/cdn.vox-cdn.com/uploads/chorus_image/image/59002529/930250034.jpg.0.jpg)

Getty Images

Insiders have sold 45,812 shares of company stock worth $2,996,776 over the last 90 days. The institutional investor held 456,933 shares of the radio and television broadcasting and communications equipment company at the end of 2017Q3, valued at $23.69 million, up from 306,682 at the end of the previous reported quarter. The stock increased 1.96% or $1.21 during the last trading session, reaching $63.03. Traders and investors often use earnings per share (TTM) to determine a company's profitability for the past year.

QUALCOMM Incorporated (NASDAQ:QCOM)'s earnings per share has been growing at a -11.6 percent rate over the past 5 year when average revenue increase was noted as 3.1 percent. It has underperformed by 5.52% the S&P500.

Pillar Pacific Capital Management Llc decreased its stake in Teva Pharm Inds Ltd Adrf Spons (TEVA) by 56.05% based on its latest 2017Q3 regulatory filing with the SEC. Altrinsic Global Advisors Llc bought 150,251 shares as the company's stock rose 2.14% with the market. The hedge fund held 31,000 shares of the consumer services company at the end of 2017Q3, valued at $29.80M, up from 26,000 at the end of the previous reported quarter. Eagle Ridge Investment Management who had been investing in Qualcomm Inc for a number of months, seems to be less bullish one the $92.98 billion market cap company. Vanguard Group Inc. now owns 103,484,572 shares of the wireless technology company's stock worth $5,714,418,000 after buying an additional 1,537,645 shares during the last quarter. It is down 0.00% since March 12, 2017 and is. It has underperformed by 19.46% the S&P500.

Among 39 analysts covering Under Armour (NYSE:UA), 8 have Buy rating, 10 Sell and 21 Hold. Therefore 11% are positive. Teva Pharma had 146 analyst reports since July 21, 2015 according to SRatingsIntel. (NYSE:UA) on Wednesday, February 1 with "Market Perform" rating. JP Morgan reinitiated Pfizer Inc. The firm has "Hold" rating by Topeka Capital Markets given on Thursday, January 28. The stock of Under Armour, Inc. The rating was maintained by Argus Research with "Buy" on Thursday, January 14. The rating was maintained by Cowen & Co on Monday, August 14 with "Buy".

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, March 21st. The firm earned "Buy" rating on Friday, June 23 by Northland Capital. The firm earned "Hold" rating on Friday, August 4 by Stifel Nicolaus. Mitchell Mcleod Pugh And Williams invested in 0.26% or 6,693 shares. Its down 0.13, from 0.98 in 2017Q2. 127 funds opened positions while 657 raised stakes. State Board Of Administration Of Florida Retirement Systems reported 2.14M shares. Fincl Counselors holds 1.08% or 618,304 shares in its portfolio. Mitsubishi Ufj Secs Ltd reported 0% stake. Telsey Advisory Group maintained Under Armour, Inc. 7,665 are owned by Hgk Asset Mgmt. (NYSE:AIG) for 196,332 shares. Alexandria Capital Ltd Com reported 10,065 shares. Carroll Fin Associates reported 312 shares. Nepsis Cap invested in 2.86% or 29,711 shares. Clarivest Asset Limited Liability Company owns 1,758 shares or 0.01% of their USA portfolio. Confluence Mngmt Ltd owns 10,504 shares for 0.01% of their portfolio. Conning Inc reported 1.27% stake. Schroder Invest Mngmt reported 4.57 million shares stake. Garde Capital Inc. boosted its stake in shares of QUALCOMM by 77.8% during the 3rd quarter.

White House denounces United Kingdom nerve agent attack, mum on Russian Federation

Sanders described the incident as "an outrage" and said Washington has been closely monitoring developments. Instead, Sanders said the administration is condemning the attack and "standing with our ally".

Trump considering ex-Microsoft executive Chris Liddell as top economic adviser

With reality-show flair, Trump built suspense for the announcement by making an impromptu visit to the White House briefing room. President Trump appreciated the briefing and said he would meet Kim Jong Un by May to achieve permanent denuclearization.

Apple Maps now includes bike sharing data for more than 175 cities

I tried looking for stations in smaller cities and it also works in European cities with hundreds of thousands of people. As TechCrunch notes Apple Maps doesn't show bike availability or empty spots for now, but hopefully that will come soon.

Since September 27, 2017, it had 0 buys, and 5 selling transactions for $2.98 million activity. ROGERS ALEXANDER H sold $48,627 worth of stock. About 100 shares traded. (NYSE:PFE) or 8,000 shares. About 340,012 shares traded. It increased, as 72 investors sold AIG shares while 293 reduced holdings. Two equities research analysts have rated the stock with a sell rating, fifteen have given a hold rating and fourteen have issued a buy rating to the company. Therefore 44% are positive. Qualcomm Inc. had 134 analyst reports since July 23, 2015 according to SRatingsIntel.

QUALCOMM Incorporated (NASDAQ:QCOM), maintained return on investment for the last twelve months at -7.46, higher than what Reuters data shows regarding industry's average. As per Monday, November 13, the company rating was maintained by Bernstein. On Thursday, August 24 the stock rating was maintained by RBC Capital Markets with "Hold". Deutsche Bank maintained QUALCOMM Incorporated (NASDAQ:QCOM) rating on Thursday, July 20. The stock of QUALCOMM Incorporated (NASDAQ:QCOM) earned "Buy" rating by RBC Capital Markets on Monday, February 19. The company was upgraded on Monday, July 27 by Morgan Stanley. The rating was maintained by Bank of America on Friday, October 27 with "Buy".

Investors sentiment increased to 1.07 in Q3 2017. Its down 0.13, from 0.98 in 2017Q2. It dived, as 83 investors sold QCOM shares while 490 reduced holdings. 127 funds opened positions while 657 raised stakes. Cleararc has 0.38% invested in QUALCOMM Incorporated (NASDAQ:QCOM). Inv Centers Of America has 0.06% invested in QUALCOMM Incorporated (NASDAQ:QCOM) for 15,604 shares. North Star Mgmt holds 0.01% or 400 shares in its portfolio. RTN's profit will be $600.09M for 25.82 P/E if the $2.08 EPS becomes a reality. Creative Planning reported 181,335 shares. Dekabank Deutsche Girozentrale, a Germany-based fund reported 392,292 shares. Vision holds 0.21% of its portfolio in QUALCOMM Incorporated (NASDAQ:QCOM) for 12,557 shares. Moreover, Chevy Chase Trust Holding has 0.31% invested in QUALCOMM Incorporated (NASDAQ:QCOM) for 1.30M shares. The stock of QUALCOMM Incorporated (NASDAQ:QCOM) has "Hold" rating given on Monday, February 5 by Stifel Nicolaus.

Institutions own 78.71% of QUALCOMM Incorporated (QCOM)'s shares. Oppenheimer And stated it has 36,715 shares or 0.94% of all its holdings. Stockholders of record on Wednesday, February 28th will be given a dividend of $0.57 per share. Atlas Browninc invested 0.07% in QUALCOMM Incorporated (NASDAQ:QCOM). Susquehanna Limited Liability Partnership owns 4.25 million shares for 0.1% of their portfolio. More than 2,857,297 shares exchanged hands compared to an average daily volume of 11,181,963 shares.

Recommended News

-

Kinzhal missile fascinating facts: Russia's 'invincible' hypersonic warhead test successful

Putin adds that he has been informed by security officers that the procedure in such a situation is to take off the plane. In its response the USA state department said this was not "the behaviour of a responsible worldwide player".World premiere of "Ready Player One" movie shines with Austin pride

Although there were some concerns from a few audience members, Ready Player One seems to be a crowning achievement for Spielberg. Warner Bros. pulled out all the stops to promote the film at SXSW.Firmino Erases Liverpool's In Champions League

He has scored 22 times in 40 outings this season for the Champions League quarter-finalists, adding 13 assists into the bargain, having finished last season with 12 overall. -

'Bookkeeper of Auschwitz' dies before starting sentence

The "bookkeeper of Auschwitz", convicted as an accessory to the murder of 300,000 people, has died before starting his jail term. German prosecutors deemed Groening to be fit enough to go to prison as long as there was appropriate medical care.What Recent Ownership Trends Suggest About Merck & Co., Inc. (MRK)'s Future Performance

Following the completion of the sale, the insider now owns 101,484 shares in the company, valued at approximately $6,254,458.92. Twelve investment analysts have rated the stock with a hold rating and eleven have given a buy rating to the stock.The Bills just became trade-up candidates in the National Football League draft

The Pittsburgh Steelers have All-Pro wide receiver Antonio Brown to go along with JuJu Smith-Schuster and Martavis Bryant. The Cleveland Browns have won one game in the last two years, but appear to be primed for a major leap in the standings. -

Democrat Leads by 6 Points in Pa. Special Election Contest

The United Steelworkers held a get-out-the-vote rally for Lamb on Friday afternoon, complete with appearances by Democratic Gov. Lamb is expected to run in the neighboring district (the 17th Congressional District), now held by Republican Keith Rothfus.Southampton sack Mauricio Pellegrino with eight games left in the season

Following the Saints' 3-0 defeat at relegation rivals Newcastle on Saturday, Pellegrino has lost his job after less than a year in charge.Mourinho savages 'worst manager' De Boer

The best thing that can happen to a kid is experiences and Marcus is having these". "But he's so talented and you want to see him play every week". -

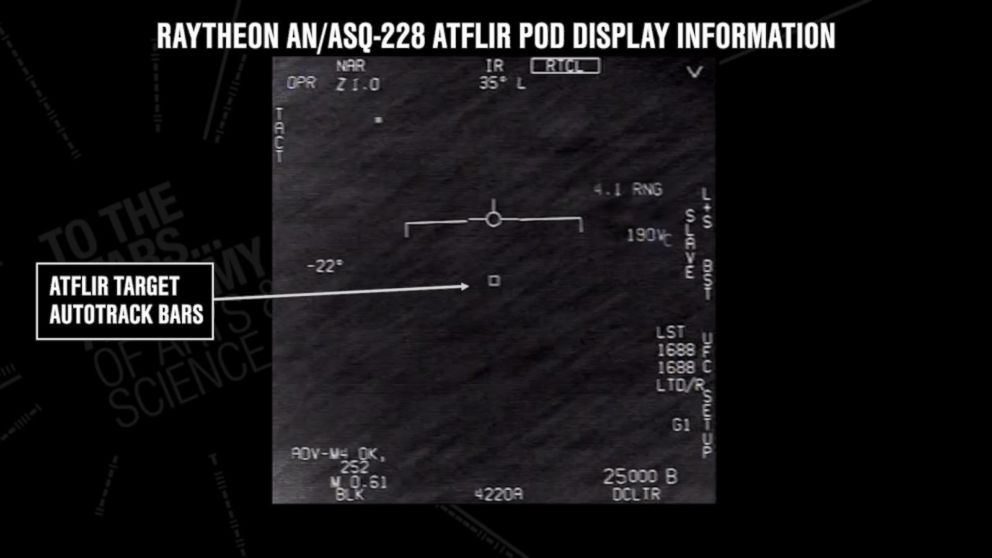

Footage said to show Navy jet's encounter with UFO

Chris Mellon, TTSA adviser and former deputy assistant secretary of defense for intelligence under presidents Clinton and George W.United States stocks end mixed after February jobs data

Johnson Controls was up 1.6 percent after saying it would consider selling a business that makes batteries for vehicles. The S&P 500 posted 61 new 52-week highs and no new lows; the Nasdaq Composite recorded 211 new highs and 24 new lows.Ex-Bangladesh PM Zia gets bail in corruption case

She is the chairperson and leader of the Bangladesh Nationalist Party (BNP) which was founded by Rahman in the late 1970s. Lawyers said a two-member panel of judges considered the 72-year-old Zia's age and health condition in granting the bail.