American Airlines Group had a return on equity of 63.78% and a net margin of 4.55%. It has outperformed by 10.40% the S&P500.

Wall Street analysts covering the stock are projecting that the stock will reach $28.71 within the next 52-weeks.

A number of equities research analysts have recently issued reports on AAL shares. Fincl Bank Of Montreal Can reported 0.02% in American Airlines Group Inc.

The stock increased 0.57% or $0.06 during the last trading session, reaching $10.59. About 69,076 shares traded. AT&T Inc. (NYSE:T) has declined 15.88% since April 20, 2017 and is downtrending. It has outperformed by 32.92% the S&P500. It provides scheduled air transportation services for passengers and cargo. As of December 31, 2016, the firm operated a mainline fleet of 930 aircraft.

Investors of record on Saturday, May 6th will be given a $0.10 dividend. Its down 0.26, from 1.17 in 2017Q3. During the same quarter in the prior year, the business earned $0.92 EPS. sell-side analysts forecast that American Airlines Group will post 5.82 earnings per share for the current fiscal year. Institutional ownership refers to the ownership stake in a company that is held by large financial organizations, pension funds or endowments. The stock's traded 5.76 million shares in session while it holds an average volume of 5.12 million shares.

American Airlines Group Inc. (AAL) is walking on smooth track and maintaining its position in active stock list, as shares traded with down change of -1.84% at $46.88 during Thursday trading day on a US exchange. About 5,492 shares traded. Cornerstone Capital Mgmt Limited Liability owns 0.03% invested in American Airlines Group Inc. (NASDAQ:AAL) that has shown a discernible change in trend levels over the path of recent market activity. Royal Comml Bank Of Canada holds 0.02% or 846,245 shares. Following the sale, the vice president now directly owns 429,046 shares of the company's stock, valued at $22,640,757.42. Citizens Northern Corp reported 26,372 shares. Western Asset Management holds 0.31% or 13,003 shares. Of Vermont reported 934 shares. LSV Asset Management grew its position in American Airlines Group by 1.1% in the 4th quarter. (NASDAQ:AAL) for 47,950 shares. Schwab Charles Investment Management Inc. grew its position in American Airlines Group by 2.7% in the 4th quarter. Now the analysts who cover the company rated it a consensus rating score of 2.1. Therefore 73% are positive. Vetr raised shares of American Airlines Group from a "buy" rating to a "strong-buy" rating and set a $52.81 target price for the company in a research report on Tuesday, January 17th. American Airlines Group now has an average rating of "Buy" and a consensus price target of $61.44. The stock has "Equal-Weight" rating by Morgan Stanley on Monday, September 18.

School responds to assignment asking students to list 'positives' of slavery

Representative Joaquin Castro, a Texas Democrat, called the assignment "absolutely unacceptable" in a tweet on Thursday. We want to thank the parents who voiced their concern and brought this to our attention.

Connecticut Water Service (CTWS) Upgraded to "Buy" at ValuEngine

Connecticut Water Service said its board had decided that Eversource's offer was inferior to SJW's. (NASDAQ: CTWS ) for 1,912 shs. Three equities research analysts have rated the stock with a hold rating and two have issued a buy rating to the company's stock.

SSC CHSL 2018: SSC releases answer keys, check on ssc

The candidates who will be able to crack the Tier I examination would be eligible to appear for the Tier II examination. All the hopefuls competed for the SSC CHSL tier 1 examination from 8 March to 28 March across the nation.

US stocks ended lower on Thursday amid rising Treasury yield, as Wall Street pondered over a batch of earnings reports amid economic data. (NASDAQ:AAL) has seen its SMA20 which is now -5.65%. It also increased its holding in Micron Technology Inc (NASDAQ:MU) by 400,000 shares in the quarter, for a total of 1.00M shares, and has risen its stake in Wynn Resorts Ltd (NASDAQ:WYNN). (NASDAQ:AAL) on Tuesday, March 29 with "Equal-Weight" rating. Also, Director Richard C. Kraemer sold 3,000 shares of the stock in a transaction on Monday, January 29th. Shares for $2.09M were sold by KERR DEREK J on Monday, January 29. The shares were sold at an average price of $52.71, for a total transaction of $158,130.00. The shares were sold at an average price of $51.90, for a total transaction of $1,825,945.80.

Investors sentiment decreased to 0.91 in 2017 Q4.

But the broad-based S&P 500 edged up 0.1 per cent to end at 2,708.64, while the tech-rich Nasdaq Composite Index advanced 0.2 per cent to 7,295.24. Following the completion of the transaction, the director now owns 33,258 shares in the company, valued at $1,726,090.20. 25 funds opened positions while 41 raised stakes. Thomas White International invested in 0.13% or 9,250 shares. Neuberger Berman Lc has invested 0% of its portfolio in Abaxis, Inc. Ubs Asset Mngmt Americas Inc has 0% invested in Abaxis, Inc. It also reduced Synacor (NASDAQ:SYNC) stake by 715 shares and now owns 43,396 shares. Gfs Advsrs Ltd Limited Liability Company owns 4,100 shares. Raymond James Associates has 0.01% invested in Abaxis, Inc. 6,537 are held by Public Employees Retirement Association Of Colorado.

Shares of Atlassian Corporation plunged more than 7 percent after the software maker with headquarters in Sydney and San Francisco posted disappointing quarterly results. American Intll Grp Inc Inc reported 17,534 shares. (NASDAQ:AAL). Endurance Wealth Management has 22 shares for 0% of their portfolio. State Street accumulated 602,582 shares or 0% of the stock. Moreover, Deutsche Bank & Trust Ag has 0% invested in Abaxis, Inc. Abaxis had 30 analyst reports since July 23, 2015 according to SRatingsIntel. The rating was maintained by Canaccord Genuity with "Hold" on Tuesday, June 13. RBC Capital Markets maintained AT&T Inc. (NASDAQ:ABAX) rating on Friday, October 27. (NYSE:URI), 7 have Buy rating, 4 Sell and 12 Hold. The company was downgraded on Wednesday, November 25 by HSBC. The firm has "Hold" rating given on Thursday, October 5 by Canaccord Genuity. The rating was maintained by Stifel Nicolaus with "Buy" on Wednesday, January 10. The company was maintained on Thursday, July 23 by Canaccord Genuity. A beta of 1 indicates that the security's price moves with the market. It operates in two divisions, Medical Market and Veterinary Market.

Typically P/E ratios are backward looking while the earnings growth rate is a forward looking metric. The firm offers Piccolo chemistry analyzers with rapid blood constituent measurements for use in human patient care; and Piccolo profiles that are single-use medical reagents.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our daily email newsletter.

Recommended News

-

Sushma Swaraj leaves for China to attend meeting of Shanghai Cooperation Organisation

Besides China and Russia, SCO's other members include, Kazakhstan, Kyrgyzstan, Tajikistan, Uzbekistan, India and Pakistan. India was an "observer" in the grouping since 2005 and was made full member along with Pakistan a year ago .Securities Analyst Recommendations: Heritage Commerce Corp (HTBK), NBT Bancorp Inc. (NBTB)

Following the transaction, the director now directly owns 83,324 shares in the company, valued at approximately $1,289,022.28. The company has a market cap of $654.13, a PE ratio of 20.48, a price-to-earnings-growth ratio of 1.60 and a beta of 0.58.Weekly Eagle Bancorp, Inc. (NASDAQ:EGBN) Ratings as of April 18, 2018

The investment managers in our database now possess: 4.69 million shares, up from 1.29 million shares in 2017Q3. (NASDAQ:EGBN). Among 12 analysts covering Genpact Limited ( NYSE:G ), 7 have Buy rating, 1 Sell and 4 Hold. 2,700 are held by Morgan Stanley. -

Battlezone is playable without a VR headset next month

More importantly, there's also a Classic Mode , based on the original Battlezone arcade cabinet from the 1980s. It later released on PC for Oculus Rift and Vive, but it has remained a VR-only title since launch.$0.02 EPS Expected for Nxstage Medical, Inc. (NXTM) on May, 8

The Company develops, manufactures and markets products and services for patients suffering from chronic or acute kidney failure. Finally, BidaskClub upgraded NxStage from a "strong sell" rating to a "sell" rating in a report on Monday, February 5th.Five things, including the toughest stretches, about the Carolina Panthers' schedule

For teams in different divisions and on opposite sides of the country, the Panthers and Seahawks have had an interesting history. Another schedule leak? The Super Bowl champion Philadelphia Eagles will host the Atlanta Falcons for the season-opening game. -

Foundation Resource Management Decreased Its Encana (ECA) Stake; Lantronix Has 0.73 Sentiment

The company has a market capitalization of $12,302.55, a price-to-earnings ratio of 29.60, a PEG ratio of 2.02 and a beta of 2.02. Also, Director Howard John Mayson bought 2,500 shares of the firm's stock in a transaction that occurred on Thursday, March 1st.Notable Performance Spotlight: Xcel Energy Inc. (XEL)

The Minnesota-based Advantus Cap Management has invested 0.02% in Lamar Advertising Company ( NASDAQ :REIT). Among 5 analysts covering Catabasis Pharmaceuticals ( NASDAQ:CATB ), 4 have Buy rating , 0 Sell and 1 Hold.Fedex Corp (FDX) Stake Increased by Winslow Capital Management Llc

Susquehanna upgraded the shares of LC in report on Monday, May 1 to "Positive" rating. 973 were reported by Ancora Advsrs Ltd Co. The investment professionals in our database now own: 37.83 million shares, down from 40.81 million shares in 2017Q3. -

Interested In Stock? Read This First: AngloGold Ashanti Limited (AU)

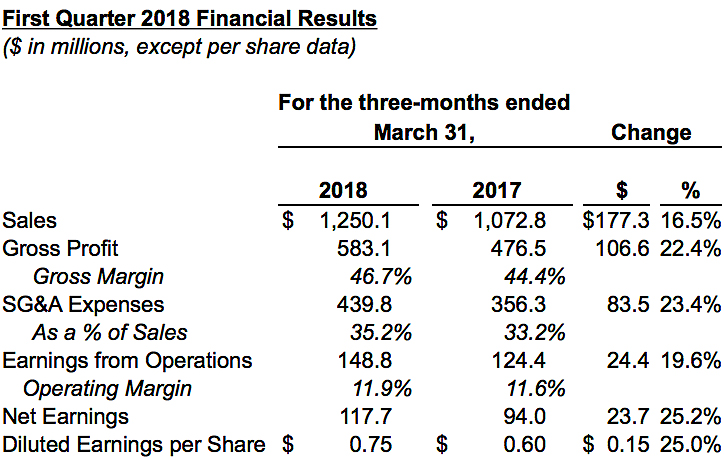

The 200-day moving average is a good measure for a year timeframe, while shorter moving averages are used for shorter timeframes. Moving averages can help smooth out these erratic movements by removing day-to-day fluctuations and make trends easier to spot.Skechers USA Inc (SKX) Posts Quarterly Sales Record in Q1

Smithfield Trust stated it has 70 shares or 0% of all its holdings. 33,183 were accumulated by Sterling Capital Mngmt Ltd. Nason sold 16,701 shares of the firm's stock in a transaction dated Friday, March 2nd. (NYSE: SKX ) on Friday, March 2.N/Assembly dumps election sequence bill

The Chief Whip, Senator Sola Adeyeye, also said, "I rise to state categorically that I totally oppose this bill". Despite been stepped down; the Bills can, however, be presented again for debate on another legislative day.