US stocks, dollar fall as Fed lifts interest rates

The action was approved, 8-0, avoiding any dissents at the first meeting that Powell has presided over as chairman since succeeding Janet Yellen last month. Virtually every USA recession is preceded by a runup in interest rates. The Fed tightened policy three times a year ago.

"While there were some aspects of today's announcement that were perhaps more hawkish than some expected, ultimately the currency market appeared to focus on the unchanged projection of a total of three rate hikes for 2018, which perhaps disappointed some who expected policymakers to signal a more aggressive near-term rate path", said Nick Bennenbroek, head of currency strategy at Wells Fargo Securities.

Since then, the FOMC has agreed on a plan to gradually unwind its asset purchases, in one of Yellen's last decisions as central bank chair.

However, he also acknowledged that central bankers now consider the prospects of a global trade war as a "more prominent risk" to the economic outlook.

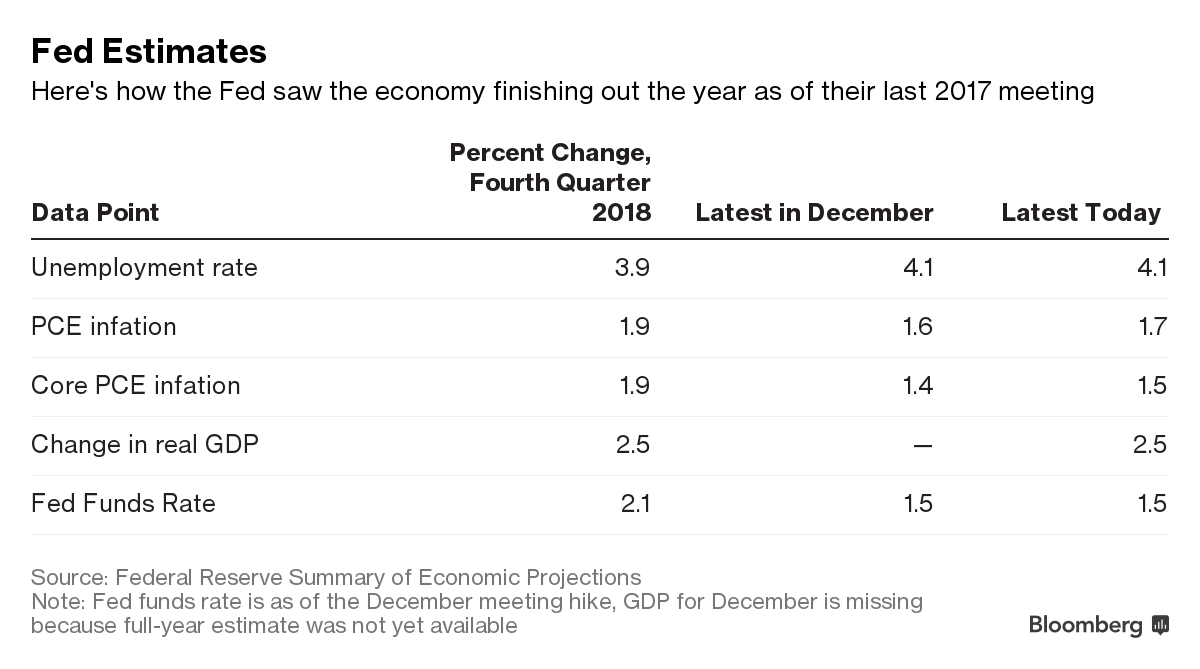

In December, the Fed predicted United States gross domestic product (GDP) to grow 2.5 percent this year, 2.1 percent in 2019 and two percent in 2020.

The short-term bias is turning bearish for the dollar index.

Shares on China's exchanges were lower, with the Shanghai Composite Index slipping as much as 1.2 percent to two-week lows.

Paradoxically, Powell's latest attempt to soft-pedal the Fed's projections comes just as they're coming more in line with those of some Wall Street economists. But even the typically sanguine Fed is predicting that the USA economy will not reach the Trump Administration's 3% target, this year or during the remainder of the president's term. The committee pushed the 2020 level up from 2 percent to 2.1 percent for both core and headline.

Canadian retailers could be helped by a USA trade battle with China

China encourages innovation and has laws to protect intellectual property rights for both Chinese and foreign companies, said Cui. Once the list of some 1,300 products is made official, US companies will have a window to comment and potentially seek relief.

Bucks' Giannis Antetokounmpo out for Friday game with Bulls

In order to stay competitive most nights they have to try to exploit their speed and athleticism by establishing a fast pace. The Bulls were unable to buck their recent trend with a fourth consecutive defeat, falling 118-105 to the Milwaukee Bucks.

Amazon.com, Inc. (NASDAQ:AMZN): Honing in on Growth Projections

It worsened, as 73 investors sold AMZN shares while 549 reduced holdings. 43 funds opened positions while 78 raised stakes. In related news , VP Shelley Reynolds sold 544 shares of Amazon .com stock in a transaction on Thursday, February 15th.

"Many investors would have expected that the Fed would have upgraded its view given the stronger growth, the lower expected unemployment rate and improved economic outlook", he noted.

"He definitely downplayed the dots", said Michael Feroli, chief USA economist for JPMorgan Chase & Co.in NY, referring to the constellation of rate forecasts that the central bank portrays as dots on a graph. Recent data suggest that economic growth is falling short of expectations for the first quarter.

On the economic front, the Australian Bureau of Statistics said that the jobless rate in Australia came in at a seasonally adjusted 5.6 percent in February.

The Fed's goal is to keep supply and demand in balance in the economy amid a tight labour market, without lifting borrowing costs so quickly that the economy stalls. More broadly, 2018's growth projection rose 20 basis points to 2.7% and the FOMC took many opportunities to tighten at the margin.

The yield on two-year USA notes slipped back to 2.304 percent from a 9-1/2-year high of 2.366 percent hit on Wednesday while the 10-year yield dipped to 2.874 percent after an initial spike to 2.936 percent. Along with raising their growth forecasts, they declared in a statement that "economic activity has been rising at a moderate rate" and that "job gains have been strong in recent months".

They now expect the jobless rate to decline to 3.6 percent from the current 4.1 percent, and stay there through the end of 2020.

"With the unemployment rate now firmly below its long-run equilibrium, the implication is that the Federal Reserve (Fed) needs to normalise rates at a gradual and regular pace". The Fed had been gradually reducing its estimate of the long-run neutral fed funds rate since it began publishing its calculations in January 2012.

Recommended News

-

Moses penalty in Poland ensures Nigeria keep up winning ways

Referee Michael Oliver pointed to the spot and Moses simple kick send the goalkeeper the wrong way. The post Victor Moses Hands Nigeria Victory Over Poland appeared first on Channels Television .Sacramento police release body cam and helicopter footage of Stephon Clark shooting

He said the city's first black police chief, Daniel Hahn, is doing what he can but protested the actions of Hahn's officers. At approximately 9:25 p.m., STAR advised they observed a subject in a backyard and began to direct SPD officers to him.Rare Addresses Sea of Thieves Server Issues with Candid Video

Here's what the post says: "This new feature has the Captain of the Ferry of the Damned deduct a small gold fee when you die". The "enemy" players' voice chat is activated by proximity, so keep that in mind when boarding another crew's ship. -

Lawmakers advance bill expanding medical marijuana program in NJ

Voters in the IL county that includes Chicago have backed the recreational use of marijuana in a nonbinding referendum. Caviness said, should the casual use amendment pass, that the first $100 million in revenue is earmarked for teachers.Nike revenue rises 6.5 pct on higher demand in…

In addition, the firm has debt to equity ratio of 0.4 sometimes it remain same with long term debt to equity ratio. Worldwide sales were behind the revenue success, led by China sales which grew by 24 percent for the quarter.Pacific Rim: Uprising review - John Boyega's charm buoys goofy sequel

I grew up on Godzilla movies and retain some vestigial fondness for them-and, incidentally, I can't stand Transformers movies . It's only when the movie moves into the end of the second act that things begin to unravel badly. -

'Heart attack, trauma, stress' - how five abducted Dapchi schoolgirls died

He said while he was sad that she was not among those released, he is happy she did not denounced Christ. Security, anti-corruption and revamping of our economy are the main focus of our Government.Rod Stewart Is Taking Potshots At Elton John's Retirement

Despite the animosity, Stewart was more understanding when asked about Elton storming off stage earlier this month. Elton John chose to halt his touring career, announcing a final three year tour are a farewell to fans.Karti Chidambaram gets bail in INX Media corruption case

The CBI has alleged irregularities were committed in giving INX Media clearance to receive Rs 305 crore in foreign investment. Chidambaram had been in judicial custody since last 11 days since 12th March, has been granted bail by Justice S.P. -

DuShon Monique Brown, 'Chicago Fire' Actress, Dead at 49

Brown also had guest roles on the USA version of Shameless and Kelsey Grammer's political thriller Boss . The medical examiner's office listed her home address in south suburban Park Forest.Vancouver to join 100s of cities rallying against gun violence

This was one of the most deadly school shootings in US history, claiming 17 lives. The resolution urged President Donald Trump and the U.S.Family Struggling Following Death Of 15-Year-Old Son In Fire

Those who saw how fast the fire grew said they are thankful the workers were there and willing to risk their lives for others. A worn-out mother is not as good a mom as one who has energy for fun things on top of housework and child-tending.

/cdn.vox-cdn.com/uploads/chorus_image/image/59127595/Sea_of_Thieves_skull_cloud.0.jpg)