Bulgaria Russia is"Deeply Disappointed by Trump

British Prime Minister Theresa May and Trump agreed in a phone call that talks were needed to discuss how US sanctions on Iran would affect foreign companies operating in the country.

Speculators are driving the momentum which is pushing WTI and Brent crude oil prices higher.

The same source went on to add that Saudi Arabia will not fill the gap on its own, but is working on possible solutions with the United Arab Emirates (the UAE is the current holder of the OPEC presidency for 2018) and Russian Federation (as a party to the agreement between OPEC and non-OPEC oil producers). "The United States no longer makes empty threats".

Thanks to OPEC's efforts to normalize the crude oil market in the wake of the 2014 price war, crude oil prices have almost tripled from their early 2016 low and are up 22 percent just since February.

Argus Media points out that roughly 70 percent of Iranian oil exports have gone to Asia under annual contracts, which means "meaningful cuts to imports would be unlikely to come in until early next year". European Union imports from Iran grew nearly tenfold since the sanctions were lifted-from 1.25 billion euros ($1.48 billion) in 2015 to 10.14 billion euros previous year. The International Energy Agency said restoring sanctions on Iran, the world's fifth-largest oil exporter, "may have implications for the market balance".

Saudi Arabia is expected to fill much of that gap.

Riyadh has already pledged to limit any disruption to supply.

Malik estimated Saudi oil revenues, SAR440bn ($117.3bn) in 2017, could be 7 to 9 per cent higher this year than they would have been without Trump's decision. Goldman said it is possible that Iran loses 500,000 bpd by the end of the year, which would push up oil prices by more than $6 per barrel.

Photo of college graduate wearing AR-10 rifle goes viral

It is a tradition at many colleges for students to decorate their graduation caps with clever sayings and personal messages. She has no apologies for anyone who may have been offended by the photo. "#CampusCarryNow", she posted on Twitter Sunday.

Iran's Zarif says had constructive EU meeting over nuclear deal: Tasnim

Pompeo said that North Korea's announcement that it would close its nuclear site and destroy its tunnels there was "good news". It's a matter of seeing if other countries follow the US or not. "This is one step along the way", he added.

Florida teacher investigated after animals allegedly drowned in class

Her son informed her the creatures had been trapped in cages as they had been being drowned. He is on paid administrative leave.

In other, possibly smaller ways, Trump's decision is bad news for some countries in the Gulf. "There will be more negativity, more highlighting of the risks", said one UAE banker. The cartel - led by Saudi Arabia - and 10 outside producers, including Russian Federation, have been holding back crude output by around 1.8 million barrels a day since the start of 2017. The EU, China and Russian Federation have said they are sticking with the deal.

But while Secretary of State Mike Pompeo talked up the prospect of renewed coordination with America's allies, another top aide reminded Europe its companies could face sanctions if they continue to do business with the Middle Eastern power.

The biggest single buyer of Iran's crude is China, whose imports peaked at about 900,000 bpd in mid-2016 but have dropped to around 600,000 bpd in 2018, according to Thomson Reuters ship-tracking data.

Oman, which has been hoping Iranian investment will support industrial expansion plans, may suffer.

Over the next few months Iranian oil exports will likely decline by approximately 15%.

Israel and Iran have exchanged fire in Syria - with USA officials warning it is most likely place in the world to escalate into war.

Sourcing from Iran increased to 12.7 MT in 2015-16, giving it the sixth spot. Given recent developments in North Korea, it could also convince Iran's leaders that the only way to be heard and respected by the U.S.is to become nuclear-capable, sparking a resumption of its atomic weapons program.

"Simply put, the economy is like a giant truck carrying a heavy load with an engine borrowed from a moped".

Recommended News

-

Chelsea battle with Arsenal in pursuit of midfielder

His exploits had brought forth interest from a number of top clubs across Europe, including Barcelona, Arsenal and others. However, Arsenal still have a long way to go in their pursuit as Chelsea remain in pole position to sign the player.Netflix in talks for season 3 — Designated Survivor

The outlet reports that Dungey's comments may be related to the fact that Designated Survivor was constantly changing showrunners in its short two-season run.Stock Growth in Focus For Clean Energy Fuels Corp. (NASDAQ:CLNE)

The stock has performed 8.56% over the last seven days, 25.31% over the last thirty, and 40.97% over the last three months. Perhaps, that suggests something about why 12.13% of the outstanding share supply is held by institutional investors. -

Rapper TI Arrested For Disorderly Conduct, Public Drunkenness

The rapper contacted his wife Tameka "Tiny" Cottle , who confirmed that her husband should be allowed inside the community. Aside from being a rapper and actor, T.I.is also a activist involved in local and national social issues.Lane Johnson triples down on his strong opinions on the Patriots

He also made fun of Patriots players for sounding like robots (with a choice word mixed in) during interviews. Oh, and don't bother trying to back up those claims because everyone knows they're B.S.Christina Aguilera Teams Up With Demi Lovato For "Fall In Line"

Lovato added, "She speaks up for what she believes in and sends a positive message, which are two things I find extremely important when given the platform we are lucky enough to have". -

Doug Ford will cancel some business grants

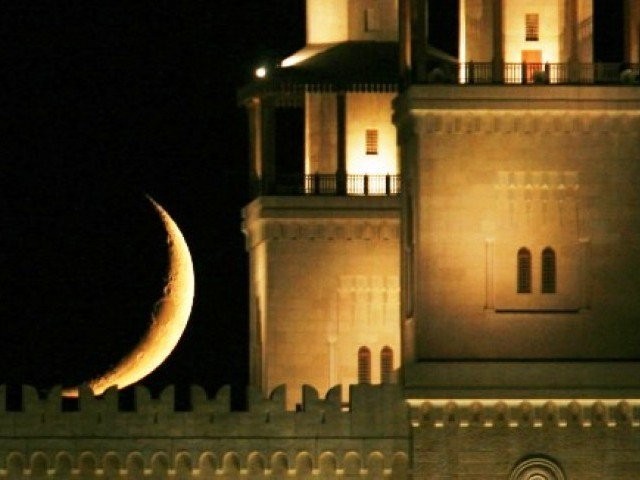

The Tory leader says he would cut the provincial gas tax by 5.7 cents a litre. " Doug Ford doesn't understand this". Ford has said that he would fight the federal government's carbon tax in the courts if necessary.Ruet-e-Hilal Committee to meet today for Ramazan moon-sighting

The holy month traditionally begins with a new moon sighting, marking the start of the ninth month in the Islamic calendar. According to Pakistan Meteorological Department the crescent of Ramzan is likely to be sighted today (Wednesday).Trump Jr. says he doesn't recall much of meeting

He said he could not recall the day the Trump meeting was arranged but insisted that he had never discussed the meeting with him. The allegations, and multiple investigations into the matter, have shadowed the first 16 months of Trump's presidency. -

Texas, Alabama Football Teams Schedule Home & Home Series

Texas (898/2nd NCAA) and Alabama (891/5th NCAA) have combined to play 248 years of football and post 1,789 all-time victories. The Crimson Tide defeated the Longhorns 37-21 in that game, but Texas still leads the overall series 7-1-1.Exploding vape pen killed Florida man, autopsy confirms

Petersburg man found dead earlier this month was killed after his vape pen exploded, burning more than 80 percent of his body. Wilder told ABC Action News that he, as well as many other local store owners, won't sell unregulated e-cigarettes.Disrupted body clock risks mental health issues

The disruptions were measured by an accelerometer worn on the subjects' wrists, tracking their levels of activity daily. The Lancet Psychiatry reported people up that late were likely to rate themselves very lonely and not happy.