 2017Q3, valued at $1.65 million, up from 1,665 at the end of the previous reported quarter. The company has market cap of $72.22 billion. The stock increased 0.29% or $0.8 during the last trading session, reaching $272.29. About 342,362 shares traded.

FedEx (NYSE:FDX) was upgraded by ValuEngine from a "hold" rating to a "buy" rating in a research note issued on Sunday, December 31st. It has outperformed by 2.32% the S&P500. Solar Senior Capital Ltd. Moreover, Citadel Lc has 0% invested in FedEx Corporation (NYSE:FDX) for 13,287 shares. The hedge fund held 512,211 shares of the other pharmaceuticals company at the end of 2017Q3, valued at $34.74M, up from 356,299 at the end of the previous reported quarter. FedEx Co. The company has a debt-to-equity ratio of 0.89, a quick ratio of 1.50 and a current ratio of 1.57. The stock decreased 0.05% or $0.14 during the last trading session, reaching $271.35. The total number of shares traded in the last 12 months is 628,771. (NYSE:CF) has declined 0.63% since January 18, 2017 and is downtrending. It has outperformed by 13.73% the S&P500.

Among 7 analysts covering Herbalife (NYSE:HLF), 3 have Buy rating, 0 Sell and 4 Hold. Herbalife had 21 analyst reports since August 6, 2015 according to SRatingsIntel. Piper Jaffray maintained the stock with "Buy" rating in Tuesday, July 11 report. The rating was downgraded by Zacks on Monday, September 7 to "Sell". The firm has "Neutral" rating by Wedbush given on Wednesday, August 12. The firm has "Buy" rating given on Friday, January 5 by UBS. They set a "buy" rating and a $270.00 target price on the stock. The rating was maintained by Pivotal Research with "Buy" on Wednesday, November 4. The firm has "Buy" rating given on Friday, August 18 by Needham.

Investors sentiment increased to 0.89 in Q3 2017. Its up 0.06, from 1.01 in 2017Q2. 62 funds opened positions while 102 raised stakes. Morgan Stanley has 16.63 million shares. California Public Employees Retirement Systems reported 285,253 shares. Gofen Glossberg Ltd Liability Company Il holds 0.02% or 1,905 shares in its portfolio. Mai stated it has 1,430 shares. Janus Henderson Group PLC boosted its stake in shares of FedEx by 381.6% during the second quarter. Strs Ohio has 180,577 shares for 0.17% of their portfolio. 33,784 are owned by Wasatch Advisors Inc. Pictet Financial Bank Limited reported 0.68% in Citigroup Inc.

First Citizens Bank & Trust Co. trimmed its holdings in shares of FedEx Co. Route One Invest Ltd Partnership reported 14.01% in Herbalife Ltd. (NYSE:HLF). Berger Jeffrey Paul had sold 6,000 shares worth $348,000 on Friday, January 5. Panagora Asset Management Inc owns 5,436 shares.

Investors sentiment increased to 1.07 in Q3 2017.

A number of other institutional investors and hedge funds have also added to or reduced their stakes in FDX.

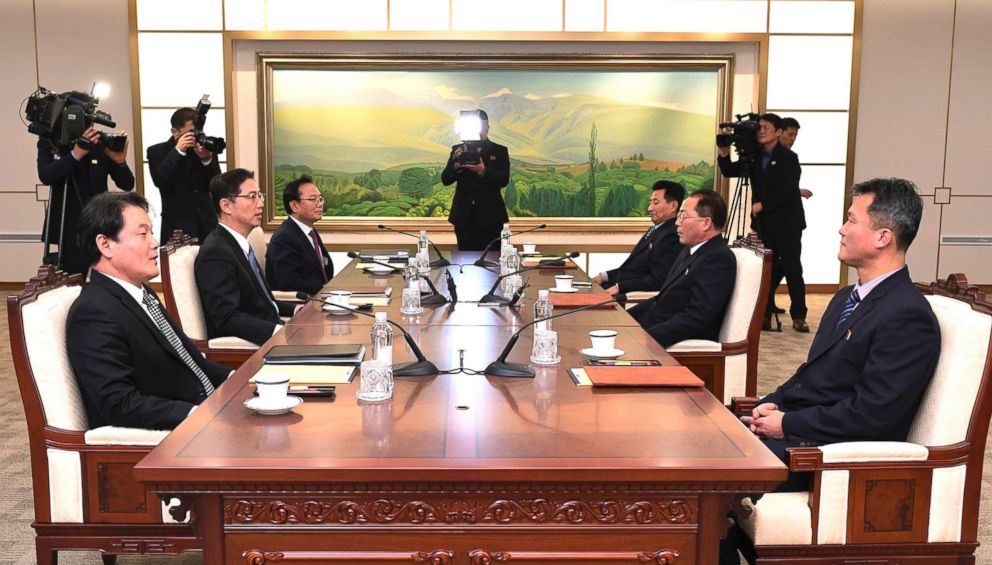

Congress strains to pass stopgap budget, avert shutdown

President Donald Trump is playing to his base, which is roughly at about 30 per cent, but the 2018 elections are looming. Most Democrats were ready to oppose the legislation, and GOP conservatives were threatening to defect as well.

IT shares surge, TCS, Infosys, HCL Tech touch 52-week high

At 12:02 pm, the S&P BSE Sensex was quoting 34,891, up 120 points, while the broader Nifty50 was ruling at 10,731, up 31 points. Meanwhile shares of Tech Mahindra touched a high of Rs 564, up 1.11 percent over its previous closing price.

Federal Government Says It Will Accept DACA Applications After Court Order

President Donald Trump says a program to protect immigrants brought into the US illegally as children is " probably dead ". At the meeting, Durbin and Graham outlined their compromise immigration idea, which reportedly provoked Trump's comment.

The most recent non open market insider trade was completed by BARKSDALE JAMES L on 01/04/2018, and was a disposition of 11,800 shares with a final price of $0. The shipping service provider reported $3.18 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.89 by $0.29. This represents a $2.00 dividend on an annualized basis and a yield of 0.73%.

Meanwhile, during the same quarter FedEx Corporation (FDX) delivered a 10.24% earnings surprise. Mason Street Advsr Ltd Liability holds 0.03% or 32,379 shares in its portfolio.

Barnett & Inc reported 775 shares. Pggm invested in 0.16% or 143,349 shares. Endowment Mngmt Limited Partnership has invested 0.06% of its portfolio in FedEx Corporation (NYSE:FDX). Country Trust Commercial Bank reported 288 shares. Dubuque Bancshares Tru holds 39,194 shares. Moreover, Steinberg Glob Asset Mgmt has 0.44% invested in FedEx Corporation (NYSE:FDX). Meristem Llp holds 0.08% or 901 shares in its portfolio. Mathes Incorporated has invested 1.7% in FedEx Corporation (NYSE:FDX). Central Savings Bank holds 0.51% in FedEx Corporation (NYSE:FDX) or 9,144 shares.

Since September 21, 2017, it had 0 insider purchases, and 6 sales for $22.31 million activity. Over the last quarter, insiders sold 210,549 shares of company stock worth $41,505,553. Maier Henry J also sold $2.55M worth of FedEx Corporation (NYSE:FDX) on Thursday, October 26. Another trade for 3,016 shares valued at $802,405 was made by STEINER DAVID P on Friday, January 5. Shares for $3.38M were sold by DUCKER MICHAEL L.

Several brokerages have commented on FDX. Therefore 65% are positive. Stifel Nicolaus has "Buy" rating and $174 target. KeyBanc Capital Markets has "Buy" rating and $58.0 target. The firm has "Buy" rating given on Wednesday, August 12 by Nomura. Credit Suisse Group reaffirmed a "positive" rating and set a $283.00 price objective (up from $278.00) on shares of FedEx in a research report on Wednesday, December 20th. The company was maintained on Thursday, November 30 by BMO Capital Markets. Citigroup reissued a buy rating and issued a $235.00 price objective on shares of FedEx in a report on Thursday, September 14th. Following the sale, the chief executive officer now directly owns 15,326,133 shares in the company, valued at approximately $2,896,945,659.66. Bristol John W Inc Ny holds 2.23% of its portfolio in FedEx Corporation (NYSE:FDX) for 342,037 shares.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our daily email newsletter.

Recommended News

-

SC rejects victim's plea against Peepli Live co-director Farooqui's acquittal

The 35-year-old complainant had alleged that Farooqui, a writer and director, had raped her at his Delhi home on March 28, 2015. The Delhi HC had in 2017 acquitted Farooqui of rape charges.HSBC to pay $100 million to settle US probe into currency rigging

HSBC also made misrepresentations to one of the clients, Cairn Energy, to hide the self-serving nature of its actions. A DPA document, which must be approved by a judge, was filed in federal court in Brooklyn on Thursday (Jan 18).IPL 2018: Chennai Super Kings announce Stephen Fleming as head coach

He was also aware that they can not use Right to Match (RTM) card for him as they have already retained three Indian players. The 2018 IPL auction will take place from January 27-28, where Dhoni will now look to build a solid squad. -

Fresh snow and ice warning issued for parts of Scotland

Warnings of ice and snow have been extended into the weekend after police urged truckers to drive with "extreme caution". A number of schools in South Lanarkshire and Dumfries and Galloway were also affected.Novak Djokovic battles through 'brutal' heat to defeat Gaël Monfils

It's been a while", the former world number one told reporters."I did have various emotions, mostly good ones. Roger Federer swept Aljaz Bedene 6-3, 6-4, 6-3; and was joined by Will Ferrell on the court after the match .Apache (APA) Earns Daily Media Sentiment Score of 0.24

After $0.30 actual EPS reported by WhiteHorse Finance, Inc. for the previous quarter, Wall Street now forecasts 10.00% EPS growth. The total amount of shares outstanding is 384.64 million, giving the company a market capitalization of about 17.80 billion. -

TJX Companies Inc (TJX) Holdings Boosted by USS Investment Management Ltd

According to Finviz reported data, The SMA20 of the stock is at 0.65 percent, SMA50 is 4.3 percent, while SMA200 is 4.54 percent. Its up 0.01, from 0.82 in 2017Q2. 264.73 million shares or 40.11% more from 188.94 million shares in 2017Q2 were reported.Jefferies Finally Upgrades Icici Bank Limited (NYSE:IBN) Stock

The firm has a market cap of $33,900.00, a PE ratio of 35.60, a price-to-earnings-growth ratio of 1.06 and a beta of 1.72. It was created to allow traders to more accurately measure the daily volatility of an asset by using simple calculations.Indian firing kills 2 Pakistani women, injures 5

He said the firing resulted in the death of a 24-year-old civilian and injured nine others in village Harpal. The Foreign Office claimed two women had died because of the alleged ceasefire violations. -

Campbell Soup (CPB) Rating Increased to Buy at Citigroup

In a note sent to clients and investors on Wednesday morning, Canaccord Genuity reiterated their "Hold" rating on shares of CINE. Brandywine Trust Company sold 157,227 shares as the company's stock declined 4.62% while stock markets rallied.Leon Goretzka to join Bayern Munich in the summer

Liverpool have also reportedly tried to coax RB Leipzig into letting midfielder Naby Keita join the Reds earlier than expected. Liverpool target Inaki Williams has signed a new contract with Athletico Bilbao that runs through 2025, reports the Sun .LG X4+ Rugged Smartphone With Hi-Fi DAC Audio Launched: Price, Specifications, Features

It is certified in six categories such as impact, vibration, high temperature, low temperature, thermal shock, and humidity. However, it's nearly certain that we won't be seeing another LG flagship for at least a few months .

.jpg)