It has underperformed by 12.00% the S&P500.

Hap Trading Llc increased its stake in Devon Energy Corp New (DVN) by 3054.25% based on its latest 2017Q3 regulatory filing with the SEC. Franklin Resources Inc sold 283,719 shares as the company's stock declined 3.22% while stock markets rallied. Asset Mgmt One Limited invested in 0.34% or 1.70M shares. Myriad Asset Management Ltd who had been investing in New Oriental Ed & Tech Grp I for a number of months, seems to be less bullish one the $14.25 billion market cap company. The stock decreased 3.41% or $0.1 during the last trading session, reaching $2.83. Deutsche Bank Ag owns 2.53M shares. Devon Energy Corporation (NYSE:DVN) has risen 13.24% since March 23, 2017 and is uptrending. It has underperformed by 16.70% the S&P500.

Since February 16, 2018, it had 0 insider purchases, and 3 selling transactions for $930,912 activity. $398,295 worth of Danaher Corporation (NYSE:DHR) was sold by Blair Rainer. Calamos Ltd Liability Company reported 0.26% stake. The insider Simmons Jeffrey N sold $1.08M.

Investors sentiment increased to 1.29 in Q3 2017. Its up 0.01, from 0.82 in 2017Q2. Shares for $17.80 million were sold by LILLY ENDOWMENT INC on Wednesday, October 4. 75 funds opened positions while 209 raised stakes. Oak Ridge Investments Ltd Com holds 0.68% in Eli Lilly and Company (NYSE:LLY) or 197,116 shares. Sfmg Limited has invested 0.21% in Amazon.com, Inc. St Johns Limited Liability invested in 0.72% or 1,029 shares. Monetary Grp accumulated 17,500 shares or 0.63% of the stock. Cim Mangement Incorporated reported 16,779 shares stake. Quantbot Techs LP reported 0.08% of its portfolio in Devon Energy Corporation (NYSE:DVN). Winslow Asset Mngmt holds 66,964 shares. They expect $1.13 EPS, up 15.31% or $0.15 from last year's $0.98 per share. MSFT's profit will be $6.54 billion for 25.64 P/E if the $0.85 EPS becomes a reality. After $1.14 actual EPS reported by Eli Lilly and Company for the previous quarter, Wall Street now forecasts -0.88% negative EPS growth. The firm has "Overweight" rating by Piper Jaffray given on Thursday, December 22. Therefore 29% are positive. Danaher Corporation had 87 analyst reports since July 28, 2015 according to SRatingsIntel. The firm has "Neutral" rating by Credit Suisse given on Tuesday, October 10. The company was downgraded on Monday, November 28 by FBR Capital. Citigroup maintained it with "Buy" rating and $100 target in Friday, April 7 report. BMO Capital Markets has "Underperform" rating and $74 target.

1/5/2018-Argus Upgrade from a "Hold " rating to a " Buy" rating.

Private Capital Advisors Inc, which manages about $293.06 million US Long portfolio, decreased its stake in Ishares Nasdaq Biotechnology (IBB) by 3,189 shares to 1,811 shares, valued at $604,000 in 2017Q3, according to the filing.

The Traders Sell Sempra Energy (SRE) on Strength (SRE)

Sempra Energy (SRE ) now trades with a market capitalization of $28.79 Billion. 67 funds opened positions while 185 raised stakes. Qs Invsts Ltd Liability Com stated it has 14,169 shares or 0.01% of all its holdings. (NYSE:WEX) to report earnings on April, 26.

No Man's Sky coming to Xbox One in 'largest update yet'

The game's most recent update, Atlas Rises , was released last summer, adding 30 hours of story as well as more planetary variety. The port of the space exploration adventure will feature 4K support and HDR enhancement on Xbox One X.

Xiaomi Mi AI Speaker Mini launched: Most affordable smart speaker ever?

Xiaomi Mi TV 4S is powered by a quad-core 64-bit Amlogic T962 chip clocked at 1.5GHz that's mated with a Mali 450 GPU. The remote can also be used for giving voice instructions for other Xiaomi smart devices in your home as well.

Since September 29, 2017, it had 0 buys, and 9 sales for $54.34 million activity. About 5.66 million shares traded.

On 3/16/2018 Joshua L Smiley, CFO, sold 3,000 with an average share price of $79.20 per share and the total transaction amounting to $237,600.00.

Fmr has invested 1.58% in Microsoft Corporation (NASDAQ:MSFT). Its up 0.21, from 0.89 in 2017Q2.

On Thursday, Eli Lilly and Company (LLY) made the way into the market negative movers list with falling -2.19%. The company reported $1.14 earnings per share (EPS) for the quarter, topping the Zacks' consensus estimate of $1.08 by $0.06. The institutional investor held 321,734 shares of the oil & gas production company at the end of 2017Q3, valued at $11.81 million, up from 10,200 at the end of the previous reported quarter. Harbour Investment Mgmt Lc holds 1.78% or 2,639 shares. Eli Lilly and Company (NYSE:LLY) has risen 4.70% since March 24, 2017 and is uptrending. Corp's holdings in Eli Lilly and were worth $33,596,000 as of its most recent filing with the Securities and Exchange Commission (SEC). East Coast Asset owns 3,360 shares. London Of Virginia reported 2.52% of its portfolio in Eli Lilly and Company (NYSE:LLY). Bronson Point Management Lc owns 300,000 shares or 3.54% of their USA portfolio. Economic Planning Group Adv invested in 4,080 shares or 0.13% of the stock. State Bank Of Stockton owns 3,900 shares. Raymond James Advisors holds 0.09% of its portfolio in Eli Lilly and Company (NYSE:LLY) for 161,795 shares. Passport Capital Llc acquired 12,818 shares as Amazon Com Inc (AMZN)'s stock rose 13.58%. Janney Capital Mngmt Limited Liability, Pennsylvania-based fund reported 2,865 shares.

Eli Lilly and Company (LLY) has ATR reading of 1.50. Osterweis Capital holds 0.16% or 24,639 shares in its portfolio. Finally, Cornerstone Capital Management Holdings LLC. boosted its holdings in Eli Lilly and by 57.7% in the second quarter. The company's revenue for the quarter was up 7.0% compared to the same quarter last year. sell-side analysts predict that Eli Lilly and Co will post 4.87 earnings per share for the current fiscal year. Therefore 18% are positive. Eli Lilly and Company had 98 analyst reports since July 23, 2015 according to SRatingsIntel. Atlantic Securities downgraded the shares of LLY in report on Friday, November 25 to "Neutral" rating. The firm has "Market Perform" rating given on Wednesday, July 26 by Leerink Swann. The firm earned "Buy" rating on Monday, July 17 by Jefferies. The stock has "Buy" rating by Berenberg on Thursday, August 27. The stock of Eli Lilly and Company (NYSE:LLY) has "Outperform" rating given on Saturday, August 22 by Cowen & Co. As per Thursday, February 1, the company rating was maintained by Bank of America. BMO Capital Markets maintained it with "Sell" rating and $73.0 target in Wednesday, August 30 report. Dodge & Cox now owns 5,991,952 shares of the company's stock worth $493,138,000 after buying an additional 5,964,955 shares during the period. Credit Suisse has "Outperform" rating and $36 target. The stock has "Sell" rating by BMO Capital Markets on Wednesday, August 16.

- Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.

Recommended News

-

Automatic Data Processing (NASDAQ:ADP) Shares Sold by Tocqueville Asset Management LP

Hence the difference between Predicted EPS and Actual EPS reported is $0.09/share which shows an Earnings Surprise of 10 Percent. Moreover, Virginia Retirement Et Al has 0.51% invested in Starbucks Corporation (NASDAQ:SBUX). (NASDAQ: ADP ) or 2,275 shares.KP 'gutted' for Smith, Warner, Bancroft

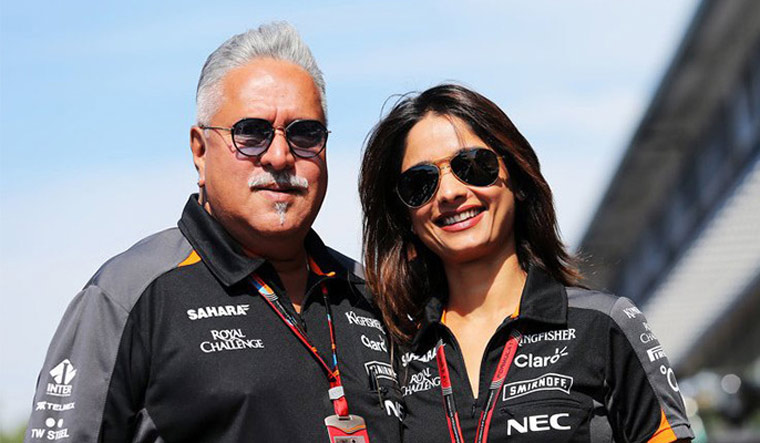

Australia's cricket player Cameron Bancroft being escorted by police officers to the departure area at OR Tambo International airport in Johannesburg.Vijay Mallya properties to be attached in FERA violation case

Vijay Mallya first marriage was with Sameera Tyabjee, with whom he stayed only for two years during 1986-1987. The duo have reportedly been dating and recently celebrated the third anniversary of their relationship. -

Australia cricket coach Lehmann to quit after South Africa series

Cricket Australia's investigation confirmed Bancroft used sandpaper to damage the ball during the third Test against South Africa .Social media reactions to Steve Smith and Cameron Bancroft's moving press conferences

So it is only fair that these players be left alone to serve their bans, without harassing them publicly in such a harsh fashion. Smith added: "I am deeply sorry, I love the game of cricket, I love kids aspiring to play the game of cricket that I love".Several oppose Kansas House Bill that supports arming teachers

She had initially been charged with two counts of furnishing liquor to a person under 21 and two counts of disorderly conduct. Police spoke to the second victim who also said that Zamora had showed him naked pictures of herself. -

SoftBank, Saudi Arabia announce massive solar power project

Additionally, Son said, the country also has great engineers, labor and, most importantly, the best and greatest vision. The total capacity to be built under its umbrella will be 200 gigawatts by 2030, the company said .Cambridge Analytica accused of violating election laws

The social network boss has said it was a mistake to rely on CA to delete tens of millions of Facebook users' data, as he apologised for the "major breach of trust".Flights from Hyderabad airport cancelled after plane tyre burst

The tyre burst triggered an emergency response at the airport as ground staff noticed sparks soon after the plane landed . According to airport sources, the runway was opened up for regular operations after the aircraft was towed to a side. -

Veterans Affairs pick impressed Trump when he gave glowing health report

He has been on active duty since 1995 and served with a Marine unit during the war in Iraq. In a statement, Trump praised Jackson as "highly trained and qualified".Tax hikes to avert teacher walkout poised for final vote

The group also urged Oklahomans to try to vote out current Republican legislators who supported the revenue-raising measures. The House late Monday obtained more than the three-fourths supermajority of votes needed for tax increases to pass the bill.Officer-involved shooting leaves one shooting suspect dead

Captain Solomon Sibiya, the Kagiso Police spokesperson, said the informant told them his employer had pointed a firearm at him. A teenager accused of stealing a auto was found to be driving the vehicle in Hamden and was accompanied by two other drivers.