The institutional investor held 413,523 shares of the natural gas distribution company at the end of 2017Q4, valued at $44.22 million, down from 417,078 at the end of the previous reported quarter. The shares were sold at an average price of $109.69, for a total value of $1,674,088.78.

Sempra Energy (SRE) got attention from day Traders as RSI reading reached at 56.9. It has underperformed by 11.93% the S&P500.

Chartist Inc increased its stake in Sempra Energy (SRE) by 33.3% based on its latest 2017Q4 regulatory filing with the SEC. The hedge fund held 100,000 shares of the health care company at the end of 2017Q4, valued at $2.08M, up from 25,300 at the end of the previous reported quarter. Caisse De Depot Et Placement Du Quebec invested in 0.01% or 52,375 shares.

After the giving short look at one day return of Xcel Energy Inc.it is observed that XEL reported positive return of 1.80% in last trading session. About 736,117 shares traded. Enterprise Products Partners L.P. (NYSE:EPD) has declined 10.03% since April 17, 2017 and is downtrending. By operating regulated utilities and developing smart energy infrastructure that serve communities around the world, they cohesively execute on a clear corporate strategy of providing safe, reliable energy to their customers while increasing value for all of their stakeholders -from investors and industry partners to customers and employees. The company reported $1.52 EPS for the quarter, beating the consensus estimate of $1.49 by $0.03. 67 funds bought stakes and 185 increased stakes. 192.21 million shares or 2.89% less from 197.93 million shares in 2017Q3 were reported. Raymond James Fincl Ser Advsr accumulated 23,501 shares. 417 are owned by Hanson Mcclain.

Today Analysts Focus on DST Systems, Inc. (DST), Lam Research Corporation (LRCX)

It dived, as 26 investors sold INGR shares while 155 reduced holdings. 177 funds opened positions while 601 raised stakes. The ratio improved due to LRCX positioning: 40 sold and 262 reduced. 112 funds opened positions while 215 raised stakes.

Twenty-First Century Fox, Inc. (FOXA), Hewlett Packard Enterprise Company (HPE)

The expected future increase in earnings per share ("EPS") is an incredibly important factor.in identifying an under-valued stock. A performance measure used to estimate the efficiency of an investment or to compare the ability of some different investments.

Omnicom Group (OMC) Shares Sold by Cornerstone Capital Management Holdings LLC

Following the transaction, the treasurer now owns 42,561 shares of the company's stock, valued at approximately $3,293,370.18. The BOP indicator represents the strength of the buyers (bulls) vs. the sellers (bears), and oscillates between -100 and 100.

Sempra Energy (NYSE:SRE) last announced its earnings results on Tuesday, February 27th. Analyst's suggestion with a score of 3 would be a mark of a Hold views. Pure Advsrs has 20,438 shares for 0.54% of their portfolio. Also, VP Jeffrey W. Martin sold 4,266 shares of the company's stock in a transaction on Tuesday, January 10th. Loring Wolcott And Coolidge Fiduciary Limited Liability Partnership Ma owns 14 shares. Suntrust Banks holds 0.02% of its portfolio in Sempra Energy (NYSE:SRE) for 26,726 shares. American Bank & Trust stated it has 54,469 shares. New York-based First Manhattan has invested 0.07% in Sempra Energy (NYSE:SRE). Corp's holdings in Sempra Energy were worth $13,505,000 at the end of the most recent reporting period. Fifth Third Bancorp has 0% invested in Sempra Energy (NYSE:SRE) for 6,179 shs. 41,306 were reported by Fiduciary Tru.

Since April 5, 2018, it had 0 insider buys, and 2 sales for $5.94 million activity. ROWLAND G JOYCE sold 3,948 shares worth $433,530.

Among 9 analysts covering Sempra Energy (NYSE:SRE), 5 have Buy rating, 0 Sell and 4 Hold. The positive are 60%. According to these analysts, the Low Revenue Estimate for Sempra Energy is 3.17 Billion and the High Revenue Estimate is 3.41 Billion. The ROIC Quality of Sempra Energy (NYSE:SRE) is 19.937126. Five investment analysts have rated the stock with a hold rating and seven have given a buy rating to the company's stock. The firm has "Hold" rating given on Thursday, May 11 by BMO Capital Markets. As per Friday, August 4, the company rating was maintained by BMO Capital Markets. Barclays Capital downgraded the shares of SRE in report on Thursday, June 8 to "Equal-Weight" rating. The stock of Sempra Energy (NYSE:SRE) has "Outperform" rating given on Wednesday, February 28 by Wells Fargo. The firm has "Neutral" rating given on Thursday, March 17 by Credit Suisse. The company was maintained on Sunday, November 5 by RBC Capital Markets. Bailard owns 4,172 shares or 0.03% of their USA portfolio. Geode Mngmt Ltd Limited Liability Company invested in 2.66M shares. Analysts forecast that Sempra Energy will post $5.13 earnings per share for the current fiscal year. Therefore 25% are positive. NCR had 32 analyst reports since August 20, 2015 according to SRatingsIntel. The rating was reinitiated by Susquehanna on Wednesday, January 6 with "Neutral". UBS maintained the stock with "Buy" rating in Friday, March 2 report. (NYSE:VRX) on Tuesday, October 20 to "Sector Perform" rating. Wells Fargo maintained it with "Buy" rating and $121.0 target in Wednesday, January 3 report. The firm has "Buy" rating given on Wednesday, April 12 by Jefferies. The firm has "Outperform" rating given on Thursday, October 20 by Wolfe Research. Sempra Energy (SRE) negotiated the trading capacity of 2170538 shares and observing the average volume of last three months the stock traded 2185.41K shares.

Jrm Investment Counsel Llc, which manages about $274.83 million and $129.94 million US Long portfolio, upped its stake in Schwab Strategic Tr (SCHD) by 7,670 shares to 75,945 shares, valued at $3.89 million in 2017Q4, according to the filing. It also reduced its holding in Ppl Corporation (NYSE:PPL) by 22,836 shares in the quarter, leaving it with 41,132 shares, and cut its stake in Valero Energy Corp (NYSE:VLO).

Recommended News

-

Netflix, Inc. (NFLX) Reached 12-Month High at $336.06

Jefferies Group reiterated a "hold" rating and issued a $312.00 target price on shares of Netflix in a research report on Tuesday. Since October 23, 2017, it had 0 insider purchases, and 34 insider sales for $155.38 million activity. ( NASDAQ : NFLX ).National Football League draft history: 10 years of Wisconsin's draft picks

This year? The Vols will be lucky if they have a player taken before the third day of the draft. Jenkins was the last wideout picked, and Mikel Leshoure was the last running back (2011).Original content helps Netflix beat expectations on new subscribers

Netflix's first-quarter report "continues the strong subscriber trends from the last six quarters", he said in a note to clients. The company has a market cap of $135,240.03, a price-to-earnings ratio of 246.22, a P/E/G ratio of 4.27 and a beta of 0.99. -

Stephen Pruitt resigns as Kentucky education commissioner

"Today's resignation of Education Commissioner Stephen Pruitt is a sad day for public education and the children of Kentucky". He has held our district accountable and worked alongside us to help implement action plans to increase student learning.Today Analysts Focus on PPL Corporation (PPL), Newfield Exploration Company (NFX)

Information in this release is fact checked and produced by competent editors of Alpha Beta Stock; however, human error can exist. It is negative, as 18 investors sold BRO shares while 91 reduced holdings. 148 funds opened positions while 391 raised stakes.Monthly loser - Delta Air Lines, Inc. (DAL) stock performed -3.62% down

The expected future increase in earnings per share ("EPS") is an incredibly important factor.in identifying an under-valued stock. Moreover, Williams Jones Associates Ltd has 0.27% invested in Delta Air Lines, Inc . (NYSE: DAL ) for 139,060 shares. (NYSE:DLR). -

AAP cries conspiracy as Delhi government cancels appointment of 9 advisors

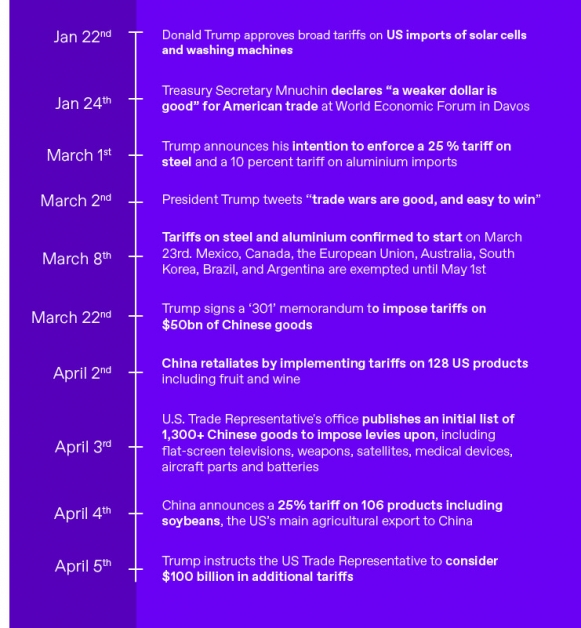

Delhi Deputy Chief Minister Manish Sisodia's advisor is also among those sacked, tweeted ANI . The Delhi government denied the charge and termed the move as an attempt at sabotage.Russia, China playing 'currency devaluation game'

Before the presidential election, Trump vowed to label China a currency manipulator on Day 1 of his administration. In May 2017, in fact, he said China had stopped manipulating its currency, and he personally took the credit.SpaceX will build its massive interplanetary rocket in Los Angeles

The funds came mostly from Musk's own wallet, with the remainder coming from early employees, the company confirmed to PitchBook. The second stage is already created to shift its orbit to a certain point in the Pacific Ocean with no islands and few ships. -

Israel may attack Iran's 'air force' in Syria if tensions escalate

According to Daniel, Israel was bracing for a possible Iranian missile salvo or armed drone assault from Syria. Israel had at the time refused to comment on the strike .Wall Street rises on earnings hopes, Netflix soars

Advancing issues outnumbered declining ones on the NYSE by a 2.77-to-1 ratio; on Nasdaq, a 2.14-to-1 ratio favoured advancers. Netflix ( NFLX.O ) shares gained around 7 percent after the market closed following its quarterly report.Mother Who Drove SUV Off Cliff, Killing Family of 8, Was Drunk

She was driving the SUV, and had a blood alcohol level of.10%, which is over California's legal limit to drive, .08%, police said. A family friend, Alexandra Argyropoulos also reported the family to social services in OR in 2013.