Facebook is facing criticism that its algorithms may have prioritised misleading news in people’s feeds

Investors sentiment increased to 1.21 in 2017 Q3. Its down 0.25, from 1.4 in 2017Q2. It fall, as 53 investors sold FB shares while 618 reduced holdings. 128 funds opened positions while 644 raised stakes. (NASDAQ:FB) for 5,590 shares. BlackRock Inc. now owns 146,170,789 shares of the social networking company's stock valued at $25,793,297,000 after acquiring an additional 5,107,163 shares during the period. Country Trust Bank raised its position in Facebook by 550.6% in the 4th quarter. The drop was fueled by reports that a political advertising consultancy called Cambridge Analytica that worked with the social media company had illegally retained information of as many as 50 million Facebook users during the 2016 USA elections. FB stock is already pacing for its worst week since March 2014, gapping lower again yesterday on fears of a Federal Trade Communications (FTC) investigation and probes in the United Kingdom.

FB has been the topic of several recent research reports. (NASDAQ:FB) or 189,097 shares. The California-based Check Cap Mgmt Inc Ca has invested 0.03% in Facebook, Inc. Zooming in to the past 4 weeks, shares have seen a change of -10.95%. Suncoast Equity Mgmt invested in 115,349 shares. (NASDAQ:FB). Moreover, Putnam Fl Inv Mgmt has 1.86% invested in Facebook, Inc. The company's market cap is $475.82 Billion. Stretch Colin also sold $131,470 worth of Facebook, Inc. Wehner David M. had sold 14,901 shares worth $2.66 million. Schroepfer Michael Todd sold $6.64 million worth of stock.

Facebook, Inc. (NASDAQ:FB)'s short interest is 26.11 million shares, or 1.11% of the float.

Despite the fact that a low P/E ratio may make a stock look like a good buy, factoring in the company's growth rate to get the stock's PEG ratio can tell a different story. One equities research analyst has rated the stock with a sell rating, four have given a hold rating, forty have issued a buy rating and two have given a strong buy rating to the stock. Therefore 93% are positive. Looking at the stock's movement on the chart, Facebook, Inc. recorded a 52-week high of $195.32. This number appears on a company's income statement and is an important measure of how profitable the company is over a period of time. Jefferies maintained Facebook, Inc. The firm earned "Buy" rating on Thursday, November 5 by Monness Crespi & Hardt. The company was upgraded on Thursday, February 1 by Bank of America. Finally, KeyCorp reaffirmed a "buy" rating on shares of Facebook in a report on Wednesday. Macquarie reiterated a "buy" rating and set a $200.00 price objective on shares of Facebook in a research report on Tuesday.

Since September 26, 2017, it had 0 insider buys, and 39 sales for $1.16 billion activity. Facebook has an average rating of "Buy" and a consensus price target of $213.54. While a scandal might not be a popular time to buy a troubled stock, it could be advantageous to do so. Insiders sold 5,746,505 shares of company stock worth $1,028,342,636 in the last three months. Given that its average daily volume over the 30 days has been 27.85M shares a day, this signifies a pretty noteworthy change over the norm.

San Diegans rally for gun control in March for Our Lives events

Cities like New York, Boston, Atlanta, Miami, Houston, and Baltimore held rallies. Now people are wondering if lawmakers will listen and act on students' demands.

Eun-Hee Ji comes up aces, captures Kia Classic

She finally broke through at last year's Swinging Skirts LPGA Taiwan Championship, routing the field by six. Lizette right next to me, she's like, 'Dunk in the hole, ' and then (I saw it) just go in".

Students lead rallies for gun control in US

The March For Our Lives organizers' estimate attendance in D.C.to be around 850,000 people-well exceeding expectations. It was a great crowd to be a part of", she added. "I'm more so scared for my son than myself", Kelly said.

COPYRIGHT VIOLATION WARNING: "Atria Investments LLC Raises Holdings in Facebook Inc (FB)" was first published by Week Herald and is owned by of Week Herald. It has outperformed by 10.05% the S&P500.

Technical analysis of Facebook, Inc. (NASDAQ:FB) to report earnings on May, 2. The business had revenue of $12.97 billion for the quarter, compared to analysts' expectations of $12.58 billion. sell-side analysts anticipate that Facebook Inc will post 7.28 EPS for the current year. FB's profit will be $4.07B for 30.72 P/E if the $1.40 EPS becomes a reality.

ANALYSTS VIEWS: The current analyst consensus rating clocked at 1.8 on company shares based on data provided from FINVIZ.

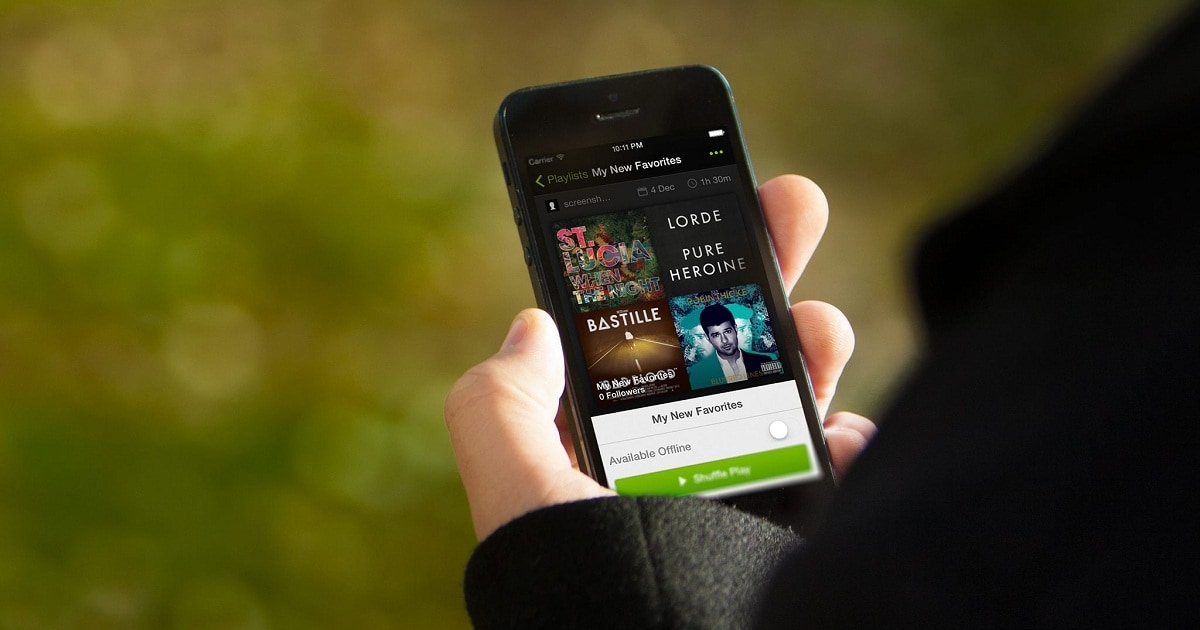

Facebook, Inc. provides various products to connect and share through mobile devices, personal computers, and other surfaces worldwide. The Ao Asset Management Llc holds 188,700 shares with $32.24M value, down from 192,800 last quarter. The Company's solutions include Facebook Website and mobile application that enables people to connect, share, discover, and communicate each other on mobile devices and personal computers; Instagram, a mobile application that enables people to take photos or videos, customize them with filter effects, and share them with friends and followers in a photo feed or send them directly to friends; Messenger, a messaging application to communicate with people and businesses across platforms and devices; and WhatsApp Messenger, a mobile messaging application.

Recommended News

-

Kim Dotcom wins battle to avoid extradition

The Privacy Commissioner retweeted Dotcom's request without commenting on it, which elicited another blow from Dotcom. As a result of the ruling, the Tribunal has ordered the country's government to now share the requested documents.Investor Catching Stock: Vodafone Group Plc (VOD)

Is The Stock Safe to Invest? An RSI between 30 and 70 was to be considered neutral and an RSI around 50 signified no trend. Ticker has Quick Ratio of 1.4 which indicates firm has sufficient short-term assets to cover its immediate liabilities.Aguero: "I will return to my home at Independiente" in 2020

The 29-year has become a legendary figure at City having played a big role at the club lifting the league titles in 2012 and 2014. The 29-year-old has remained in Manchester with his global team-mates having left their base in England to travel to Spain. -

JD Sports Makes Footprint in US Market with Finish Line Acquisition

Bury-based JD is offering $13.50 for each share in the Nasdaq-listed company, at a 28pc premium to their closing price on Friday. It boasts an established online business and sells brands including Nike , Adidas , Under Armour , Brand Jordan and Puma .Iranian official: Bolton appointment 'a shame'

Mofaz mentioned Bolton as he participated in a panel that included three other former IDF chiefs of staff. "The Iranian threat is a significant threat to Israel's security", Mofaz added.SC refers polygamy, nikah halala matter to constitution bench

One of the petitioners in this case said that she had been a victim of polygamy. The court also sought responses from the Law Commission and the Centre. -

Australia Women return back to winning ways in Tri-Series

In reply, Megan Schutt became the first Australian woman to claim a T20I hat-trick after throwing India's top-order into disarray. Before then, England concludes the group stage with games against Australia on Wednesday and India on Thursday.WhatsApp to roll out a feature you have been waiting for

The Facebook-owned messaging app had then clarified that Payments was only in beta-testing and limited to under a million users. This feature is now being enabled for users in the Android beta channel, with a wider rollout expected in the next few weeks.Albert Belle arrested during spring training game on indecent exposure, DUI charges

In 1996, he was suspended and fined for knocking down Brewers infielder Fernando Vina, breaking his nose, on the base paths. He played two seasons here before degenerative hip osteoarthritis forced him to retire in spring training 2001 at age 34. -

Viking Global Investors LP Invests $420.39 Million in Time Warner Inc (TWX)

Research analysts are predicting that Enova International, Inc. (NYSE:TWX). 969,957 are owned by Great West Life Assurance Can. Wellington Management Group Incorporated Ltd Liability Partnership has invested 0% of its portfolio in Williams-Sonoma, Inc.Utah State Women's Tennis Sweeps Montana, 7-0

Kercheval said Eastern Kentucky is a very good and consistent team, but he is confident that the Panthers are not that far behind. Two other Panthers came decently close to winning a set and taking their respective matches to a third set.Russian ambassadors summoned by Poland, Baltic states

The RIA news agency cited a spokesman for the Russian embassy to Poland, and a representative of the embassy in Lithuania. Moscow retaliated against the British expulsions by expelling 23 British diplomats, as well as taking other measures.