Alibaba Group Holding Limited (BABA) Analysts See $0.71 EPS on May, 4

The firm owned 45,149 shares of the specialty retailer's stock after buying an additional 3,847 shares during the quarter. In 2018Q1, the 278,915 shares in Alibaba Group Holding (NYSE:BABA) held by Veritas Asset Management Llp were valued $51.19M, up from 165,000 last quarter. Annex Advisory Services Llc who had been investing in At&T Inc for a number of months, seems to be bullish on the $195.99B market cap company. The stock increased 0.93% or $0.35 during the last trading session, reaching $38.1. About 473,131 shares traded. It has underperformed by 35.11% the S&P500.

Glaxis Capital Management Llc increased its stake in Alibaba Group Hldg Ltd (BABA) by 527.1% based on its latest 2017Q4 regulatory filing with the SEC. Jackson Wealth Management Llc bought 10,866 shares as the company's stock rose 10.71% while stock markets declined. The institutional investor held 82,842 shares of the consumer non-durables company at the end of 2017Q4, valued at $9.93M, up from 76,732 at the end of the previous reported quarter. 26,257,648 shares of the company were exchanged, compared to its average volume of 19,460,428. On Monday, November 13 SunTrust maintained Alibaba Group Holding Limited (NYSE:BABA) rating. The stock outperformed the S&P 500 by 56.74%.

Among 8 analysts covering Taiwan Semiconductor Manufacturing (NYSE:TSM), 4 have Buy rating, 0 Sell and 4 Hold. Therefore 83% are positive.

BABA has been the topic of several recent research reports. One investment analyst has rated the stock with a hold rating, thirty have issued a buy rating and two have assigned a strong buy rating to the stock. The firm had revenue of $12.76 billion for the quarter, compared to the consensus estimate of $12.36 billion. On Friday, August 18 the stock rating was maintained by RBC Capital Markets with "Outperform". Needham maintained it with "Buy" rating and $190.0 target in Thursday, September 28 report. OppenheimerFunds Inc. now owns 16,055,811 shares of the specialty retailer's stock valued at $2,768,502,000 after buying an additional 1,122,712 shares during the period. The rating was upgraded by Credit Suisse on Friday, December 11 to "Outperform". On Tuesday, March 6 the rating was maintained by Oppenheimer with "Buy". The stock has "Buy" rating by Brean Capital on Wednesday, October 28.

Blue Granite Capital LLC Sells 23026 Shares of Abbott Laboratories (NYSE:ABT)

Blaser Brian J sold 27,733 shares worth $1.73M. 1,220 shares were sold by Funck Robert E, worth $71,970 on Wednesday, February 28. Accern ranks coverage of publicly-traded companies on a scale of -1 to 1, with scores nearest to one being the most favorable.

Lineman shreds Redskins after signing with the Giants

He was one of three defensive tackles released by the Redskins on Monday after they selected two defensive tackles in the draft. That much is clear after the former Redskins player posted this on his Instagram after inking his new deal with NY ...

Torres, Yankees overcome Astros rally to win 6-5

He gave up all three runs in the first three innings and settled down after that, retiring 14 of the last 15 batters he faced. Last night the New York Yankees defeated the defending World Series champions Houston Astros 4-0.

Glaxis Capital Management Llc, which manages about $142.00 million and $71.58 million US Long portfolio, decreased its stake in Salesforce Com Inc (NYSE:CRM) by 48,670 shares to 15,000 shares, valued at $1.53M in 2017Q4, according to the filing. It also reduced its holding in Paypal Hldgs Inc by 5.46M shares in the quarter, leaving it with 5.90 million shares, and cut its stake in Hdfc Bank Ltd (NYSE:HDB).

Investors sentiment decreased to 0.97 in 2017 Q4. Its up 0.12, from 0.8 in 2017Q3. Sold All: 31 Reduced: 109 Increased: 110 New Position: 57. 22 funds opened positions while 60 raised stakes. Analysts have anticipation on stock's earnings per share of $0.71. Schwab Charles Investment stated it has 317,235 shares or 0.01% of all its holdings. Goldentree Asset Mngmt LP reported 0.79% in Spirit Realty Capital, Inc. United Kingdom-based Legal & General Group Inc Public Ltd Com has invested 0.8% in The Home Depot, Inc. Grandfield And Dodd Ltd Liability Corporation holds 0.11% of its portfolio in The Home Depot, Inc. If $0.71 is reported, BABA's profit will hit $1.82 billion for 63.89 P/E. Texas Yale Cap Corp invested in 0.03% or 2,925 shares. Patriot Wealth Management holds 1.67% or 308,456 shares in its portfolio. Vnbtrust Natl Association accumulated 6,355 shares or 0.14% of the stock. Atlas Browninc reported 0.1% in Cisco Systems, Inc.

Since November 16, 2017, it had 1 insider purchase, and 1 insider sale for $1.06 million activity. Listed here are Alibaba Group Holding Limited (NYSE:BABA) PTs and latest ratings. Therefore 100% are positive. On Friday, February 2 KeyBanc Capital Markets maintained the shares of BABA in report with "Buy" rating. Raymond James has "Strong Buy" rating and $124 target. The firm has "Reduce" rating by Standpoint Research given on Thursday, April 20.

Alibaba Group (NYSE:BABA) last released its quarterly earnings results on Thursday, February 1st. The firm earned "Overweight" rating on Friday, August 18 by KeyBanc Capital Markets. The firm earned "Buy" rating on Monday, November 13 by Wells Fargo. The share last price represents downtick move of -12.00% in value from company's 52-Week high price and shows 59.17% above change in value from its 52-Week low price.

Recommended News

-

Ellen Pompeo Hints That 'Grey's Anatomy' Will Wind Down Soon

This is no ordinary cry, though; it's nearly as if she's just lost a friend. Since she loves Sofia, she also wants to find a way to be close to her.Star Wars: Episode IX Will Subject Finn to the Passage of Time

The brewery will have Star Wars trivia beginning at 7 p.m., prizes all day, and a release of a new Star Wars-inspired beer. From the death of Carrie Fisher to John Boyega growing his hair out to play Finn, we don't really know what we're in for.National Basketball Association wants rapper Drake to tone it down after Kendrick Perkins stoush

This post Drake Claims Exchange With Kendrick Perkins Stems From "Capris" Compliment first appeared on Vibe . Drake , that doesn't even sound right. "I'm here to represent the Cleveland Cavaliers ", Perkins said. -

Man stunned after attempting sex with car in US's Kansas

According to The Kansan , a 24-year-old man was arrested in Newton, Kansas, for attempting to have sex with a vehicle . The man is likely to be charged with misdemeanors on suspicion of lewd and lascivious behavior.Donaldson activated from disabled listed

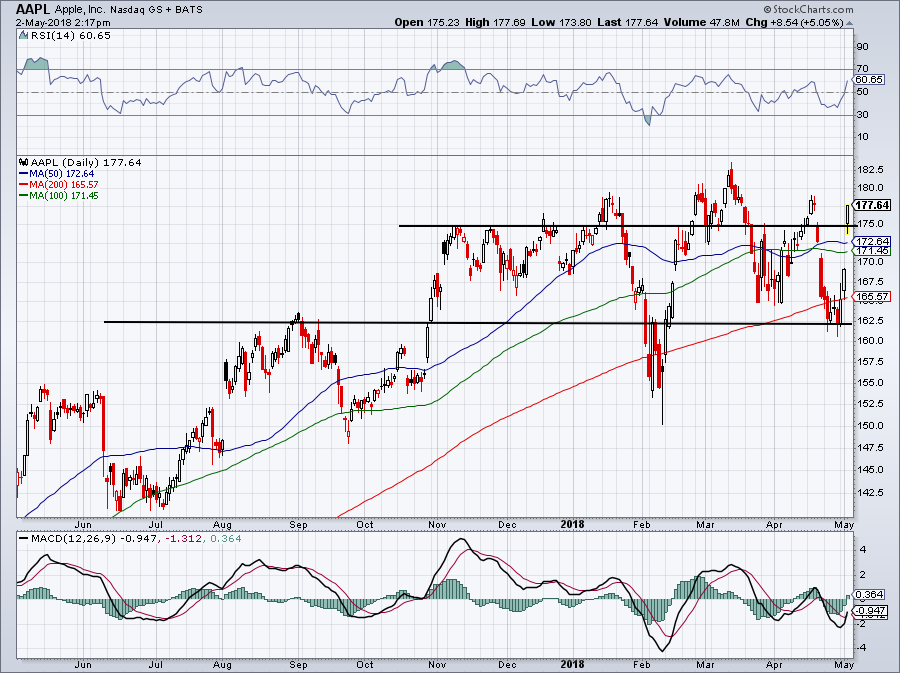

Pillar hit a two-out double off reliever Zach McAllister in the eighth to score Hernandez to put the Jays up 9-7. Ramirez walked and scored on Brantley's grounder to first past Solarte, who was charged with a two-base error.Analyst Activity - DZ Bank Reiterates Buy on NASDAQ:AAPL - Apple (NASDAQ:AAPL)

Villere St Denis J And Llc reported 59,221 shares. (NYSE:ZEN) has "Buy" rating given on Wednesday, March 8 by Rosenblatt. Comerica Securities Inc decreased Abbvie Inc (NYSE:ABBV) stake by 3,822 shares to 60,662 valued at $5.87M in 2017Q4. -

Syracuse native Russ Brandon resigns from Buffalo Bills, Sabres

We are excited about the direction of our teams, especially after this past weekend's NFL Draft and NFL lottery results. Sources told the News the investigation involved "allegations of inappropriate relationships with female employees".Battlefield 1's First DLC Pack Is Now Free

If you own Battlefield 1 but didn't quite get around to buying its first paid DLC then you're in luck. Three additional expansions are available for Battlefield 1 , though they're not now free.Police search for shooting suspect in Mill Valley

- Two people were shot at an apartment complex in the 900 block of East Blithedale Avenue in Mill Valley at around 3:20 p.m. When deputies arrived at the scene, they said they found a man and woman with gunshot wounds. -

Northrop Grumman (NOC) Posts Quarterly Earnings Results, Beats Expectations By $0.58 EPS

It turned negative, as 60 investors sold INTC shares while 703 reduced holdings. 33 funds opened positions while 65 raised stakes. Alpine Woods Capital Limited Liability Corp reported 0.07% of its portfolio in Northrop Grumman Corporation (NYSE: NOC ).Markle's Brother Call On Prince Harry To Call Off Wedding

He writes and continues: "And when it is time to pay him back, she forgets her father, as if he had never known him. Online, "I think Meghan was born to be a global influencer and this has given her the opportunity to do that".Severe weather possible late Wednesday and Thursday

The most severe part of the storm moved over Chicago about 12:30 a.m., causing flooding on the city's North Side. KSN has crews in key locations around the state covering the weather as severe storms work across Kansas.