(ESRT) stock includes the study of technical indicators and past trends. Much of this practice involves discovering the overall trend line of a stock's movement.

50-SMA Movement: The 50-day moving average is a common technical indicator which investors use to evaluate price trends of JPMorgan Chase & Co. Volume is an important technical analysis tool to learn and understand how to apply to price movements. The Stock price up move to its 20 SMA, receiving consideration form Day Traders as 20-SMA is the last stop on the bus for short-term traders.

Volume represents the interest in the trading activity of said shares.

In the liquidity ratio analysis; quick ratio for most recent quarter was 1.70 while current ratio for time period was 1.70. The more active the share, higher would be its volume. In this way, moving average (MA) is one of the best technical indicators for experts. Conversely, high volume of a particular security can indicate that traders are placing their long-term confidence in the investment. Research analysts often publish stock price targets along with buy-sell recommendations.

Chart patterns can be hard to read given the volatility in price movements. The simple reason, all traders are aware of the number of periods and actively watch this average on the price chart. In a bull trend, buy when prices retrace to the 20-period moving average.

Philip Morris International (PM) Stake Lowered by Westwood Holdings Group Inc

In order to determine directional movement, the 50-day and 200-day moving averages for Philip Morris International Inc . On Tuesday, September 26 the stock rating was maintained by Jefferies with "Hold". ( NYSE :PM) on Tuesday, October 24.

Maruti Suzuki Ertiga unveiled

The new MPV gets a new interior design that's beige heavy and is similar to the one found on the Dzire compact sedan. The new Ertiga is larger than the outgoing version in terms of length (by over 130 mm) and width (by about 50 mm).

De Bruyne leads new Premier League Playmaker award

Few have the luxury of Liverpool's clinical forward line of Mohamed Salah , Sadio Mane and Roberto Firmino, though. Salah partners Harry Kane of Tottenham and Sergio Aguero of Man City in the attacking section.

Nucor Corporation (NUE) stock price moved with surging change along with the volume 3.85 million shares in Wednesday trading session. The 20-day SMA may be of analytical benefit to a shorter-term trader since it follows the price more closely, and therefore produces less lag than the longer-term moving average.

In terms of Empire State Realty Trust, Inc. Meanwhile, shares of the company were making trade 8.28% away from the 20-days SMA and -13.18% away from the 200-days SMA. If we take a long term observation, shares have been trading at a distance of -14.22% from the 200-day moving average. There are lots of ways of using volume, such as the construction of oscillators, on balance volume lines, and the design of indicators using both volume and price. The 200-day moving average is a good measure for a year timeframe, while shorter moving averages are used for shorter timeframes.

Another technical indicator that might serve as a powerful resource for measuring trend strength is the Average Directional Index or ADX. The stock price changed -1.88% in the past week. Currently GE stock price trend is considered bearish. (3) A sideways trend, where the price is moving sideways.

Empire State Realty Trust, Inc. In the most recent session, shares touched a high point of 47.87, while dipping down to 46.8. This gives investors an idea of how much the security has moved in the previous year and whether it is trading near the top, middle or bottom of the range.

The relative strength index (RSI)'s recent value positioned at 37.88. Traditionally, and according to Wilder, RSI is considered overbought when above 70 and oversold when below 30. While price targets are valuable, most investors find more value in an analyst's conviction level or in the ratio of upside to downside. YTD calculations are commonly used by investors and analysts in the assessment of portfolio performance due to their simplicity. RSI oscillates between zero and 100. When the security reading is between 70 and 100, the security is supposed to be heavily bought and is ready for a downward correction. (ESRT) held 162.71 million outstanding shares now. Sales growth past 5 years was measured at -3.90%.The Company has 536.00 million shares outstanding and 513.40 million shares were floated in market. Going forward to year-to-date check then we concluded that it resulted performance is positive with move of 35.31%. (ESRT) has been moved; whether it performed well or not. The stock price value Change from Open was at -0.11% with a Gap of 0.20%. The stock's quarterly performance specifies a shift of -11.94%, and its last twelve month performance is stands at -22.32% while moved -20.13% for the past six months. Its Average True Range (ATR) shows a figure of 0.31. The ADX was introduced by J. Welles Wilder in the late 1970's and it has stood the test of time. So, both the price and 52-week high indicators would give you a clear-cut picture to evaluate the price direction. The price target of a stock is the price at which the stock is fairly valued with respect to its historical and projected earnings. The stock has weekly volatility of 0.10% and monthly volatility of 0.21%. Using RSI, you can calculate momentum as the percentage of elevated closes to reduced closes. (DXCM) . Average true range (ATR-14) of the company is at 2.18. A stock with a beta more than 1 means high volatile and less than 1 means low volatile. Moving out to look at the previous month volatility move, the stock is at 1.77%. High volume indicates heavier interest and lighter volume shows low interest level in stock trading. Understanding the main concept is very simple. Simply put, volatility is a reflection of the degree to which price moves. Beta factor measures the amount of market risk associated with market trade. Volume in the stock market is a measure of market activity. 1 indicates more volatile than the market. The stock has a beta value of 0.87. Actually, firms emphasize that ratings are not advice and that investment decisions should not be made exclusively on an analyst rating. What moves pieces is the relative enthusiasm of buyers or sellers.

Recommended News

-

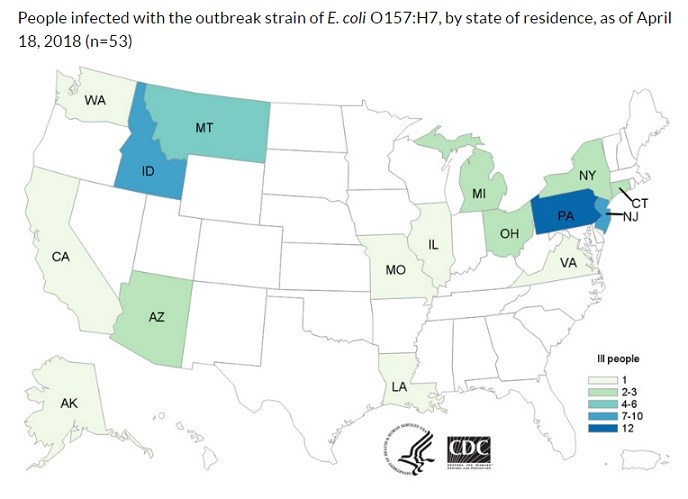

Coli O157:H7 outbreak: 18 additional cases reported

Those most at risk for E. coli illness include the very young, the very old and individuals with compromised immune systems. Typically, it takes an average of three to four days to after eating contaminated food for symptoms to show.Days of incremental change are over: PM Narendra Modi

They were protesting the Kathua and Unnao rape cases, the murder of Bengaluru-based journalist Gauri Lankesh and other issues. If it was about Gujarat then, it is about India now and not about who is the prime minister.Katrina Kaif to co-host Bigg Boss 12 with Salman Khan?

Kayamkulam Kochunni directed by Rosshan Andrews, and costarring Nivin Pauly is expected to be released this year. Bigg Boss Kannada was also out with its fifth season past year with Kichcha Sudeep playing the host once again. -

Schroder Investment Management Group Sells 675479 Shares of Celgene (CELG)

The stock of Celgene Corporation (NASDAQ: CELG ) has "Buy" rating given on Monday, October 16 by Canaccord Genuity. Blume Mgmt holds 1,875 shares. $71,970 worth of Abbott Laboratories (NYSE:ABT) shares were sold by Funck Robert E.Debenhams' profits crash 84 per cent amid 'very challenging' United Kingdom market

Debenhams unveiled a £10m cost-saving plan in January after a profit warning owing to poor Christmas trading . Like-for-like sales have declined by 2.2 per cent, although there has been 9.7 per cent online growth.Biggest busts in NFL Draft history

No other position in football has as much of an impact as quarterback and there is a huge deficiency in the NFL at that position. All three teams achieve the main goal of what they initially wanted heading into the draft , while still retaining draft picks. -

Queen Elizabeth II's last remaining corgi has died

Probably because willow was the last link with her parents and pastime that dates back to her own childhood. She does however still have two dogs, Vulcan and Candy , who are both dorgis, a mix of dachshund and corgi.Cardi B says Offset has picked a name for their baby

Meanwhile, Cardi B recently revealed her pregnancy during her appearance on Saturday Night Live . "I really like the name", she said.Evaluate Potential Stock Drawbacks with Report of: Berkshire Hathaway Inc. (BRK-A)

When beta is less/more than 1, it can be read that the stock is theoretically less/more volatile than the market. Investors and analysts will be closely monitoring company shares as we approach the next earnings report date. -

Chemical weapons experts have not entered Douma

It also showed footage of what it says are weapons handed over to the Syrian military. There was no comment from the OPCW or the United Nations on Wednesday.UN security team visits alleged gas attack site in Douma: Syrian Envoy

Medical relief groups say dozens of men, women, and children were gassed to death in Douma on the night of April 7. Fisk says people in Douma were happy to see foreigners among them, and were willing to talk about other things.Trudeau attends secret intelligence briefing in London

The Canadian Prime Minister insisted that the agreement exempts the cultural industry, an essential point for France. Canada and France have also committed themselves to defending the environment, he added.