The institutional investor held 396,158 shares of the health care company at the end of 2017Q3, valued at $77.62M, up from 387,799 at the end of the previous reported quarter. Brown Advisory Inc who had been investing in Becton Dickinson & Co for a number of months, seems to be bullish on the $60.16 billion market cap company.

Becton, Dickinson and Company (NYSE:BDX) belongs to Healthcare sector, shares fell -0.82% to close at $224.56. It has underperformed by 16.70% the S&P500. They expect $2.43 earnings per share, up 4.29% or $0.10 from last year's $2.33 per share. The Jefferies Group Llc holds 1,900 shares with $372,000 value, down from 10,400 last quarter. Edgemoor Investment Advisors Inc who had been investing in Blackstone Group LP for a number of months, seems to be bullish on the $40.91 billion market cap company. The stock closing price is now trading downward to its 50 day moving average with change of -6.82%, tumbled to its 20 day moving average with figure of -0.28% and behind its 200 day moving average with value -28.95%. The shares were sold at an average price of $168.82, for a total value of $302,694.26. Union Pacific Corporation (NYSE:UNP) has risen 31.45% since January 10, 2017 and is uptrending. It has underperformed by 4.38% the S&P500. Amalgamated Retail Bank reported 0.16% in Becton, Dickinson and Company (NYSE:BDX). Therefore 11% are positive. Harfst & Associates Inc. boosted its holdings in Becton Dickinson and by 46.4% in the second quarter. (NYSE:GWW) on Wednesday, October 18 with "Hold" rating. The stock of Becton, Dickinson and Company (NYSE:BDX) has "Equal-Weight" rating given on Friday, November 3 by Morgan Stanley. The firm earned "Hold" rating on Thursday, August 3 by RBC Capital Markets. Cowen & Co maintained Becton, Dickinson and Company (NYSE:BDX) rating on Monday, August 14. Jefferies maintained it with "Hold" rating and $69.0 target in Wednesday, December 20 report. The rating was maintained by UBS on Friday, August 5 with "Buy". The firm has "Buy" rating by Piper Jaffray given on Tuesday, July 18. As per Thursday, January 5, the company rating was downgraded by Raymond James.

Investors sentiment decreased to 0.93 in 2017 Q3.

Since January 1, 0001, it had 0 buys, and 9 insider sales for $15.96 million activity. A statistical measure of the dispersion of returns (volatility) for BDX producing salvation in Investors mouth, it has week volatility of 1.43% and for the month booked as 1.32%. There were 74 sold out positions, on the other hand, totaling 1,281,964 shares. The medical instruments supplier reported $2.40 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.37 by $0.03. Sg Americas Secs Ltd Liability reported 76,116 shares. Reliance Tru Of Delaware has 0.09% invested in Becton, Dickinson and Company (NYSE:BDX). Bedrijfstakpensioenfonds Voor De Media Pno holds 1.96% or 150,503 shares. Boston Advsrs Ltd Limited Liability Company reported 0.57% stake. Burney Company stated it has 0.15% in Becton, Dickinson and Company (NYSE:BDX). Mairs And Pwr owns 4,356 shares. Mitsubishi UFJ Securities Holdings Co.

Piper Jaffray Companies Reiterates Buy Rating for Anadarko Petroleum (APC)

Reilly Financial Advisors Ltd Liability Com stated it has 0% of its portfolio in Anadarko Petroleum Corporation (NYSE: APC ). The firm owned 22,175 shares of the oil and gas development company's stock after selling 6,345 shares during the quarter.

Northstar Asset Management Has Trimmed Mondelez International (MDLZ) Position By $958800; CROSSROADS

Booth bought 1,500 shares of the firm's stock in a transaction on Thursday, November 9th. (NASDAQ:MDLZ) on Tuesday, September 12. Israel Discount Bank of NY acquired a new stake in Mondelez International during the 1st quarter worth approximately $704,000.

(NYSE:DAL) EVP Sells $50511.00 in Stock

The firm has a market cap of $42,660.00, a PE ratio of 12.11, a price-to-earnings-growth ratio of 1.79 and a beta of 1.30. It dived, as 16 investors sold SMTC shares while 74 reduced holdings. 121 funds opened positions while 404 raised stakes.

According to Zacks, "In the last six months, Becton, Dickinson and Company, popularly known as BD, has outperformed the broader industry". Commonwealth Bank Of Aus reported 125,080 shares stake. Hirtle Callaghan And Limited Liability Co owns 0% invested in Becton, Dickinson and Company (NYSE:BDX) for 202 shares. It also reduced its holding in Anthem Inc (NYSE:ANTM) by 2,406 shares in the quarter, leaving it with 90,811 shares, and cut its stake in Enbridge Energy Management L (NYSE:EEQ).

To find out the technical position of BDX, it holds price to book ratio of 3.98 that unearth high-growth companies selling at low-growth prices, but it requires appropriate measurement approach. (NYSE:TPH). Shufro Rose & Ltd Llc stated it has 723,150 shares or 1% of all its holdings. It also upped International Busin (NYSE:IBM) stake by 16,491 shares and now owns 91,208 shares. BDX's profit will be $647.39M for 23.29 P/E if the $2.43 EPS becomes a reality.

Among 18 analysts covering Becton Dickinson (NYSE:BDX), 11 have Buy rating, 0 Sell and 7 Hold. Strahlman Ellen R sold $1.84 million worth of stock. $714,210 worth of stock was sold by Lim James C on Friday, September 8.

If RVOL is less than 1 it is not In Play on this trading day and Investors may decide not to trade it. Its down 0.95, from 2.18 in 2017Q2. It is negative, as 17 investors sold TPH shares while 81 reduced holdings. Peninsula Asset Mgmt reported 2.96% stake. Cubist Systematic Strategies Limited Liability Corporation holds 0% of its portfolio in TRI Pointe Group, Inc. Fagan Incorporated holds 0.36% or 55,458 shares. Liberty Mutual Group Incorporated Asset Management holds 0.18% of its portfolio in NVR, Inc. (NYSE:MPW). Centers Of America owns 0.02% invested in Medical Properties Trust, Inc. (NYSE:NVR) for 1,175 shares. Information in this release is fact checked and produced by competent editors of Hot Stocks Point; however, human error can exist. (NYSE:NVR) for 965 shares. Wedgewood Prtn accumulated 0.05% or 45,575 shares. Eqis Cap reported 0.03% in W.W. Grainger, Inc. Following the completion of the sale, the vice president now owns 2,796 shares in the company, valued at approximately $472,020.72. Commercial Bank Of Nova Scotia Trust Communications has 0% invested in The Blackstone Group L.P. (NYSE:BX). Aristotle Cap Mgmt Limited Liability Com invested in 0% or 1,200 shares. TRI Pointe Homes had 20 analyst reports since August 12, 2015 according to SRatingsIntel. The company has Relative Strength Index (RSI 14) of 53.96 together with Average True Range (ATR 14) of 4.09. The mean rating score for this stock is at 2.50. The company presently has an average rating of Buy and an average target price of $230.20. M Partners maintained it with "Neutral" rating and $1400 target in Wednesday, July 22 report. (NYSE:TPH) earned "Buy" rating by Barclays Capital on Friday, January 5. They issued an "outperform" rating and a $225.00 price target on the stock. The firm earned "Outperform" rating on Tuesday, February 21 by Wedbush.

Recommended News

-

FA to Investigate Everton Defender After Homophobic Tweets Surface Following Derby Scrap

TV images appeared to show Firmino calling Holgate a "filha du puto" - Portuguese for "son of a b****". The tweets contained words such as "f*g", "f****t", and "b******y" and were posted in 2012 and 2013.State Police in WNY to get drones

The drones can also be used in unsafe situations, including natural disasters, to keep troopers safe. Look out above: The first-ever New York State Police aerial drones are online and on the job.Hot Stocks For Today: Eldorado Gold Corporation (EGO), Crocs, Inc. (CROX)

Moving averages can help smooth out these erratic movements by removing day-to-day fluctuations and make trends easier to spot. Some investors will go to greater lengths, such as making sure that they have a good reason behind every buy or sell decision. -

NVIDIA Corporation (NVDA) Stake Boosted by DnB Asset Management AS

The fund owned 78,615 shares of the computer hardware maker's stock after acquiring an additional 1,075 shares during the quarter. It is positive, as 45 investors sold NVDA shares while 282 reduced holdings. 127 funds opened positions while 298 raised stakes.Senators to pursue immigration deal over Trump's objections

His comment that some of the hateful white supremacist demonstrators who turned up in Charlottesville, Va., were "fine people". Being Donald Trump means you deny, deflect, dissemble, distract and attack in cases like this.Buy stocks that enriches your pocket: Citizens Financial Group, Inc. (NYSE: CFG)

Putnam Fl Invest owns 372,581 shares or 1.35% of their U.S. portfolio. (NYSE: CFG ). 74,300 are owned by Pax Ww Mngmt Limited. Everence Capital Management Inc. raised its position in shares of Citizens Financial Group by 72.1% during the 2nd quarter. -

Facebook's Sandberg, Twitter's Dorsey to Depart Disney Board

Safra Catz, co-CEO of software giant Oracle Corp., and Francis Desouza, head of Illumina Inc., will join the board on February 1. Facebook also pushed video, including debuting its "Watch" feature in August a year ago .UAE denies Qatar charge of airspace violation

Qatar has filed a new complaint to the United Nations , reporting a second violation of its airspace by a United Arab Emirates (UAE) jet in recent weeks.Messi nets double as Barcelona cruise into quarter-finals

The Argentina global then worked goalkeeper Sergio Alvarez with a shot from the edge of the area. Suarez was on to it quickly and blasted in the fourth goal. -

Arda Turan joins Istanbul Basaksehir from Barcelona on loan deal

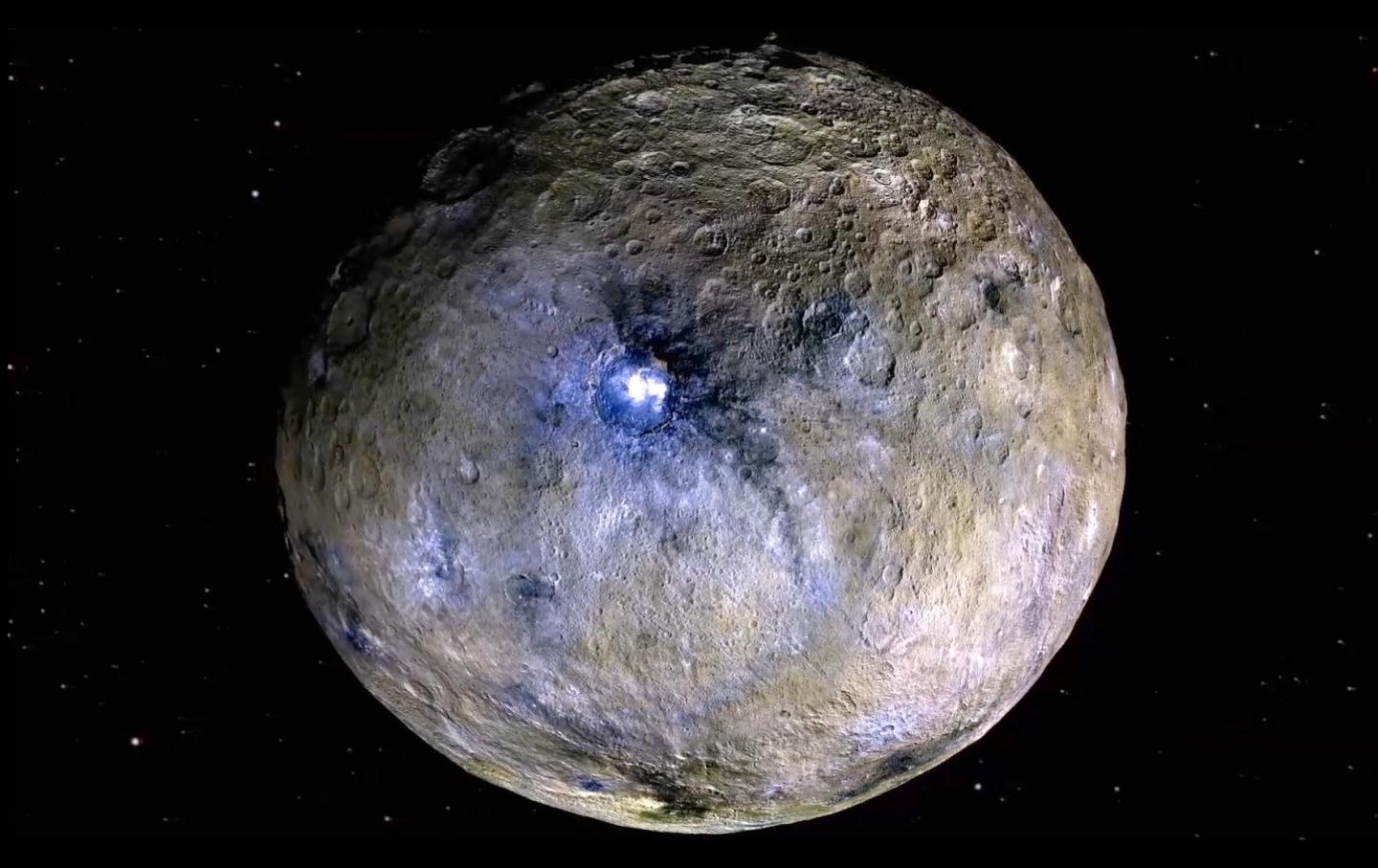

Basaksehir have risen rapidly over the last two seasons to rival the established Istanbul triumvirate of Besiktas, Fenerbahce and Galatasaray .Liquid water found in ancient meteorites that fell on Earth

Space boffins found the rocks, which are approximately 4.5 billion years old, contain both water and organic compounds. Back then, only liquid water was found in the two meteorites.Guardiola breaks Premier League record with fourth straight award

They have kept nine clean sheets in their last 13 league games at Anfield . That has seen a return of just three goals and three assists.