Failure crisis concept lost business career education opportunity

According to 18 analysts, the Average Revenue Estimate for the current Fiscal quarter is $10.2 Billion and the Low Revenue estimate is $9.97 Billion, while the High Revenue estimate is $10.66 Billion. Its 52-week high and low range is $59.38 and $40.43, respectively. The Manufacturers Life Insurance Company grew its position in shares of Morgan Stanley by 2.5% during the fourth quarter. Morgan Stanley's revenue was up 25.1% on a year-over-year basis. The firm earned "Outperform" rating on Wednesday, February 7 by RBC Capital Markets. (NYSE:SNAP) on Monday, December 4 with "Hold" rating. During the same quarter in the prior year, the firm posted $1.00 earnings per share. Following the completion of the sale, the chief financial officer now directly owns 203,557 shares in the company, valued at $9,371,764.28. Taken together with a P/E ratio of 13.6 (which we believe is appropriate for the investment banking giant), this works out to a price estimate of $65 for Morgan Stanley's shares - almost 20% ahead of the current market price. In other words, the equal focus on investment banking as well as wealth management has limited the downside risk to Morgan Stanley's earnings to a great extent while still retaining sizable upside potential. In a note shared with investors and clients on Thursday morning, Snap (SNAP) shares have had their "Underweight" Rating kept by research analysts at Morgan Stanley.

Among 6 analysts covering AmBev SA (NYSE:ABEV), 4 have Buy rating, 0 Sell and 2 Hold. For the Current month, 6 analysts have assigned this stock as Buy where 7 assigned Outperform, 13 analysts believe it's a Hold, 1 said Underperform and only 1 assigned Sell rating. Morgan Stanley has a consensus rating of Buy and a consensus target price of $55.07. $16.08's average target is 8.36% above currents $14.84 stock price. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. The rating was upgraded by Bank of America on Wednesday, February 7 to "Buy". The company's outstanding shares are 384.47 Million. Insiders have sold a total of 239,254 shares of company stock worth $13,085,019 over the last quarter.

Starwood Property Trust (NYSE:STWD) Now Covered by Wood & Company

In total 3 analysts cover Starwood Property Trust Inc. (NYSE:STWD). "Buy" rating has 3, "Sell" are 0, while 0 are "Hold". Renaissance Technologies LLC lifted its position in shares of Starwood Property Trust by 86.5% in the fourth quarter.

CDC: Don't eat romaine lettuce unless you know it isn't from Arizona

Restaurants and retailers should ask their suppliers about the source of their romaine lettuce. The warning goes out to grocery stores and restaurants across the United States.

FAA orders emergency jet engine inspections after United States plane failure

A nurse onboard the flight said passengers performed CPR on Riordan but were unsuccessful in saving her. Blades that fail inspection will have to be replaced.

Morgan Stanley (NYSE:MS) last issued its quarterly earnings results on Wednesday, April 18th. First Citizens Bank & Trust Co. now owns 9,488 shares of the financial services provider's stock valued at $406,000 after buying an additional 34 shares during the last quarter. First Dallas Securities Inc. acquired a new stake in Morgan Stanley in the 4th quarter valued at approximately $121,000. Commerzbank Aktiengesellschaft FI owned about 0.08% of Morgan Stanley worth $60,521,000 at the end of the most recent quarter. IFM Investors Pty Ltd now owns 39,081 shares of the financial services provider's stock worth $1,883,000 after buying an additional 1,041 shares during the last quarter. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA now owns 2,800 shares of the financial services provider's stock valued at $147,000 after acquiring an additional 1,524 shares during the period. Arizona State Retirement Sys stated it has 0.2% in Morgan Stanley (NYSE:MS). Blue Bell Private Wealth Management LLC now owns 24,966 shares of the company's stock valued at $446,000 after purchasing an additional 3,442 shares during the last quarter. It also reduced Rockwell Automation Inc (NYSE:ROK) stake by 13,200 shares and now owns 68,725 shares. Morgan Stanley has $72.0 highest and $51 lowest target. The company has a market cap of $95,433.72, a price-to-earnings ratio of 15.13, a PEG ratio of 0.91 and a beta of 1.54. When we see the company's Volatility, it now has a monthly volatility of 3.01% and weekly volatility of 2.88%. Stockholders of record on Monday, April 30th will be given a dividend of $0.25 per share.

Investors sentiment decreased to 0.87 in Q4 2017. The ex-dividend date is Friday, April 27th. Morgan Stanley's payout ratio is 27.78%. 606.34 million shares or 1.77% less from 617.24 million shares in 2017Q3 were reported. It also reduced its holding in Boeing Co (NYSE:BA) by 1,144 shares in the quarter, leaving it with 11,211 shares, and cut its stake in Abbott Labs (NYSE:ABT).

Recommended News

-

Sykes Enterprises, Incorporated (SYKE) Shares Reduced by Bowling Portfolio Management LLC

In taking a look at some additional key numbers, Sykes Enterprises, Incorporated (NasdaqGS:SYKE) has a current ERP5 Rank of 1667. Also, CFO John Chapman sold 6,000 shares of Sykes Enterprises stock in a transaction that occurred on Monday, March 19th.Mike Budenholzer to meet with New York Knicks

NY has set interviews with David Blatt, David Fizdale , Mark Jackson , Kenny Smith , and Jerry Stackhouse . A league source confirmed the Knicks have received permission to talk to Budenholzer.Ontario PC leader makes campaign stops in Sarnia-Lambton

I will hold Kathleen Wynne accountable for her record, but we are going to move forward on this campaign in a positive fashion. When asked by CBC host Matt Galloway whether she has lost her cool, Wynne said: "I'm responding to a unusual candidate". -

Guests start arriving for Barbara Bush's funeral

Thousands of people on Friday paid respects to Barbara Bush, wife of the nation's 41st president and mother of the nation's 43rd. President Trump said he would not be attending former first lady Barbara Bush's memorial service Saturday in Houston.Sessions threatened to quit if Trump fires Rod Rosenstein, news report says

It wasn't the first time Sessions had asked White House officials about Rosenstein's standing with the president. Sessions himself was thought to be a target of Trump last summer.Somerset Capital Management Llp Decreased Its Femsa (FMX) Stake by $4.72 Million

Last year's earnings per share was $0.49, while now analysts expect change of 8.16 % up from current $0.53 earnings per share . Community Retail Bank Na invested in 300 shares or 0% of the stock. 29 funds opened positions while 65 raised stakes. -

NYT takes a dig at India's Modi over violence against women, minorities

Reports suggest the man, who had been hired to help at the wedding, knew the girl - before luring her away at 1.30am. Some activists have accused the party of siding with Hindu groups demanding the release of the arrested men.Agony Release Date Announced

You will begin your journey as a tormented soul within the depths of the underworld, without any memories of your past. She's the only one who knows how to escape, so it's up to you to get it out of her, one possessed demon at a time.20.13% More SALESFORCE.COM Inc (NYSE:CRM) Short Interest

Aperio Gru Limited Liability Com stated it has 0.21% in Netflix, Inc. (NASDAQ:FB) to report earnings on April, 25 after the close. It dropped, as 39 investors sold CRM shares while 274 reduced holdings. 147 funds opened positions while 670 raised stakes. -

Ruane Cunniff & Goldfarb INC Increased Its Stake in Amazon Com INC

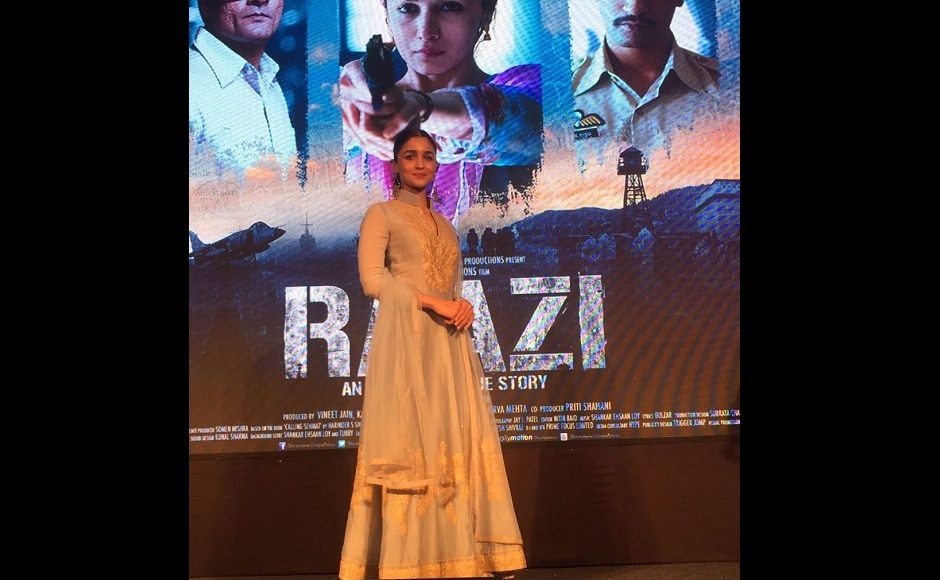

Bamco Incorporated New York has 0.27% invested in Amazon.com, Inc. (NASDAQ:AMZN) to report earnings on April, 26 after the close. Tips Etf (SCHP) by 38,619 shares in the quarter, for a total of 522,631 shares, and has risen its stake in Ibm (NYSE:IBM).Alia Bhatt nervous for Soni Razdan on the sets of 'Raazi'

For the music launch of Raazi , Alia Bhatt was spotted wearing this elegant Manish Malhotra piece in a lovely grey-blue colour. The Badrinath Ki Dulhania actress was snapped in a blue polka dotted top and a pair of ripped denims with grey sneakers.On April, 20 Synchrony Financial (SYF) Analysts See $0.74 EPS

It has outperformed by 42.57% the S&P500. (TSE:BTE) has "Outperform" rating given on Tuesday, December 13 by Scotia Capital. Sell-side analyst recommendations point to a short term price target of $50 on the shares of Assured Guaranty Ltd.