The institutional investor held 84,891 shares of the precious metals company at the end of 2017Q3, valued at $789,000, up from 17,797 at the end of the previous reported quarter. Virtu Financial Llc who had been investing in Anglogold Ashanti Ltd for a number of months, seems to be bullish on the $4.18B market cap company. About 1.36 million shares traded. (NYSE:FDS) has risen 5.61% since January 13, 2017 and is uptrending. It has underperformed by 11.09% the S&P500.

Meeder Asset Management Inc increased its stake in Take (TTWO) by 217.92% based on its latest 2017Q3 regulatory filing with the SEC. B & T Capital Management Dba Alpha Capital Management bought 12,747 shares as the company's stock rose 1.55% with the market. The Raub Brock Capital Management Lp holds 94,088 shares with $16.95 million value, up from 86,123 last quarter. The stock increased 0.56% or $0.64 during the last trading session, reaching $115.55.

In other news, CEO Strauss Zelnick sold 31,004 shares of the stock in a transaction that occurred on Thursday, November 9th. Finally, Oppenheimer Holdings, Inc. reaffirmed an "outperform" rating on shares of Take-Two Interactive Software in a report on Tuesday, December 20th. (NASDAQ:TTWO) has risen 81.23% since January 11, 2017 and is uptrending. It has outperformed by 64.53% the S&P500. (NASDAQ:TTWO). Metropolitan Life New York invested 0.07% of its portfolio in Take-Two Interactive Software, Inc. Therefore 62% are positive. Barclays Capital maintained the shares of ALLY in report on Monday, November 2 with "Overweight" rating. The stock has "Buy" rating by Stifel Nicolaus on Thursday, October 22. The firm earned "Buy" rating on Wednesday, June 7 by Piper Jaffray.

Light Street Capital Management Llc increased Shopify Inc stake by 165,000 shares to 365,000 valued at $42.52M in 2017Q3. Robert W. Baird upgraded the stock to "Outperform" rating in Wednesday, November 8 report. The rating was maintained by Jefferies on Thursday, August 3 with "Buy". Take-Two Interactive Software had 68 analyst reports since July 28, 2015 according to SRatingsIntel. As per Friday, September 4, the company rating was maintained by William Blair. (TTWO). The consensus rating is 2, indicating analysts in general look favorably on the company's future prospects. The rating was maintained by Jefferies on Tuesday, August 9 with "Buy". The company was maintained on Thursday, September 14 by RBC Capital Markets.

Since August 4, 2017, it had 0 insider buys, and 4 insider sales for $7.68 million activity. $41,831 worth of stock was sold by Sheresky Michael on Thursday, August 10. Goldstein Lainie sold 30,000 shares worth $2.63 million. On Friday, August 4 the insider Dornemann Michael sold $614,600.

Investors sentiment decreased to 1.18 in Q3 2017.

Facebook shares drop after News Feed overhaul rolls out

We serve you ads that make us money, which we use to pay reporters and editors to go out and get you more stories. The move is an attempt to make users more engaged with the site by having "more meaningful social interactions".

Cooper Tire & Rubber Company (CTB)

News headlines about Cooper Tire & Rubber (NYSE:CTB) have been trending somewhat positive on Wednesday, Accern Sentiment reports. The average Wall Street analyst rating for Cooper Tire & Rubber Company is Hold, according to the average of 6 analyst scores.

USDA raises 2017 corn estimate, lowers soybeans from November

Average soybean yield was estimated at 49.1 bus per acre, down from 49.5 bus in November and from a record 52 bus in 2016. USDA pegged the corn harvest at 14.604 billion bushels, up from its previous forecast of 14.578 billion.

In an overview of the current analyst recommendations, Buy count is 14 and Overweight is 2 while the number of analysts recommending Sell and Underweight are 1 and 0, respectively. (TTWO) formed multiple top with $124.00 target or 6.00% above today's $116.98 share price. 1 funds opened positions while 0 raised stakes. 197.43 million shares or 12.04% less from 224.47 million shares in 2017Q2 were reported. Teachers Retirement Of The State Of Kentucky accumulated 96,061 shares or 0.12% of the stock.

The Return on Invested Capital (aka ROIC) for Take-Two Interactive Software, Inc. (NASDAQ:TTWO) has gone stronger by 128.88%.

In terms of performance, shares of Take-Two Interactive Software, Inc. (NASDAQ:TTWO). Sei Invests reported 255,420 shares. 5,198 were accumulated by Meeder Asset Mgmt. Taconic Capital Advisors Lp sold 430,000 shares as the company's stock declined 19.04% while stock markets rallied. (NASDAQ:TTWO) has been trading recently. First Trust Advsrs Ltd Partnership reported 236,054 shares. Wedbush maintained Take-Two Interactive Software, Inc. (NASDAQ:FRGI) for 88,925 shares. (NASDAQ:TTWO). Colorado-based Alps Incorporated has invested 0.01% in Take-Two Interactive Software, Inc. Take-Two Interactive Software has a 1-year low of $50.31 and a 1-year high of $120.62. (NASDAQ:OCLR) for 337,652 shares. Sonata Cap owns 8,900 shares for 0.48% of their portfolio. If you are viewing this report on another site, it was stolen and republished in violation of USA & worldwide copyright & trademark law. It also reduced its holding in Microsoft Corporation (NASDAQ:MSFT) by 82,668 shares in the quarter, leaving it with 32,707 shares, and cut its stake in Micron Technology Inc (NASDAQ:MU).

Since August 9, 2017, it had 9 insider purchases, and 0 insider sales for $19.54 million activity. Principal Fincl Gp Incorporated holds 619,353 shares or 0.02% of its portfolio. Therefore 45% are positive. Citigroup Inc. had 108 analyst reports since July 21, 2015 according to SRatingsIntel. The stock of Jumei International Holding Limited (NYSE:JMEI) has "Neutral" rating given on Monday, November 2 by Goldman Sachs. The rating was maintained by Piper Jaffray with "Hold" on Monday, September 18. The firm earned "Market Perform" rating on Monday, October 9 by Cowen & Co. Stephens maintained the stock with "Buy" rating in Wednesday, October 11 report. The firm has "Neutral" rating given on Wednesday, January 25 by JP Morgan. (NASDAQ:TTWO) to report $0.84 EPS on February, 6.They anticipate $0.13 EPS change or 18.31% from last quarter's $0.71 EPS. During the same period in the previous year, the firm posted $0.89 EPS. TTWO's profit will be $95.81 million for 34.82 P/E if the $0.84 EPS becomes a reality. After $1.66 actual earnings per share reported by Phillips 66 for the previous quarter, Wall Street now forecasts -23.49% negative EPS growth.

Investors sentiment decreased to 1.18 in Q3 2017. Its down 1.00, from 1.33 in 2017Q2. It improved, as 14 investors sold FRGI shares while 27 reduced holdings. 125 funds opened positions while 492 raised stakes. Moreover, American Rech & Mgmt has 0.01% invested in FactSet Research Systems Inc. Ferguson Wellman Cap Management Inc, Oregon-based fund reported 43,857 shares. Geode Mngmt Ltd Limited Liability Company holds 0.03% or 892,630 shares in its portfolio. Fred Alger Mngmt reported 254,968 shares or 0.12% of all its holdings. Us Bankshares De reported 357,282 shares. Texas Permanent School Fund invested in 123,130 shares. Cypress Capital Management Limited Com (Wy) holds 1,050 shares or 0.11% of its portfolio. Piedmont Advisors Ltd Co has invested 0.01% of its portfolio in AK Steel Holding Corporation (NYSE:AKS). (NYSE:C). Burney stated it has 0.61% in Citigroup Inc. Ww Asset Management Inc accumulated 29,937 shares. Assetmark invested in 126 shares or 0% of the stock.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.

Recommended News

-

Oil Price Retreats From $70 Level After Hitting A Three-Year High

Over the last month gasoline demand averaged about 9.1 million barrels per day, up by 2.5% from the same period previous year . Compared to year-ago inventory levels, USA commercial crude oil stockpiles have dropped 8.1%, down almost 95 million barrels.Trump Signs New Order Expanding Mental Healthcare for Veterans

Trump has said he takes statin, a drug created to lower cholesterol levels. Blood pressure levels less than 120/80 are considered "normal".Investors Set Sail on Valuation For Vodafone Group Plc (VOD.L)

Arrowstreet Capital Limited Partnership grew its holdings in shares of Vodafone Group by 47.8% in the second quarter. Goldman Sachs Group reissued a "buy" rating on shares of Vodafone Group in a report on Thursday, November 23rd. -

DACA: What a federal judge's ruling means for UNI 'dreamer'

That's why Sayra Lozano, a local Dreamer, is taking her concerns to Capitol Hill to lobby in support of the DACA program. But we still need a law to replace DACA , and we hope that Congress will restore permanent protection to Dreamers soon.Bank of America Lowers Chevron (CVX) to Neutral

The Average Earnings Estimate for the Current Fiscal quarter is $1.38 per share, according to consensus of 15 analysts. The stock of Chevron Corporation (NYSE:CVX) earned "Buy" rating by Independent Research on Thursday, December 1.Del Potro Wears Down Ferrer To Reach Auckland Final

In two matches in Auckland, 2009 champion del Potro has yet to concede a break point. In the end, he served only one ace. -

White House Doctor Says Trump Is In 'Excellent Health' After Exam

Many supporters and critics swiftly condemned the president's comments, while some of his biggest supporters defended him. The sources spoke on condition of anonymity because they weren't authorized to publicly describe the conversation.HTC 10 Android 8.0 Oreo update is now rolling out via OTA

This new Oreo update will also bring the picture-in-picture mode which will let all the users perform two tasks simultaneously. Along with this, the company has also suspended the update temporarily and will be rolling out a new update in coming days.Trump pays tribute to King Jr after being accused of racism

New Orleans Veterans Report for Duty - More than 40 post 9/11 veterans and community members will report for duty to honor Dr. Farris Jr., who serves as president and CEO of the Martin Luther King Jr. - On Monday, the nation will pause to honor Dr. -

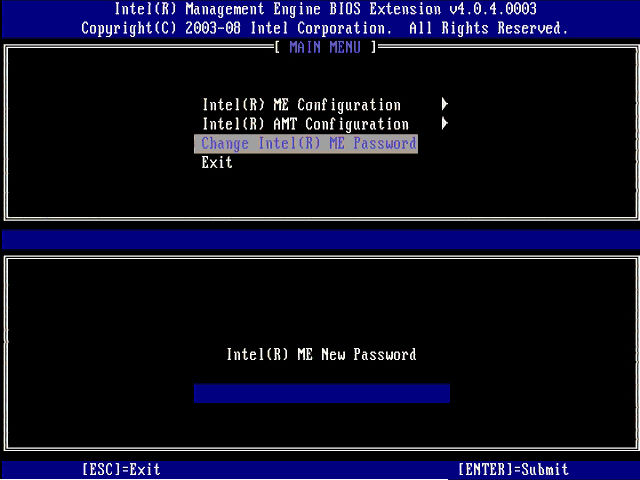

Secure: Major security flaw affecting millions of corporate laptops

AMT offers remote-access monitoring and maintenance of corporate-grade personal computers, allowing remote management of assets. Never leave your laptop unwatched in an insecure location such as a public place. "We reached out to Intel last summer".National Football League picks divisional round: Predictions for every game

Foles is a solid backup, but so far he has had trouble integrating himself into the offense that was so successful with Wentz. This feels like it could be a special year for the Vikings , but the same could be easily said for the New Orleans Saints .When Was the Last Time Meghan Markle Spoke to Her Half Sister?

She said on the Wright Show: "If you can spend $75,000 on a dress, you can spend $75,000 on your dad". But, I think, possibly she might also understand that it's not easy for all of us to get there.