The institutional investor held 160,503 shares of the health care company at the end of 2017Q4, valued at $9.03 million, up from 153,653 at the end of the previous reported quarter. Ferguson Wellman Capital Management Inc who had been investing in Merck for a number of months, seems to be less bullish one the $148.53B market cap company.

The price volatility of stock was 2.21% for a week and 1.77% for a month. About 4.32 million shares traded. (NYSE:MRK) has declined 14.94% since March 29, 2017 and is downtrending. It has underperformed by 11.55% the S&P500. American Century Incorporated owns 0.47% invested in Merck & Co., Inc.

Matrix Asset Advisors Inc increased its stake in Target Corp (TGT) by 13.79% based on its latest 2017Q4 regulatory filing with the SEC.

Market Capitalization/Outstanding Shares/Intraday Volume: The company's Market capitalization is $150.51B with the total Outstanding Shares of 2.73B. Hancock Holdings Com owns 0.02% invested in Merck & Co., Inc. The stock increased 0.08% or $0.04 during the last trading session, reaching $49.36. Shares of MRK moved downward with change of -2.65% to its 50-day Moving average. (NYSE:MRK). Employees Retirement System Of Texas owns 260,000 shares or 0.19% of their USA portfolio. It has underperformed by 26.49% the S&P500.

Steelers confirm Ryan Shazier will not play in 2018

Colbert did say that teams had reached out to the Steelers about Bryant, but they "quickly dismissed those" inquiries. When Shazier's injury took him out of the rotation, the Steelers realized just how profound that depth problem was.

Investors watching summary on Fitbit, Inc. (FIT)

Going move backward a period of six month analysis we come to know that stock dipped -25.27% giving falling alert for Investors. The average is taken over a specific period of time, like 10 days, 20 minutes, 30 weeks, or any time period the trader chooses.

Trump officials end policy exempting pregnant immigrants from detention

Under the new policy , pregnant women will be released from immigration detention only on a case-by-case basis. However officials cautioned that the new directive does not mean that all pregnant women will be detained.

Investors sentiment increased to 0.75 in 2017 Q4. At the same time as, it has debt to equity ratio of 0.71 and similar long term debt to equity ratio was 0.62.

Several other large investors also recently modified their holdings of MRK. 123 funds opened positions while 558 raised stakes. Assetmark has 158 shares. California State Teachers Retirement Sys holds 5.12 million shares or 0.59% of its portfolio. Sva Plumb Wealth Limited Liability Corporation, Wisconsin-based fund reported 77,134 shares. After $0.98 actual EPS reported by Merck & Co., Inc. for the previous quarter, Wall Street now forecasts 1.02% EPS growth. Ameritas Invest Prtnrs invested in 0.33% or 132,575 shares. About 1,008 shares traded. Hbk Sorce Advisory Lc reported 0.31% stake. The company reported $0.98 EPS for the quarter, beating the Zacks' consensus estimate of $0.94 by $0.04. National Bank & Trust Of Nova Scotia reported 0% in Applied Optoelectronics, Inc. Hirtle Callaghan & Ltd Liability holds 0.04% or 8,500 shares. Outstanding shares refer to a company's stock now held by all its shareholders, including share blocks held by institutional investors and restricted shares owned by the company's officers and insiders. Delta Asset Mgmt Ltd Liability Tn has 15,216 shares. 97,840 are held by Schaller Inv Grp Inc. (NASDAQ:CSGP) rating on Thursday, October 5. Birmingham Mngmt Co Al, a Alabama-based fund reported 72,769 shares. (NYSE:MRK) for 8,093 shares. (NASDAQ:AAOI) to report earnings on May, 3. Its up 0.02, from 0.73 in 2017Q3. AAOI's profit will be $4.49M for 27.20 P/E if the $0.23 EPS becomes a reality. One analyst has rated the stock with a sell rating, ten have issued a hold rating and twelve have issued a buy rating to the company. Therefore 36% are positive. Wells Fargo & Company had 132 analyst reports since July 29, 2015 according to SRatingsIntel. ValuEngine cut Merck & Co., Inc. from a "buy" rating to a "hold" rating in a research note on Friday, February 2nd. The company maintains price to book ratio of 4.25. The stock of CoStar Group, Inc. Credit Suisse initiated the shares of TGT in report on Monday, March 5 with "Buy" rating. The rating was maintained by BMO Capital Markets with "Buy" on Tuesday, June 6. Jefferies has "Hold" rating and $53 target. The company's exhibited YTD return of -2.10%. As per Thursday, February 22, the company rating was downgraded by Craig Hallum. Cowen & Co has "Hold" rating and $210 target. The rating was maintained by Northland Capital with "Sell" on Friday, October 13.

Since November 17, 2017, it had 0 buys, and 1 insider sale for $292,234 activity. (NYSE:GLW) by 56,074 shares to 3.71 million shares, valued at $118.70 million in 2017Q4, according to the filing. It also increased its holding in Ameris Bancorp (NASDAQ:ABCB) by 12,792 shares in the quarter, for a total of 289,237 shares, and has risen its stake in Pros Hldgs Inc (NYSE:PRO). Ahl Partners Llp has invested 0.03% in Merck & Co., Inc. In the last five years, the company's full-year sales growth remained over -3.20% a year on average and the company's earnings per share moved by an average rate of 1.82. During the same quarter in the previous year, the company earned $0.89 EPS. The company has a market capitalization of $145,702.11, a P/E ratio of 59.24, a price-to-earnings-growth ratio of 2.28 and a beta of 0.81. (NYSE:MRK). Glg Lp holds 0% in Merck & Co., Inc. Merck & Co. Inc. had 82 analyst reports since August 13, 2015 according to SRatingsIntel.

Analysts have a mean recommendation of 2.10 on this stock (A rating of less than 2 means buy, "hold" within the 3 range, "sell" within the 4 range, and "strong sell" within the 5 range). Therefore 75% are positive. Jefferies maintained Merck & Co., Inc. (NYSE:MRK) rating on Monday, July 17. As per Sunday, February 4, the company rating was maintained by Susquehanna. The stock has "Buy" rating by Piper Jaffray on Friday, July 28. Finally, Credit Suisse Group reduced their price objective on shares of Merck & Co., Inc. from $67.00 to $66.00 and set an "outperform" rating for the company in a research report on Monday, February 5th. The rating was downgraded by BMO Capital Markets on Monday, July 18 to "Market Perform". NY lifted its holdings in Merck & Co., Inc.by 10.6% during the 2nd quarter.

Recommended News

-

Jack Wilshere fit for Arsenal game against Stoke, says Steve Bould

Asked if Wenger's desire was as strong as ever, Bould said: " Absolutely, he is remarkable ". "It's a pleasure to sit next to him".Apple iPhone Aims To Become More Flexible?

Aimed at the education market, the updated iPad is rumored to boast an upgraded processor and perhaps Apple Pencil support . It was only a few days ago that we heard the 2018 iPhone X was going to be cheaper than the 2017 iPhone X .The OLD Mutual Customised Solutions Proprietary Ltd. Boosts Position in Autodesk (ADSK)

It is positive, as 36 investors sold ADSK shares while 132 reduced holdings. 61 funds opened positions while 177 raised stakes. It increased, as 12 investors sold FBNK shares while 20 reduced holdings. 117 funds opened positions while 547 raised stakes. -

The Weeknd teases new music on Instagram

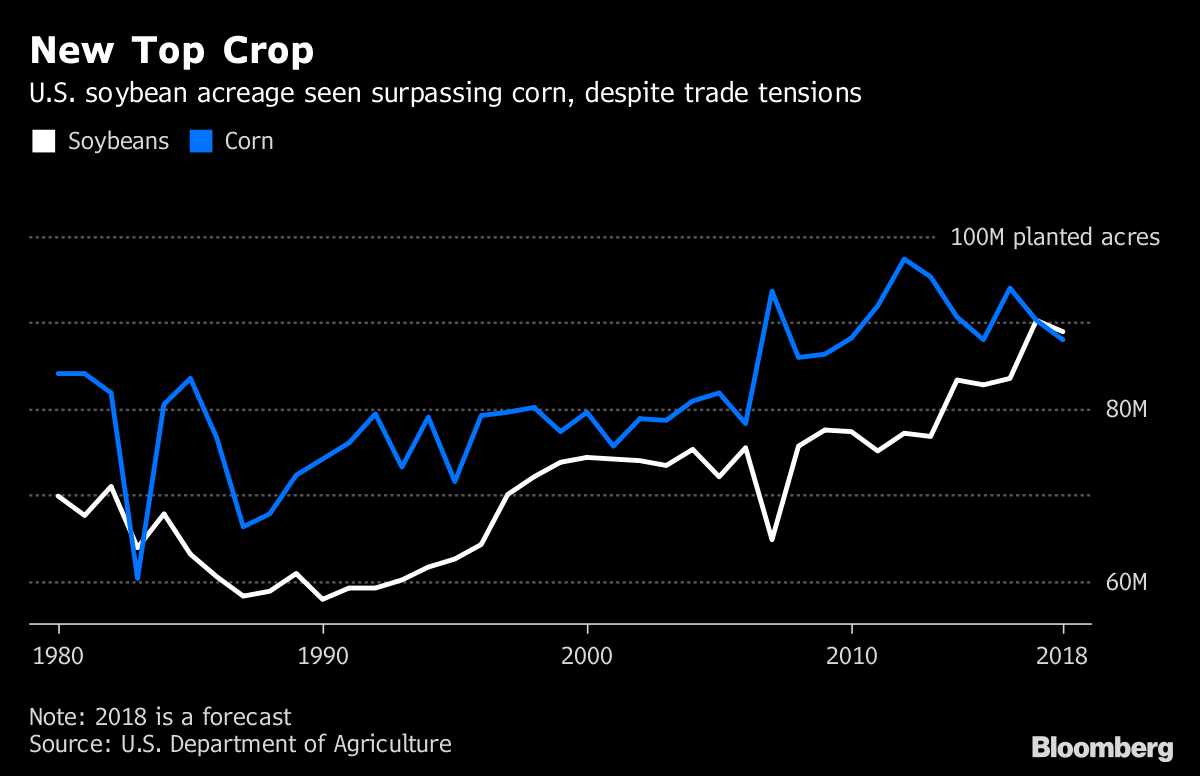

This week he posted a mysterious message suggesting his new project is right on the horizon. Last week (Mar. 22), he was reportedly spotted shooting a video of some sort in California.Minnesota Farmers Plan to Plant More Soybeans Than Corn

USDA's February projection for all cotton acres planted in 2018 was 13.3 million acres, up 700,000 acres from 2017. All cotton planted area for 2018 is expected to total 13.5 million acres, seven percent higher than past year .'Smallville' Actresses Allison Mack Linked to Alleged Sex Trafficking Cult Leader

The actress, along with other women, can be heard saying they are going to get in a vehicle and follow the cops. Mack was with Raniere in Puerto Vallarta at the time of his arrest. -

APC celebrates Tinubu at 66

The former governor of Lagos state also used the occasion to react to the Peoples Democratic Party ( PDP)'s apology to Nigerians .Watch A Tribe Called Quest's Final Music Video 'The Space Program'

Thank You 4 Your Service is available now! It all builds towards a powerful, thought-provoking ending. Following the video's premiere on Thursday (March 29), Q-Tip spoke to Zane Lowe about Phife's passing.(NASDAQ:CSX) Holdings Cut by Teachers Advisors LLC

It increased, as 50 investors sold BDX shares while 294 reduced holdings. 147 funds opened positions while 670 raised stakes. Considering that the stock daily volume of 7.64 million shares, this represents a pretty noteworthy trading in volume size. -

Wilshere, Lacazette Back Against Stoke

Arsenal continues the race to finish in the top four this season and will ensure they win their remaining Premier Leagues games. Alexandre Lacazette has returned to training after knee surgery and is in contention for the Stoke game.Cambridge Analytica whistleblower raises questions on Brexit vote result

Cambridge Analytica's parent company Strategic Communication Laboratories (SCL) had observed six states including Kerala on activities other than elections.West Indies captain Brathwaite skips Pakistan T20s over security concerns

To a question, he said that the doors of global cricket have been opened for Pakistan and more teams will also visit Pakistan now. The three fixtures will be played on April 1, 2 and 3 at the National stadium in Karachi.