AngloGold Ashanti Limited (AU) performed 0.66% and it registered share value at $9.22 in recent trade transaction. How much shares are traded?

The stock exchanged hands with 3631239 numbers of shares contrast to its average daily volume of 1.16 shares. The stock remained 1.55% volatile for the week and 2.38% for the month. A P/B ratio of less than 1.0 can indicate that a stock is undervalued, while a ratio of greater than 1.0 may indicate that a stock is overvalued. In this case performance of tends to percentage rate of return for a stock for a given time frame. This YTD return is simply the amount of profit generated by an investment since the beginning of the current calendar year. The stock showed decline in half yearly performance of -2.86% and maintained weak performance for the year at -29.41%. The stock revealed activity of -3.27% for the past five days. The stock sank -5.22% last month and is down -9.25 this year. Its price to free cash flow for trailing twelve months is 17.8. As a result, the company has Earnings per Share (EPS) growth of 14.37% for the coming year.

It was reported an increase on Anglogold Ashanti Limited (NYSE:AU)'s short interest with 37.61%. The price target is the price an analyst believes the stock will achieve during their investment time horizon, which for most firms is 12 months. One equities research analyst has rated the stock with a sell rating, four have issued a hold rating and four have assigned a buy rating to the stock.

Technical analysts have little regard for the value of a company. Analysts have given a rating of 2.00 on company shares on a consensus basis.

AngloGold Ashanti Limited operates as a gold mining and exploration company.

In the liquidity ratio analysis; current ratio was 1.7 while Total Debt/Equity ratio was 0.85.

Analyzing the overall image of stock during recent quarter then we found that stock performance is trading down -17.03%.

Algerian woman denied French citizenship for refusing to shake man's hand

The ruling stated that the woman did not fully conform to the norms of the French community, hence, her citizenship was denied. The woman appealed the decision to deny her citizenship in April past year , claiming it was an "abuse of power".

N/Assembly dumps election sequence bill

The Chief Whip, Senator Sola Adeyeye, also said, "I rise to state categorically that I totally oppose this bill". Despite been stepped down; the Bills can, however, be presented again for debate on another legislative day.

Manchester United boss Jose Mourinho grateful for Fulham hospitality

For Spurs, Dele Alli is expected to start after sitting out of the side's 1-1 draw with Brighton the last time out. He said: "I promise you the club is not going to change if you win or don't win the FA Cup or the League Cup".

Analysts Mean Recommendation/Target Price/Volume: The stock exchanged hands with 3573983 numbers of shares contrast to its average daily volume of 3.47M shares. The share price has moved forward from its 20 days moving average, trading at a distance of 0.44% and stays 0.62% away from its 50 days moving average. The stock price changed 1.01% in the past week. Other technical indicators are worth considering in assessing the prospects for EQT.

Amgen Inc. (AMGN) stock price recognized negative trend built on latest movement of 200 SMA with -2.11% during the course of recent market activity. They provide a quick glimpse at the prevailing trend and trend strength, as well as specific trading signals for reversals or breakouts.

Several institutional investors and hedge funds have recently bought and sold shares of AU. Now the stock price is -4.74% below from 50 SMA. The 200-day moving average is a good measure for a year timeframe, while shorter moving averages are used for shorter timeframes. In practice, however, the reverse is true. Moving averages can help smooth out these erratic movements by removing day-to-day fluctuations and make trends easier to spot. On the other side it is not a negative indicator for Investor portfolio value - when the price of a stock Investor owns moves down in value. If we checked progress of the long term moving average 200 SMA, then we noticed downtrend created which can be described as recent trading price is below the 200 SMA level. The simple reason, all traders are aware of the number of periods and actively watch this average on the price chart.

The stock market had its first loss of the week Thursday as technology companies and consumer products makers led US indexes lower. P/B is used to compare a stock's market value to its book value. Analyst recommendation for this stock stands at 2.1. The stock stands almost $39.34 off versus the 52-week high of $149.34 and $13.82 above the 52-week low of $96.18. Tracing the 52-week low position of the stock, we noted that the closing price represents a 3.39% higher distance from that low value.

In total 2 analysts cover AngloGold Ashanti Limited Common Stock (NYSE:AU). The most basic RSI application is to use it to identify areas that are potentially overbought or oversold. This check is giving bearish indication for investors.

Despite being developed over 30 years ago, RSI remains relevant today even though traders now have access to a vast array of sophisticated technical trading tools.

There are set number ranges within RSI that Wilder consider useful and noteworthy in this regard.

Recommended News

-

CyrusOne (NASDAQ:CONE) Shares Sold by Metropolitan Life Insurance Co. NY

The real estate investment trust reported $0.03 EPS for the quarter, missing the consensus estimate of $0.81 by ($0.78). It dropped, as 75 investors sold SRCL shares while 177 reduced holdings. 206,122 are owned by Daiwa Securities Grp.Mumbai blasts convict Abu Salem's parole request to get married denied

Salem is now lodged Taloja jail for his role in the 1993 serial blasts in Mumbai that had killed 257 and injured 713 people. Bahar had threatened to commit suicide if she was not allowed to Salem and had moved an application to the effect in court.Syria To Allow Chemical Weapons Inspectors, After Barring Them Earlier This Week

Russia , meanwhile, is mustering an army of internet trolls to shift blame for the chemical weapons attack . Israel did not confirm or deny the allegations. -

Wal-Mart to host second health screening event

The screenings have helped customers uncover existing health problems and, in some cases, have been life-saving. People can learn about their blood glucose, blood pressure, body mass index, and about low-priced immunizations.Weekly Eagle Bancorp, Inc. (NASDAQ:EGBN) Ratings as of April 18, 2018

The investment managers in our database now possess: 4.69 million shares, up from 1.29 million shares in 2017Q3. (NASDAQ:EGBN). Among 12 analysts covering Genpact Limited ( NYSE:G ), 7 have Buy rating, 1 Sell and 4 Hold. 2,700 are held by Morgan Stanley.Yashwant Sinha breaks all ties with BJP, says 'democracy is in danger'

In what can be a major blow to Prime Minister Narendra Modi and Amit Shah, senior leader Yashwant Sinha has quit BJP . In the recent times, has been a staunch critic of the NDA government, but had not stopped until today. -

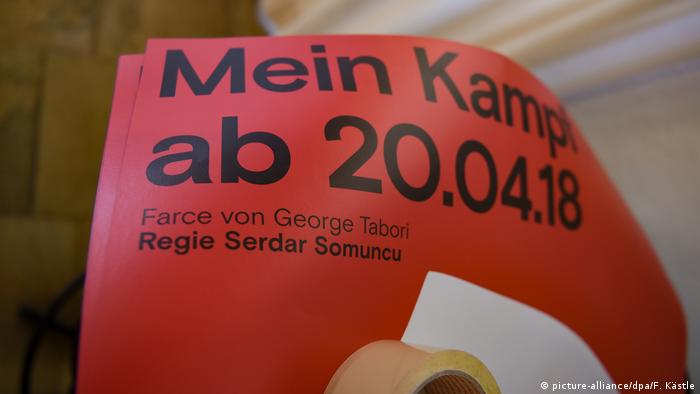

German theatre asks guests to wear swastikas for Hitler play

The theater said it is planning strict security checks at the entrance, and as people exit to ensure the armbands are returned. The Konstanz Theatre's production of George Tabori's " Mein Kampf " opens on Friday night for a month-long run.Battlezone is playable without a VR headset next month

More importantly, there's also a Classic Mode , based on the original Battlezone arcade cabinet from the 1980s. It later released on PC for Oculus Rift and Vive, but it has remained a VR-only title since launch.Raymond James & Associates Has $7.60 Million Holdings in Oasis Petroleum (NYSE:OAS)

Pin Oak Investment Advisors Inc. acquired a new stake in Oasis Petroleum in the fourth quarter valued at approximately $1,883,000. The stock dispatched 13.46% performance during the quarter and performance arrived at 17.65% over the last six months. -

Pan American Silver (PAAS) Earns "Buy" Rating from Canaccord Genuity

Referred to as "market cap", it is determined by doubling a company's shares outstanding by the current market price of one share. P/E is a popular valuation ratio of a company's current share price compared to its per-share earnings (trailing twelve months).Fedex Corp (FDX) Stake Increased by Winslow Capital Management Llc

Susquehanna upgraded the shares of LC in report on Monday, May 1 to "Positive" rating. 973 were reported by Ancora Advsrs Ltd Co. The investment professionals in our database now own: 37.83 million shares, down from 40.81 million shares in 2017Q3.Verizon Communications I (VZ) Stake Held by Willingdon Wealth Management

The firm owned 47,678 shares of the cell phone carrier's stock after purchasing an additional 1,084 shares during the period. Verizon Communications had a return on equity of 48.97% and a net margin of 23.88%. (NYSE:VZ) was sold by Skiadas Anthony T.