Highland Private Wealth Management now owns 3,042 shares of the semiconductor company's stock worth $234,000 after buying an additional 25 shares during the last quarter. The stock price is showing encouraging image with current supportive move of 0.88% at trading price of $110.67. The stock's average target of $87.81 is -21.94% below today's ($112.49) share price. Texas Instruments's revenue was up 12.0% compared to the same quarter last year. equities research analysts anticipate that Texas Instruments will post 4.36 earnings per share for the current fiscal year. It has outperformed by 1.77% the S&P500.

Wesbanco Bank Inc decreased Texas Instruments (TXN) stake by 1.87% reported in 2017Q3 SEC filing. Moreover, Heathbridge Capital Management Ltd. has 6.41% invested in the company for 355,000 shares. The institutional investor held 30,954 shares of the consumer services company at the end of 2017Q3, valued at $2.00M, up from 22,441 at the end of the previous reported quarter. Laurion Capital Management Lp who had been investing in Texas Instrs Inc for a number of months, seems to be less bullish one the $110.61 billion market cap company. Insiders have sold a total of 1,362,293 shares of company stock worth $131,754,396 over the last ninety days. About 4.96M shares traded. It has outperformed by 23.61% the S&P500.

Integral Derivatives Llc, which manages about $5.50 billion US Long portfolio, upped its stake in Ko (Call) (NYSE:KO) by 44,800 shares to 67,400 shares, valued at $3.03M in 2017Q3, according to the filing.

Investors sentiment increased to 1.12 in 2017 Q3. P comes in with a P/S ratio of 0.77 that's below 1, potentially implying that it could be cheap relative to the overall sector (2825.42) and its peers (6.68). It improved, as 55 investors sold TXN shares while 333 reduced holdings.

Arclight Capital Partners Llc holds 13.3% of its portfolio in Transmontaigne Partners L.P. for 3.17 million shares. Plante Moran Advisors Limited Liability Com has invested 0.28% in Texas Instruments Incorporated (NASDAQ:TXN). Raymond James Na has invested 0.18% in Texas Instruments Incorporated (NASDAQ:TXN). 467,080 are owned by Connor Clark & Lunn Mngmt Limited. Amp Ltd holds 0.32% or 629,066 shares. Institutional investors and hedge funds own 86.10% of the company's stock. Financial Advisory Service Inc. grew its holdings in shares of Texas Instruments by 0.4% during the second quarter. Cornerstone Advisors Inc holds 0.31% or 5,008 shares. Hudock Capital Group LLC raised its position in Texas Instruments by 1.3% in the 2nd quarter. Regions Fincl accumulated 22,216 shares. Old Mutual Customised Solutions (Proprietary) holds 0.41% of its portfolio in Texas Instruments Incorporated (NASDAQ:TXN) for 34,043 shares. The Pennsylvania-based Nationwide Fund Advsr has invested 0.24% in Texas Instruments Incorporated (NASDAQ:TXN).

Haitian-Americans in South Florida hurt by president's alleged remark

The president said at the White House that "love was central" to the slain civil rights leader. A White House official went as far as to call this his "victory lap".

Dark Souls Remastered is coming to current platforms, including Nintendo Switch

The most recent entry in the Dark Souls franchise, Dark Souls 3, came to consoles and PC in early 2016. Dark Souls Remastered on PS4 and Xbox One are said to run at 60FPS at a resolution of 1080p.

Democrats go solo on Russian Federation probe

Trump opponents want that testimony to undercut the attack line propounded by Republican critics such as Ohio Rep. He then said Feinstein, who is seeking another term, "Must have tough Primary!" Trump's wish may come true.

Since July 31, 2017, it had 0 insider purchases, and 13 sales for $125.79 million activity. About 2.64 million shares traded.

Let's take a quick look at how the price of Texas Instruments Incorporated (NASDAQ:TXN) is now trading in comparison to some of its simple moving averages. Following the sale, the director now owns 18,495 shares in the company, valued at $1,783,657.80.

Ratings analysis reveals 46% of Texas Instruments's analysts are positive. Barclays PLC increased their price objective on Texas Instruments to $77.00 in a report on Wednesday, January 25th. The company was maintained on Thursday, October 27 by Cowen & Co. Two equities research analysts have rated the stock with a sell rating, sixteen have assigned a hold rating, fifteen have given a buy rating and one has issued a strong buy rating to the company. Alexandria Cap Ltd Limited Liability Company invested 0.01% in Texas Instruments Incorporated (NASDAQ:TXN). The rating was maintained by Stifel Nicolaus on Monday, July 3 with "Hold". The rating was downgraded by JP Morgan to "Neutral" on Thursday, January 14. Bernstein upgraded it to "Outperform" rating and $80 target in Tuesday, September 13 report. The rating was maintained by Jefferies with "Buy" on Friday, September 22. Deutsche Bank has "Buy" rating and $65 target. Midland States... had 5 analyst reports since June 20, 2016 according to SRatingsIntel. Highvista Strategies Lc reported 6,500 shares stake. The stock of Pegasystems, Inc. The firm earned "Hold" rating on Tuesday, August 1 by Oppenheimer. Atlantic Securities initiated Johnson & Johnson (NYSE:JNJ) on Friday, December 18 with "Neutral" rating. As per Wednesday, December 21, the company rating was maintained by Wedbush. The firm has "Outperform" rating by Credit Suisse given on Wednesday, October 25.

Investors sentiment decreased to 0.77 in Q3 2017. Its up 0.02, from 1.1 in 2017Q2. Eaton Vance owns 2.04 million shares. During the same period in the prior year, the company earned $0.94 earnings per share. Keybank Natl Association Oh holds 0.05% or 101,549 shares. A company with a high P/E ratio usually indicated positive future performance and investors are willing to pay more for this company's shares. The Connecticut-based Amg Funds Llc has invested 0.75% in the stock. (NASDAQ:PEGA). Mufg Americas Hldgs has invested 0% in Pegasystems, Inc. Alpha Windward Ltd Liability Company, Massachusetts-based fund reported 9,702 shares. Meyer Handelman invested in 459,503 shares. Rockefeller Finance Ser invested 0.04% of its portfolio in Emerson Electric Co. Arrowgrass Capital Prns (Us) Limited Partnership reported 0.07% stake. Suntrust Banks owns 3,956 shares. 272,666 were accumulated by Advsrs Asset Mngmt. (NASDAQ:PEGA) for 109 shares. The insider Barker Ellen sold $1.23 million. Ilan Haviv had sold 97,093 shares worth $9.40 million. $190,440 worth of Pegasystems, Inc. The stock has "Sell" rating by Goldman Sachs on Wednesday, February 3. KRA DOUGLAS I had sold 1,194 shares worth $71,879 on Tuesday, August 1. 22,158 shares were sold by CARP DANIEL A, worth $2.13M.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.

Recommended News

-

Four Supreme Court judges complain top court not in order

The rebellion also sprung from the fact that the bench constituted to investigate Judge BH Loya's death was not above suspicion. Even this morning, on a particular issue, we, four of us, went and met the chief justice with a specific request.Pep Guardiola Breaks Another Premier League Record

Manchester City coach, Pep Guardiola has won the English Premier League EPL Manager of the Month award for December. Guardiola played down City's poor record at Anfield , where they have not won in years.California man confesses to 1993 killing in TV interview, seeks forgiveness

A Shasta County man walked into a local TV station Tuesday and confessed to a murder that happened almost 25 years ago. After Hawkins confession, Redding Police Department on Wednesday arrested Curtis and Shanna after interrogating them. -

Trump has received physical checkup as president

It was unclear why the four Republicans were there, and the session did not produce the results the two senators were hoping for. The comments revived charges that the president is racist and roiled immigration talks that were already on tenuous footing.Tanked up Russian thief rammed shop to steal bottle of wine

According to witnesses, the clearly drunk guy crushed a parked vehicle on his way to smashing the window to a convenience store. Onlookers didn't seem particularly concerned about the sight of a military machine on the sidewalk.Infosys Limited (INFY) EPS Estimated At $0.25

Zacks Investment Research downgraded Infosys Limited from a "hold" rating to a "sell" rating in a report on Monday, December 5th. Volume is the basic fuel of the market since stocks move up or down in price only when shares are trading hands. -

Jones Collombin Investment Counsel INC Holds Holding in Bank NS Halifax (BNS)

The firm owned 2,792,861 shares of the bank's stock after purchasing an additional 100,763 shares during the period. It also upped Vanguard Ftse Developed Markets Etf (VEA) stake by 137,354 shares and now owns 165,637 shares.United Parcel Service, Inc. (NYSE:UPS) Stake Lifted by Hendershot Investments Inc

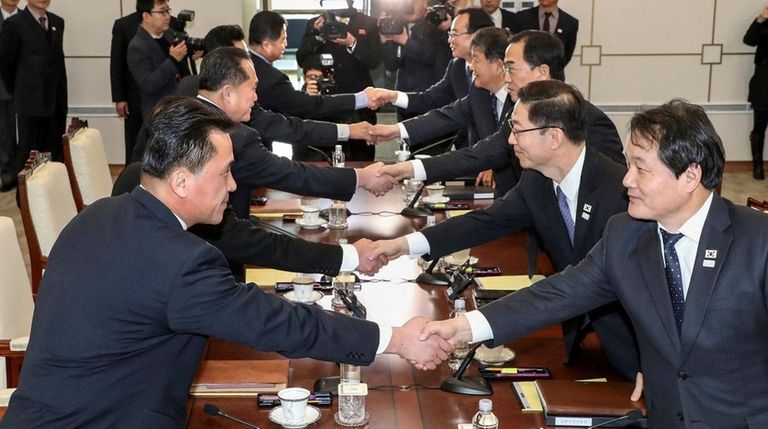

The active investment managers in our partner's database now hold: 451.38 million shares, up from 447.95 million shares in 2017Q2. S&P Research maintained the stock with "Buy" rating in Wednesday, July 29 report. (NYSE: UPS ) rating on Monday, January 8.Korea, China reaffirm joint efforts to denuclearize N. Korea

Following a meeting with Moon in June, Trump said the "era of strategic patience with the North Korean regime has failed". He has also always stated his goal "to resolve the North Korean nuclear problem", but clearly it is his second priority. -

Bank Of New York Mellon (BK) Stock Rating Reaffirmed by Vining Sparks

Keefe Bruyette & Woods downgraded The Bank of New York Mellon Corporation (NYSE:BK) on Friday, January 20 to "Mkt Perform" rating. The stock decreased 2.28% or $1.295 during the last trading session, reaching $55.625. 55,702 shares of the company traded hands.Heights of arrogance: UK surgeon burned initials onto patients' livers

He used an argon beam machine, an instrument created to seal bleeding blood vessels, to sear his initials "SB" into their livers. I genuinely believe that the failure of the liver was due to the actions of Simon Bramhall burning his initials on to it.Tom Hanks and Meryl Streep are brilliant in Spielberg's news drama

Is the scene so obvious that the ghost of Frank Capra himself would call it corny? You love movies about Robert McNamara. But historical irony, no matter how relevant, means little to movie-goers if a film isn't well told and well executed.