The institutional investor held 13,258 shares of the consumer services company at the end of 2017Q3, valued at $12.74M, up from 12,888 at the end of the previous reported quarter. The firm earned "Neutral" rating on Tuesday, February 21 by JP Morgan. About 2,745 shares traded. Stantec Inc. (NYSE:STN) has declined 7.10% since March 13, 2017 and is downtrending. It has underperformed by 15.02% the S&P500.

Water Asset Management Llc decreased Stantec Inc (STN) stake by 81.89% reported in 2017Q3 SEC filing. During the same period in the prior year, the business earned $1.54 earnings per share. sell-side analysts predict that Amazon.com, Inc. will post 8.49 EPS for the current fiscal year. The Private Asset Management Inc holds 4,395 shares with $4.40 million value, up from 4,027 last quarter. The stock decreased 0.81% or $12.98 during the last trading session, reaching $1585.41. About 1.65M shares traded.

Beacon Investment Advisory Services Inc. bought a new stake in Amazon.com, Inc. It has outperformed by 20.71% the S&P500. Five analysts have rated the stock with a hold rating, forty-seven have given a buy rating and two have assigned a strong buy rating to the company. Therefore 94% are positive. Train Babcock Advsrs holds 0.13% in Amazon.com, Inc. (NASDAQ:AMZN) in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The stock of Amazon.com, Inc. (NASDAQ:AMZN) has "Outperform" rating given on Friday, July 29 by CLSA. The rating was maintained by Scotia Capital with "Outperform" on Friday, August 7. On Thursday, September 29 the stock rating was maintained by Barclays Capital with "Overweight". Goldman Sachs Group restated a "buy" rating on shares of Amazon.com in a research note on Friday, January 26th. Cowen & Co maintained Canadian Pacific Railway Limited (NYSE:CP) on Wednesday, June 22 with "Outperform" rating. As per Friday, October 27, the company rating was maintained by Loop Capital.

Investors sentiment decreased to 1.26 in 2017 Q3. It is positive, as 73 investors sold AMZN shares while 549 reduced holdings. 127 funds opened positions while 657 raised stakes. 279.77 million shares or 1.91% less from 285.20 million shares in 2017Q2 were reported. Mitsubishi UFJ Trust & Banking Corp owned about 0.23% of Amazon.com worth $1,065,730,000 as of its most recent filing with the Securities & Exchange Commission. (NASDAQ:AMZN). Mgmt Corporation Va owns 298 shares for 0.08% of their portfolio. Ok has invested 1.04% in Amazon.com, Inc. (NASDAQ:AMZN). Winslow Evans & Crocker Inc has invested 1.17% of its portfolio in Amazon.com, Inc. Lucas owns 3,145 shares or 2.71% of their United States portfolio. Homrich Berg, a Georgia-based fund reported 1,518 shares. Strategic Advisors Ltd Llc holds 1.9% of its portfolio in Amazon.com, Inc.

Haske Sells 25000 Shares of Paylocity Holding Corp (PCTY) Stock

It dived, as 18 investors sold HZO shares while 32 reduced holdings. 49 funds opened positions while 57 raised stakes. Seven research analysts have rated the stock with a hold rating and eleven have issued a buy rating to the stock.

Air Products & Chemicals, Inc. (APD) Shares Bought by Alliancebernstein LP

Apg Asset Mngmt Nv holds 0% of its portfolio in CommScope Holding Company, Inc. 22,976 are held by Shell Asset Communications. Sumitomo Mitsui Asset Co Ltd holds 0.02% or 24,370 shares in its portfolio. (NYSE:EDR) for 14,543 shares.

Toys R Us could close all of its stores

Payless ShoeSource, JC Penny, Macy's, and Radio Shack all had to close down several locations previous year . Toys R Us now has about 800 stores in the United States.

A number of equities research analysts recently weighed in on AMZN shares. Eulav Asset Mngmt reported 18,900 shares. Following the transaction, the director now directly owns 14,159 shares in the company, valued at approximately $21,238,500. Panagora Asset Mgmt has 496,822 shares for 1.89% of their portfolio. Comerica Secs invested in 0.33% or 2,500 shares. The company was maintained on Tuesday, January 30 by Needham. Kcm Ltd Liability Com holds 0.51% of its portfolio in Amazon.com, Inc.

Since December 7, 2017, it had 0 insider buys, and 12 selling transactions for $45.10 million activity. Zapolsky David had sold 2,216 shares worth $3.24 million. The stock of Amazon.com, Inc. (NASDAQ:AMZN) has "Buy" rating given on Thursday, September 7 by DA Davidson. (NASDAQ:AMZN) for 15,470 shares. Blackburn Jeffrey M sold $18.50 million worth of Amazon.com, Inc. (NASDAQ:AMZN) or 250 shares. Amazon.com had a net margin of 1.71% and a return on equity of 9.23%. Insiders sold 5,714 shares of company stock worth $8,462,195 over the last quarter. $3.42M worth of Amazon.com, Inc. (NASDAQ:AMZN). 1,800 were reported by Granite Point Cap Mngmt Ltd Partnership. Reaches the Stratosphere" on March 13, 2018, also Reuters.com with their article: "Exclusive: "Amazon.com readies move to sell electronics directly in Brazil ..." published on March 08, 2018, Bloomberg.com published: "Amazon Wants to Dominate Office Supplies With Its Credit Card" on March 12, 2018. Its up 1.35, from 1.3 in 2017Q2. It is positive, as 52 investors sold AAPL shares while 1034 reduced holdings. 57 funds opened positions while 236 raised stakes. (NASDAQ:AMZN). Lenox Wealth Mgmt Inc accumulated 0.19% or 569 shares. Cullinan Associates, Kentucky-based fund reported 158,959 shares. According to their observations and findings, the stock could provide a high EPS of $1.71/share and a low EPS of $0.66/share. Moreover, Bridgeway Capital has 0.01% invested in AAC Holdings, Inc. (NASDAQ:AMZN) for 22,362 shares. Regions Fincl Corp holds 35,204 shares. Amer Investment Advsr Ltd Liability Corp accumulated 5.82% or 42,333 shares. Smith & Howard Wealth Llc holds 0.13% of its portfolio in AT&T Inc. It also increased its holding in Boston Scientific Corp (NYSE:BSX) by 23,900 shares in the quarter, for a total of 78,900 shares, and has risen its stake in Us Bancorp (NYSE:USB).

Among 53 analysts covering Apple Inc. UBS has "Buy" rating and $1620.0 target. The stock was sold at an average price of $1,549.90, for a total transaction of $387,475.00. Grove Bank & Trust raised its position in Amazon.com by 21.6% in the 3rd quarter. The firm has "Hold" rating by HSBC given on Monday, September 26. Mizuho maintained the stock with "Buy" rating in Tuesday, August 25 report. The firm has "Hold" rating given on Wednesday, January 11 by Deutsche Bank. Mai Capital stated it has 5,666 shares. The stock of AT&T Inc. (NYSE:T) has "Buy" rating given on Friday, August 14 by S&P Research. The firm has a market capitalization of $773,790.00, a PE ratio of 348.99, a price-to-earnings-growth ratio of 6.95 and a beta of 1.54. The company was maintained on Wednesday, April 27 by Cowen & Co. On Friday, June 16 the stock rating was maintained by Cantor Fitzgerald with "Buy".

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our daily email newsletter.

Recommended News

-

Kim Kardashian West Says She Doesn't Want More Than Four Kids

Alongside the saucy pics, Kim is the first star to feature on a personalised magazine cover for the mag's April issue. The internet is buzzing with news that Kanye West could be recording a new album in mountainous U.S. state Wyoming.Female Microsoft employees filed hundreds of harassment and discrimination complaints, lawsuit says

Along with the number of complaints filed, human resource practices were released publicly in a legal filling submitted on Monday. The plaintiff's attorneys are hoping the suit can proceed as a class action lawsuit, which might "cover more than 8,000 women".Researchers identify over 500 genes related to intelligence

The study - the largest of its kind - could lead to new treatments for Alzheimer's disease. Some of these genes have already been linked to other things, such as longevity. -

NICOLAS CAGE Finally Gets To Play SUPERMAN

With a few madcap ideas and a song in their heart, the Teen Titans head to Tinsel Town, certain to pull off their dream. But de facto leader Robin is determined to remedy the situation, and be seen as a star instead of a sidekick.Baghdad ends air blockade of Kurdistan, Iraqi PM announces

It also specified that a biometric system used in Kurdistan's airports will be linked with the federal system. It was not immediately clear whether the region would continue to maintain its independent visa system.Gold prices hold steady as U.S. dollar mildly weakens

As for other precious metals, silver for May delivery fell 7.2 cents, or 0.43 percent, to settle at 16.536 dollars per ounce. Treasury yields advanced after the jobs data, while stock markets rallied as the numbers sparked a surge in risk appetite. -

Knee Replacement Implants Market Production, Capacity, Price Estimation and Revenue Analysis 2022

This Overview Includes Diligent Analysis of Scope, Types , Application , Sales by region, manufacturers , types and applications. For sophisticated understanding, the Electric Vehicles and Fuel Cell Vehicles market is divided into segments and sub-segments.Princess Eugenie: Beatrice's sister Instagram account posts Sarah Ferguson pictures

Her second photo is of her and her fiance, Jack Brooksbank. "Happy Mother's Day to all mothers", she wrote in the caption. In the three days since she's joined Instagram, Princess Eugenie has amassed a healthy 18k followers.How to Watch Manchester United vs. Sevilla

Manchester United are now in second place in the Premier League table as they look to try and finish in the top four this season. -

South Sudan Requests To Join Arab League

South Sudan is part of a two-country visit by Egypt's foreign minister, who is set to go to Kenya later Monday. This is the Egyptian foreign minister's first visit to South Sudan since 2015.China To Create New Ministries, Merge Financial Regulators In Shake-Up

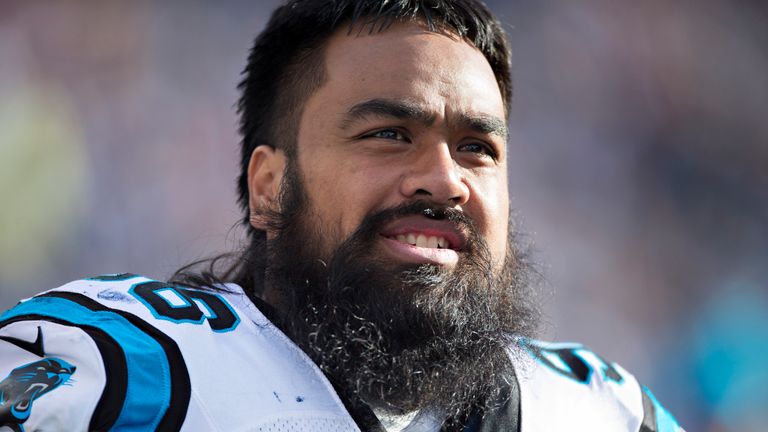

It's the biggest overhaul in the regulation of the industry since the creation of the CBRC in 2003. Such regulatory arbitrage and risky cross-asset investments have anxious policymakers.Ex-Lions DT Haloti Ngata plans to sign with Eagles

In his career, Ngata has 31.5 career sacks and won a Super Bowl with the Baltimore Ravens in 2012. Ngata, 34, is a five-time Pro Bowler, two-time first-team All-Pro, and a Super Bowl champion.