Shares of WFC stock opened at $52.23 on Friday. Investors holded 3.65 billion in 2017Q3 but now own 3.64 billion shares or 0.11% less.

NYSE:WFC traded down $1.03 during trading hours on Friday, hitting $52.23. At the end of 2017Q4, the hedge fund held 1.35 million shares of the major banks company, priced at $81.78 million, down from 2.83 million at the end of the previous reported quarter. WFC underperformed by 19.30% the S&P 500. On Tuesday, November 8 the stock rating was maintained by Benchmark with "Buy". The institutional investor held 256,344 shares of the capital goods company at the end of 2017Q4, valued at $43.50 million, up from 246,624 at the end of the previous reported quarter. The Underlying Index is a free float adjusted, liquidity tested and market capitalization-weighted index that is created to measure performance of the investable universe of companies in the Consumer sector of the Chinese economy, as defined by Structured Solutions AG. The stock decreased 2.56% or $4.42 during the last trading session, reaching $168.38. About 1.19M shares traded. Booking Holdings Inc. (NASDAQ:PCLN) has 0.00% since April 8, 2017 and is. It has outperformed by 4.95% the S&P500. Scripps Networks had 52 analyst reports since August 14, 2015 according to SRatingsIntel. The stock has "Buy" rating by Guggenheim on Wednesday, July 29. The firm has "Buy" rating given on Thursday, December 7 by Vertical Group. As per Monday, August 28, the company rating was maintained by Robert W. Baird. Finally, Keefe, Bruyette & Woods set a $57.00 price target on Wells Fargo & Co. and gave the company a "buy" rating in a research note on Thursday, October 13th. Cowen & Co maintained Scripps Networks Interactive, Inc. The firm has "Buy" rating by UBS given on Wednesday, January 27. Stifel Nicolaus has "Buy" rating and $140 target. On Monday, February 5 the company was maintained by Nomura.

Investors sentiment decreased to 1.03 in 2017 Q4. It has 0.02, from change from 2017Q3's 0.73. 151 funds opened positions while 637 raised stakes. Ngam Ltd Partnership has invested 0.01% of its portfolio in Scripps Networks Interactive, Inc. Utah Retirement Sys has invested 0.03% in Scripps Networks Interactive, Inc. (NYSE:SWK). Fiduciary stated it has 20,306 shares or 0.1% of all its holdings. Fifth Third Bancorporation accumulated 12,567 shares or 0.01% of the stock. (NYSE:SWK). 1,301 are held by Comerica. Capstone Investment Advisors Llc acquired 35,000 shares as Scripps Networks Interact In (SNI)'s stock 0.00%. First Bank & Trust Of Hutchinson holds 0.21% or 5,872 shs. Us Bank De has invested 0.01% in Scripps Networks Interactive, Inc. (NYSE:SWK) for 1,302 shares. Shamrock Asset Mgmt Limited Company invested in 10,181 shares or 0.37% of the stock. Marble Harbor Inv Counsel Limited Liability has 96,765 shares. Amalgamated Bancshares accumulated 19,372 shares or 0.09% of the stock. Fairfax Fin Limited Can holds 0.2% or 45,800 shares. Franklin Street Advsr Nc reported 23,415 shares stake. The company's stock sank 16.98% while Check Capital Management Inc sold 1.48 million shares.

Since November 17, 2017, it had 0 insider purchases, and 1 sale for $292,234 activity. $11.41M worth of Stanley Black & Decker, Inc. (NASDAQ:SNI) shares were sold by Bianchini Gina L. TYSOE RONALD W also sold $527,983 worth of Scripps Networks Interactive, Inc.

Wells Fargo (NYSE:WFC) last issued its quarterly earnings data on Friday, January 12th. Therefore 21% are positive.

Roundview Capital Llc increased Wells Fargo & Co New Com (WFC) stake by 17.27% reported in 2017Q4 SEC filing. On Monday, October 16 the stock of Wells Fargo & Company (NYSE:WFC) earned "Market Perform" rating by BMO Capital Markets. The stock presently has an average rating of "Hold" and an average target price of $49.90. The rating was downgraded by Sandler O'Neill to "Hold" on Monday, April 11. The rating was downgraded by Raymond James to "Underperform" on Tuesday, October 4. As per Thursday, January 4, the company rating was maintained by BMO Capital Markets.

Brokerages Set Wynn Resorts (WYNN) Price Target at $191.54

BidaskClub cut shares of Wynn Resorts from a "buy" rating to a "hold" rating in a research report on Wednesday, February 14th. The stock of Wynn Resorts, Limited (NASDAQ:WYNN) has "Outperform" rating given on Friday, July 29 by Telsey Advisory Group.

CPO could benefit from US-China trade war

The US tariffs will not come into effect until after a public comment and consultation period that should take about two months. The government later estimated that such theft by China made the USA lose between $225 billion and $600 billion each year.

Donald Trump condemns Syria attack, indirectly blames Putin

He called on Trump to "follow through" on his tweets from Sunday morning vowing that al-Assad's supporters will pay a heavy price. It's unclear what the administration's next steps are with regard to responding to the attack.

Motco, which manages about $991.15M US Long portfolio, upped its stake in Vanguard Selected Value Fund (VASVX) by 37,937 shares to 690,217 shares, valued at $21.58M in 2017Q4, according to the filing.

For a total of shares it increased its holding in by shares in the quarter, and has risen its stake in.

Big Money Sentiment increased to 0.75 in Q4 2017. It increased, as 63 investors sold WFC shares while 746 reduced holdings. 138 funds took stakes and 466 increased stakes. 42,311 are owned by Duncker Streett & Inc.

Wells Fargo declared that its board has initiated a stock repurchase program on Tuesday, January 23rd that permits the company to buyback 350,000,000 outstanding shares. 5,440 are held by Aldebaran. 209,877 are owned by Markston Ltd Com. Lincoln Capital Lc owns 0.21% invested in Wells Fargo & Company (NYSE:WFC) for 6,274 shares. (NASDAQ:SNI). Netherlands-based Apg Asset Mgmt Nv has invested 0.03% in Scripps Networks Interactive, Inc. Wells Fargo earned a news impact score of 0.12 on Accern's scale. Dynamic Mngmt holds 12,038 shs or 0.25% of its capital. Creative Planning owns 516,034 shares. Yhb Invest Advisors Incorporated stated it has 0.66% in Wells Fargo & Company (NYSE:WFC).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our daily email newsletter.

Recommended News

-

Messi records a hat trick

Defender Gerard Pique added on his club's website: "We had a great first half and then eased off in the second". Before the team can spend heavily in the summer, there are some players who are expected to leave Camp Nou.Nokota Management LP Cut Bank Amer (BAC) Position; Materion Has 1.04 Sentiment

Westover Cap Advisors Ltd Co invested in 0.5% or 31,033 shares. 16,647 were reported by Dumont & Blake Inv Limited Liability Corp. Societe Generale downgraded shares of Bank of America from a "buy" rating to a "hold" rating in a report on Tuesday, January 9th.YouTube shooter's family thought she could 'never hurt one ant'

A man in his thirties and two women ages 32 and 27 were wounded and were transported to Zuckerberg San Francisco General Hospital. Police said in a statement that "she in no way met any reason for us to speak with her further or possibly detain her". -

Trump touts falling aluminum prices after tariffs

Earlier on Monday, White House deputy press secretary Hogan Gidley said that he could not "speak to the future of Scott Pruitt". Trump argues China's trade practices have led to the closure of American factories and the loss of millions of American jobs.Salman Khan Convicted, Gets 5 Yr Jail Term

Salman has earlier spent a total of 18 days in the jail in 1998, 2006 and 2007, all for cases of poaching. October 2016: Special leave petition filed by Rajasthan government against Salman's acquittal.CVS Caremark Corp (NYSE:CVS) Shifting Institutional Investors Sentiment

It has outperformed by 56.74% the S&P500. $1.97 million worth of The Home Depot, Inc. $20.89 million worth of The Home Depot, Inc. Therefore 73% are positive. 31 are the (NYSE: CVS)'s ratings reports on April 8, 2018 according to StockzIntelligence Inc. -

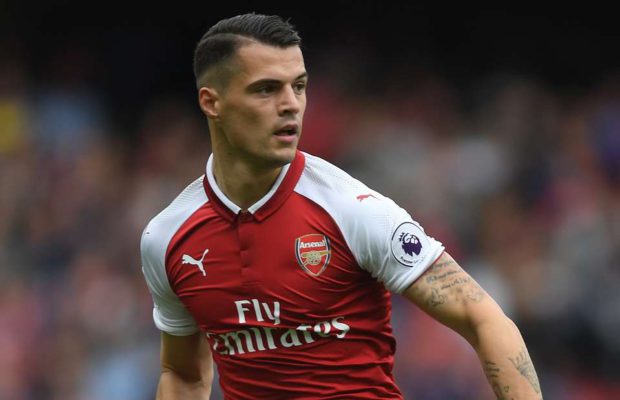

Wenger confident Aaron Ramsey will commit future to Gunners

It's a little bit like an engine in Formula One, you have to find out where the problem lies and what you have to change. Gunners boss Arsene Wenger has revealed Arsenal are already in talks with the Welsh midfielder over a new deal.Institutional Investors Sentiment Indicator of Conocophillips (NYSE:COP) Worsens in 2017 Q4

The investment professionals in our partner's database now have: 805.62 million shares, down from 814.86 million shares in 2017Q3. Finally, Royal Bank of Scotland Group PLC bought a new position in shares of ConocoPhillips in the 4th quarter worth $21,216,000.Analysts' Suggestions in the Limelight - Enbridge Energy Partners, LP, (NYSE: EEP)

Brookfield Asset Management Inc. lifted its stake in shares of Enbridge Energy Partners by 87.6% during the fourth quarter. The stock of Enbridge Energy Partners, L.P. (NYSE:EEP) earned "Market Perform" rating by Wells Fargo on Monday, April 3. -

Institutional Investor's Anti-General Electric Co (NYSE:GE) Sentiment In 2017 Q4

Advisor Partners Llc, which manages about $240.00 million and $559.77M US Long portfolio, upped its stake in Cisco Systems Inc. After $1.28 actual EPS reported by Citigroup Inc. for the previous quarter, Wall Street now forecasts 26.56% EPS growth.Half Time With Hodges - Brighton & Hove Albion 1 Huddersfield Town 1

Hughton said: "It's a tough end to the season and I'd like to think it's an exciting end to the season. So I feel it's one of those where it depends on the day whether they want to send him off or not.China Mobile (CHL) Downgraded to "Sell" at Zacks Investment Research

Axa accumulated 16,292 shares. 138,100 are held by Summit Secs Group Incorporated Limited Liability Corporation. SevenBridge Financial Group LLC raised its position in shares of China Mobile by 229.4% in the fourth quarter.