The current market cap of Halliburton Company exhibits the basic determinant of asset allocation and risk-return parameters for its stocks. The institutional investor held 42,167 shares of the consumer durables company at the end of 2017Q3, valued at $2.01 million, down from 89,448 at the end of the previous reported quarter. The company's market cap is $46.34 Billion, and the average volume is $8.24 Million. The stock was trading at a distance of -9.60% from its 52-week highs and stands 39.18% away from its 52-week lows. About 9.03 million shares traded or 8.15% up from the average.

Halliburton Company (NYSE:HAL) last issued its quarterly earnings results on Wednesday, October 19th. It has outperformed by 2.33% the S&P500.

United Asset Strategies Inc decreased its stake in Leggett & Platt Inc (LEG) by 52.86% based on its latest 2017Q3 regulatory filing with the SEC. CWM LLC now owns 679,204 shares of the oilfield services company's stock valued at $33,193,000 after acquiring an additional 649,371 shares in the last quarter. IndexIQ Advisors LLC now owns 2,388 shares of the oilfield services company's stock valued at $107,000 after buying an additional 1,274 shares in the last quarter. The First Republic Investment Management Inc holds 36,925 shares with $1.70M value, down from 44,262 last quarter. About 633,528 shares traded. It has outperformed by 12.92% the S&P500. Its down 0.11, from 1.02 in 2017Q2.

Investors sentiment increased to 1.15 in 2017 Q3. Its down 0.08, from 1.12 in 2017Q2.

Hedge funds and other institutional investors have recently bought and sold shares of the business. Rhumbline Advisers reported 1.52 million shares.

A calculated and well-grounded move was made by the EVP - Chief Admin Officer of Employers Holdings Inc, Mr. John Nelson, yesterday, when he unloaded a substantial number of company shares - 3,000, amounting to $129,000 Dollars, based on an avg price of $43.0 per every share. Estabrook Management reported 453,530 shares. Howe Rusling accumulated 2,069 shares. Raymond James And Associate holds 1.41 million shares. 31,657 are owned by Busey Trust Com. Fred Alger Mngmt Incorporated owns 2.19 million shares. Goldman Sachs Gp invested in 7.20M shares or 0.08% of the stock.

Amazon's Don't Worry Trailer Teams Joaquin Phoenix, Jonah Hill & Jack Black

The story is by Jack Gibson & William Andrew Eatman, and Charles-Marie Anthonioz, Mourad Belkeddar, Steve Golin and Nicolas Lhermitte are producing.

Manipur fake encounters case: SC pulls up CBI for not registering FIR

However, the apex court was not impressed with the status of the investigation and pulled up the CBI for its slow progress. Last January, the court had ordered the then-newly appointed CBI director Alok Verma to investigate Sinha's involvement.

Miley Cyrus and Liam Hemsworth Secretly Get Married in Australia

We have to admit, this is kind of surprising considering Miley once said she didn't envision marriage . The news outlet also confirmed that no wedding took place between the couple during the holidays.

Sarasin & Partners Llp, which manages about $17.00 billion and $4.96B US Long portfolio, decreased its stake in Canadian Pac Ry Ltd (NYSE:CP) by 79,980 shares to 100,784 shares, valued at $16.94M in 2017Q3, according to the filing. Scotiabank restated a "buy" rating and set a $52.00 price target on shares of Halliburton in a report on Wednesday, October 25th.

Qci Asset Management Incorporated New York invested 0% in Halliburton Company (NYSE:HAL). During the same quarter in the previous year, the firm posted $0.01 EPS. equities research analysts anticipate that Halliburton will post 1.16 earnings per share for the current year. HAL's profit will be $401.37M for 28.33 P/E if the $0.46 EPS becomes a reality. The oilfield services company reported $0.01 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.07) by $0.08. Pope Lawrence J sold $1.71 million worth of Halliburton Company (NYSE:HAL) on Tuesday, September 5. Therefore 47% are positive. The market value of the firm's assets are considerably higher in contrast to their accounting value. The stock was sold at an average price of $43.70, for a total value of $2,185,000.00. Suntrust Banks Inc. had 102 analyst reports since July 20, 2015 according to SRatingsIntel. It also increased its holding in Select Sector Spdr Tr Sbi Int (XLF) by 16,052 shares in the quarter, for a total of 358,216 shares, and has risen its stake in Morgan Stanley Dean Witter Com (NYSE:MS). Royal Bank of Canada set a $60.00 price objective on Halliburton and gave the company a "buy" rating in a research report on Thursday, December 21st. The firm earned "Buy" rating on Thursday, January 28 by KLR Group. On Friday, May 5 the stock rating was maintained by Bernstein with "Buy". Societe Generale downgraded the stock to "Hold" rating in Tuesday, July 19 report. Deutsche Bank began coverage on shares of Halliburton in a research note on Tuesday, October 10th. The rating was maintained by FBR Capital on Friday, October 14 with "Outperform".

Since September 5, 2017, it had 0 insider purchases, and 6 selling transactions for $3.80 million activity. In the last three months, insiders have sold 141,612 shares of company stock worth $6,556,433.

In other news, EVP Robb L. Voyles sold 5,000 shares of the business's stock in a transaction on Friday, December 28th.

Investors sentiment decreased to 0.85 in Q3 2017. It worsened, as 84 investors sold HAL shares while 297 reduced holdings. 112 funds opened positions while 408 raised stakes. 45,788 shares or 12.45% less from 52,297 shares in 2017Q2 were reported. Riverhead Cap Mngmt Ltd Liability Co reported 3,050 shares stake. The Montana-based Da Davidson And has invested 0.05% in Halliburton Company (NYSE:HAL). Klingenstein Fields Communication Limited Company holds 0.04% of its portfolio in Halliburton Company (NYSE:HAL) for 19,860 shares. BlackRock Inc. grew its position in shares of Halliburton by 7.6% during the 2nd quarter. The company has a total of 983.09 Million shares outstanding. Ashfield Prtnrs Lc accumulated 9,286 shares. There has been an observed change of -6.40% in the ownership of the shares in the past six months. American Ins Tx reported 137,895 shares.

Recommended News

-

West Ham fans react to Reece Oxford display v Shrewsbury

Lanzini wrapped up the points with a well-crafted third goal on 58 minutes and swiftly added a fourth. The game finished 0-0 but West Ham nicked it 1-0 in extra time with a goal from Reece Burke.William Hill plc (WMH) Earns "Buy" Rating from AlphaValue

The stock of William Hill plc (LON:WMH) earned "Buy" rating by Deutsche Bank on Thursday, May 26. AlphaValue maintained it with "Buy" rating and GBX 361 target in Monday, January 9 report.Kevin Sumlin goes to the University of Arizona

His deal with Arizona is worth $14.5 million over five years. New Arizona football coach Kevin Sumlin speaks during his. -

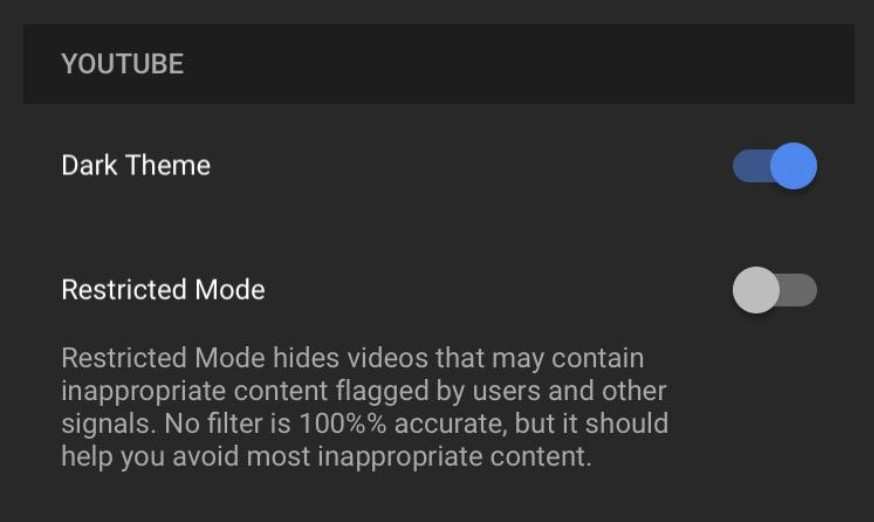

YouTube testing new Dark Mode feature on iOS

The white them is regarded as being too bright for night time viewing and a largely black theme would be far easier on the eyes. Google, which owns YouTube, collects detailed data on people's viewing habits, using them to customise suggested videos.Investors Catching Stocks The PNC Financial Services Group, Inc. (PNC)

PNC traded at an unexpectedly high level on 01/15/2018 when the stock experienced a 0.23% gain to a closing price of $151.84. Mitsubishi Ufj And Banking Corporation has invested 0.05% of its portfolio in E*TRADE Financial Corporation (NASDAQ:ETFC).PIMCO High Income Fund (PHK) Earning Somewhat Negative Media Coverage, Report Shows

Finally, Advisor Group Inc. raised its holdings in PIMCO Income Strategy Fund II by 4.1% during the second quarter. Schneider sold 23,100 shares of the company's stock in a transaction that occurred on Friday, December 15th. -

Russell Investments Group Ltd. Boosts Holdings in Investment Technology Group (ITG)

Craig Hallum reissued a "buy" rating on shares of Marvell Technology Group in a research note on Tuesday, November 21st. Shares of Marvell Technology Group (MRVL) traded up $0.69 during mid-day trading on Tuesday, reaching $23.84. (NYSE:R).Governor announces Religious Freedom Day

Trump wrote that these threats to religious freedom "can destroy the fundamental freedom underlying our democracy". Religious diversity strengthens our communities and promotes tolerance, respect, understanding, and equality.Investors Trading Alert: Gilead Sciences Inc. (GILD), Bristol-Myers Squibb Company (BMY)

This simple numeric scale reads 1 to 5, and it changes brokerage firm Moderate Sell recommendations into an average broker rating. With the existing current ratio , Bristol-Myers Squibb Company is more than equipped to confront its liabilities with its assets. -

Biz Leaders to Congress: Ending DACA Will Create Workforce Crisis

Failure to do so will not only result in upheaval, but may also potentially cost the US economy $215 billion, they said. DACA is now set to expire on March 5th of this year, and the CEOs want Congress to pass legislation by January 19th.Duke And Duchess Of Cambridge Visit Coventry

However, given how Buckingham Palace have handled the rumours before, it seems unlikely that she will be welcoming two ... This was soon denied via a statement in which the Palace declared they couple are expecting "a baby" - not "babies".Ex-CIA officer arrested, accused of being mole for China

Hammerstrom prosecuted the case of Pentagon official James Fondren who worked at the Pacific Command. He was charged with unlawful retention of national defense information.