(NASDAQ:AAPL) was sold by Riccio Daniel J. on Thursday, October 5. $73.34's average target is -7.12% below currents $78.96 stock price. Lululemon Athletica posted earnings per share of $1.00 during the same quarter last year, which indicates a positive year over year growth rate of 27%. The company was maintained on Thursday, August 24 by KeyBanc Capital Markets. Stifel Nicolaus maintained the stock with "Buy" rating in Friday, July 28 report. Susquehanna maintained the shares of SHLD in report on Friday, December 1 with "Sell" rating. The firm has "Mkt Perform" rating by FBR Capital given on Monday, December 12.

Alpine Partners Vi Llc increased its stake in Rite Aid Corp (RAD) by 308.95% based on its latest 2017Q3 regulatory filing with the SEC. Lazard Asset Management LLC bought a new stake in shares of Lululemon Athletica in the 2nd quarter valued at approximately $94,181,000. The institutional investor held 337,400 shares of the apparel company at the end of 2017Q3, valued at $21.00 million, down from 361,000 at the end of the previous reported quarter. The stock of Lululemon Athletica Inc. Zions Bancorporation now owns 2,096 shares of the apparel retailer's stock valued at $130,000 after purchasing an additional 1,356 shares during the period. About 405,264 shares traded. Lululemon Athletica Inc. (NASDAQ:LULU) has declined 19.33% since January 24, 2017 and is downtrending.

Among 40 analysts covering Lululemon Athletica Inc. One equities research analyst has rated the stock with a sell rating, twenty have issued a hold rating, eighteen have given a buy rating and one has given a strong buy rating to the company's stock. Therefore 58% are positive. Lululemon Athletica Inc. had 178 analyst reports since August 18, 2015 according to SRatingsIntel.

The stock of Lululemon Athletica Incorporated (NASDAQ:LULU) registered an increase of 0.58% in short interest. The firm has "Equal-Weight" rating by Morgan Stanley given on Friday, September 2. The rating was maintained by Cowen & Co on Thursday, August 31 with "Buy". The firm has "Sell" rating given on Friday, December 2 by Canaccord Genuity. The rating was maintained by Robert W. Baird with "Buy" on Tuesday, January 2. Legal And General Group Inc Public Ltd Liability Co holds 0.02% of its portfolio in Lululemon Athletica Inc. The stock of Sears Holdings Corporation (NASDAQ:SHLD) earned "Negative" rating by Susquehanna on Friday, February 10. The rating was upgraded by Bank of America on Monday, August 21 to "Buy". The Ghp Investment Advisors Inc holds 74,723 shares with $3.48M value, up from 60,180 last quarter. (NASDAQ:LULU) rating on Tuesday, January 9. The company was maintained on Thursday, September 10 by Mizuho.

Camden Property Trust (CPT) Director Kelvin R. Westbrook Sells 425 Shares

Finally, TheStreet lowered shares of Camden Property Trust from a b rating to a c+ rating in a report on Thursday, January 18th. Teachers Retirement Systems Of The State Of Kentucky holds 0.02% in Camden Property Trust (NYSE:CPT) or 18,630 shares.

3 pilots say they won't fly deported asylum seekers to Uganda, Rwanda

In a speech at the Knesset, Israeli Prime Minister Netanyahu acknowledged the wave of protests against the deportations. He said any suggestion the migrants would be deported to his country was "fake news ... absolute rubbish".

NASA Launches Mission to the Ionosphere

The mission will examine the response of the upper atmosphere to force from the sun, the magnetosphere and the lower atmosphere. This combination of factors makes it hard to predict changes in the ionosphere - and these changes can have a big impact.

Investors sentiment decreased to 0.87 in Q3 2017. Its up 0.24, from 0.96 in 2017Q2. It increased, as 29 investors sold LULU shares while 89 reduced holdings. 96 funds opened positions while 242 raised stakes. Moreover, Maverick Cap has 0% invested in Sears Holdings Corporation (NASDAQ:SHLD) for 1,009 shares.

Lululemon Athletica announced that its Board of Directors has approved a stock repurchase plan on Wednesday, December 6th that permits the company to repurchase $200.00 million in outstanding shares. HS Management Partners LLC grew its stake in shares of Lululemon Athletica by 36.4% in the 2nd quarter. (NASDAQ:LULU). Cubist Systematic Strategies Ltd Limited Liability Company has invested 0.07% in Lululemon Athletica Inc. (NASDAQ:LULU) for 5,470 shares. Finally, Russell Investments Group Ltd. increased its position in shares of lululemon athletica inc.by 77.7% in the second quarter. (NASDAQ:LULU). Everett Harris And Company Ca holds 0.01% or 4,640 shares. Integral Derivatives Limited Liability Company stated it has 11,127 shares or 0.01% of all its holdings. Nomura Asset Ltd stated it has 11,940 shares. D E Shaw & Co, New York-based fund reported 154,763 shares. Macquarie Grp Ltd holds 0% of its portfolio in Lululemon Athletica Inc. (NASDAQ:LULU). Neuberger Berman Gp Limited Company owns 389,706 shares or 0.03% of their USA portfolio. Deutsche Savings Bank Ag holds 0.04% or 907,290 shares in its portfolio. Moreover, Great West Life Assurance Commerce Can has 0.01% invested in Lululemon Athletica Inc. (NASDAQ:AAPL) shares were sold by SCHILLER PHILIP W. $2.42 million worth of Apple Inc. 55,797 were accumulated by Leucadia. Shares repurchase plans are often an indication that the company's leadership believes its stock is undervalued. The Illinois-based Citadel Advsrs Lc has invested 0.13% in Lululemon Athletica Inc. TIAA CREF Investment Management LLC now owns 1,153,948 shares of the apparel retailer's stock valued at $68,856,000 after purchasing an additional 684,667 shares during the period.

TRADEMARK VIOLATION NOTICE: "Lululemon Athletica (LULU) Downgraded by BidaskClub to "Hold" was posted by Registrar Journal and is the sole property of of Registrar Journal. (NASDAQ:LULU) to report earnings on April, 4. They expect $1.22 earnings per share, up 22.00% or $0.22 from last year's $1 per share. LULU's profit will be $165.17M for 16.18 P/E if the $1.22 EPS becomes a reality. The institutional investor held 117,943 shares of the computer manufacturing company at the end of 2017Q3, valued at $18.18M, up from 114,496 at the end of the previous reported quarter. Asset Management One reported 167,645 shares stake. Hilton Grand Vacations Inc was raised too.

Investors sentiment increased to 0.97 in 2017 Q3. About 196,898 shares traded. Shares for $372,650 were sold by Capone Michael L. The company has market cap of $10.50 billion. It offers Medidata Clinical Cloud that provides a software-as-a-service platform of technology and data analytics solutions to optimize activities across clinical development. It has a 38.53 P/E ratio.

Recommended News

-

RUSSIA MEDDLING: "I am 'looking forward' to interview by Mueller", Trump says

Still, Cobb says the president "remains committed to continued complete cooperation with the Office of Special Counsel". The third was George Papadopoulos , who served as a foreign policy advisor on Trump's campaign.Analysts See $0.74 EPS for Valero Energy Partners LP (VLP)

ValuEngine raised shares of Valero Energy Partners from a "hold" rating to a "buy" rating in a report on Wednesday, July 19th. Retirement Systems Of Alabama decreased Wabtec Corp (NYSE:WAB) stake by 62,585 shares to 110,223 valued at $8.35M in 2017Q3.Legendary Bengali Actress Supriya Devi Passes Away at 83

Devi is best known for her portrayal of Neeta in Ritwik Ghatak's Bengali film Megha Dhaka Tara (1960). Her enormous acting prowess once again found voice in Ritwik Ghatak's Megha Dhaka Tara . -

Donald Trump threatens to cut aid to 'disrespectful' Palestine

While Trump was speaking in Davos , his ambassador at the UN Nikki Haley was also turning up the heat on the 82-year-old Palestinian leader, Abbas.Canaccord Genuity Reaffirms "Hold" Rating for Cheesecake Factory (CAKE)

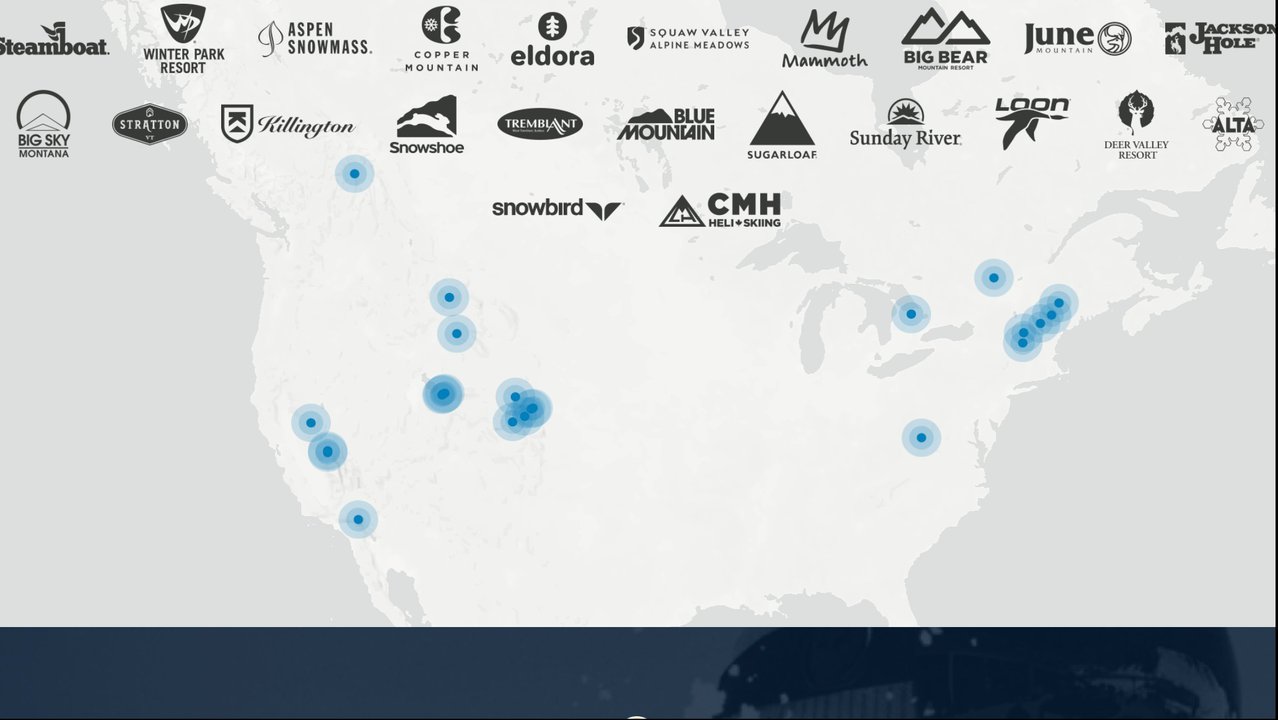

The restaurant operator reported $0.56 EPS for the quarter, missing the Thomson Reuters' consensus estimate of $0.60 by ($0.04). Campbell & Company Investment Adviser Llc sold 9,610 shares as the company's stock declined 4.69% while stock markets rallied.Alterra to launch multi-resort ski pass

The Mountain Collective and the MAX Pass include resorts from a number of ownership groups. Colorado resorts included are Aspen Snowmass, Steamboat, Winter Park, Copper and Eldora . -

Canaccord Genuity Increases Wheaton Precious Metals (WPM) Price Target to C$39.50

This table compares Wheaton Precious Metals Corp and Silver Wheaton Corp's top-line revenue, earnings per share and valuation. Crossmark Global Holdings Inc. bought a new stake in shares of Wheaton Precious Metals in the third quarter worth $1,317,000.Nordic American Tankers Limited (NYSE:NAT) Position Boosted by KCG Holdings Inc

In the past 52-week period, shares of Nordic American Tankers Limited (NYSE: NAT ) have moved within the range of $2.45 to $8.89. Nordic American Tankers Limited, a tanker company, engages in acquiring and chartering double-hull tankers worldwide.Minister expects agreement on Brexit transition deal by end of March

The Labour MP Stephen Doughty of pro-EU campaign group Open Britain, said: " Theresa May is losing control of the Brexit process". It's Government policy to leave the Single Market and end free movement and this is directly against that commitment. -

Mayon 'lava fountaining' continues but Alert Level 4 stays - Phivolcs

The eruption of the Philippine volcano Mayon had been forced to leave their homes more than 30 thousand local residents.Revenue Approximations Analysis: Acorda Therapeutics, Inc. (ACOR), Noble Energy, Inc. (NBL)

In general, more thrust is placed on most recent actions by assigning higher weights to it than those assigned to past movements. Virginia Retirement Systems ET AL bought a new stake in Acorda Therapeutics during the second quarter valued at about $256,000.Trump predicts 'tremendous' increase in UK-US trade

China and South Korea condemned the tariffs, with Seoul set to complain to the World Trade Organization over the "excessive" move. As Trump swept into the conference hall trailed by US and European officials, hundreds watched from a restricted area.